Bitcoin Fails at Key Price Hurdle, Risks Return to $8,000

Bitcoin is facing further losses after the bulls failed to capitalize on price gains seen this week.

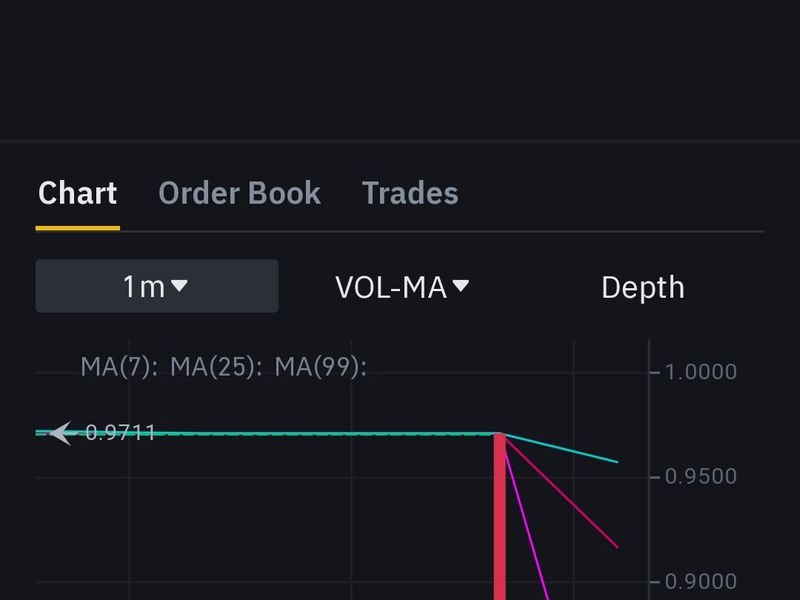

The cryptocurrency’s quick pullback from a 2.5-week high of $8,830 to below $8,400 this morning has invalidated a bullish breakout on the 4-hour chart seen Wednesday, as seen below.

4-hour chart

The failure to hold above the 200-day moving average (MA) at $8,654 has also weakened the bullish outlook on the daily chart and may have shifted risk in favor of a drop to $8,000 in the next 24 hours.

Daily chart

Bitcoin crossed the 200-day MA in the Asian trading hours on Friday and jumped to highs above $8,800, as expected. The breakout was short-lived, however, and prices fell from $8,820 to $8,356 in the 60 minutes to 06:00 UTC.

The failure to hold above the long-term average – a barometer of the long-term trend and a level which has acted as stiff resistance over the last two weeks – may embolden sellers, possibly leading to the deeper slide to $8,000.

A daily close above the 200-day MA is needed to revive the short-term bullish setup.

Bitcoin image via Shutterstocck; charts via TradingView