Bitcoin Failed As a Safe-Haven During COVID-19 Pandemic Because Of Market Manipulation: Research

The University of Sussex recently published a paper regarding the performance of Bitcoin and gold during the COVID-19 pandemic. The research team behind the project believes that both assets failed to serve as safe-havens, primarily because of significant market manipulations.

Bitcoin And Gold Failed In The 2020 Crisis?

The sudden outbreak of the COVID-19 pandemic earlier this year prompted numerous disturbances in everyday life and in financial markets. March alone was among the worst trading months, with assets losing substantial portions of their values.

Wall Street had to trigger trading curbs (circuit breakers) on several occasions to prevent further declines. Bitcoin, being a free-market asset and lacking such regulatory instruments, had no assistance and lost up to 50% of its price at one point.

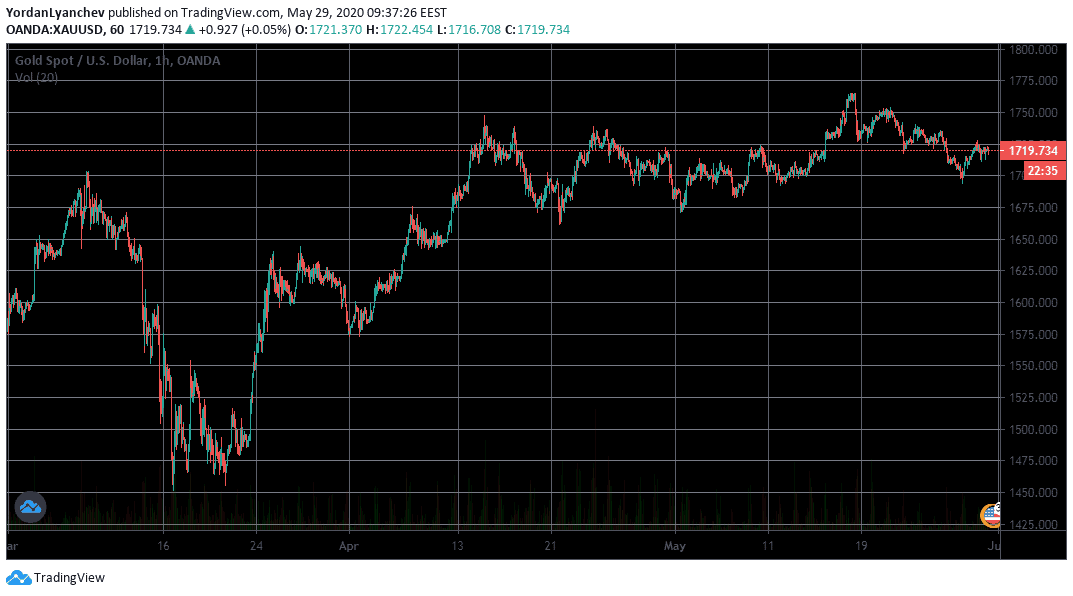

The devastating effects didn’t omit gold – the asset traditionally regarded as a safe haven. The price of the precious metal plunged from about $1,700 to $1,450 in days.

According to the paper from the public research university, these events have rattled the perception of Bitcoin and even gold to operate as safe-havens during times of uncertainty. The university’s research team blamed it on “intense and large-scale manipulations.”

“As the S&P 500 crashed in March 2020, gold had its worst week in eight years when it should have been its best, because of massive shorts on COMEX gold futures.

Bitcoin has also been driven down by some pretty obvious manipulation bots on the unregulated crypto derivatives exchanges, especially BitMEX.” – said Carol Alexander, Professor of Finance at the University of Sussex Business School.

Correlation Between Financial Markets

By diving, all examined assets increased its correlation with each other, the paper explained. During March and April this year, the correlation level between the S&P 500 and gold was plus 20%. Contrary, during the Lehman Brothers collapse in September 2008, the same comparison indicated minus 40%.

The research also noted that since its inception in January 2009, Bitcoin’s behavior “was completely uncorrelated with any traditional assets.” During the most intense days of the COVID-19 price drops, however, their correlation grew to plus 63%, and it remains now at about 40%.

It’s worth noting that while most assets have displayed similar recovery attempts since the March lows, the reasons behind those could differentiate significantly.

For instance, the popular S&P 500 index recently surged above 3,000 basis points, which is near the ATH from February 2020. However, the US Federal Reserve printed trillions-of-dollars to fight the consequences of the pandemic, and a large amount went into the markets. Hence, the pump of Wall Street seems artificial to some extent.

The primary cryptocurrency, on the other hand, has no central bank or authority behind it. Bitcoin began its March descend at $9,100 and bottomed at below $4,000. However, BTC has recovered fully since then and is currently trading at about $9,500.

Interestingly, gold has also surged to new highs since its yearly bottom of $1,450 and is currently trading at about $1,720.

US Assets Emerge Victorious?

The report outlines that “the biggest beneficiaries of these market attacks” are holders of US dollars and US assets.

“These become the main sources of positive returns for global investors in attempts to curtail the recent trend of some central banks to diversify their reserve away from the US dollar.” – reads the paper.

The demand for the dollar has increased lately, as some believe that “US financial markets are the key to weathering difficult economic headwinds.”

In the long-term, though, the consequences could quickly turn around. Prominent US economist Peter Schiff recently noted that printing such extensive amounts of money could depreciate the USD’s value. More alarmingly, he warned that these countermeasures could lead even to hyperinflation.

The post Bitcoin Failed As a Safe-Haven During COVID-19 Pandemic Because Of Market Manipulation: Research appeared first on CryptoPotato.