Bitcoin Eyes Minor Price Bounce But Bear Trend Intact

View

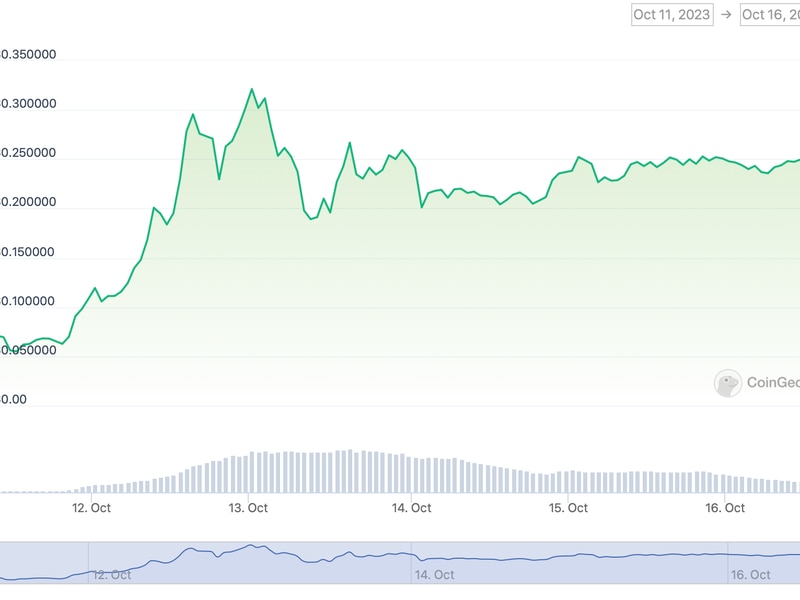

- Bitcoin’s minor recovery rally from six-week lows could be extended further to levels above $3,500 as back-to-back long-tailed daily candles are indicating a lack of conviction among sellers, despite Monday’s high-volume range breakdown.

- A break above the downward sloping 10-day MA of $3,511 would expose the crucial resistance of $3,658 (the high of Saturday’s gravestone doji and last week’s classic doji candle). The outlook would turn bullish if BTC secures a convincing UTC close above $3,658.

- Rejection at the 10-day MA would reinforce the primary bearish trend and could yield a quick drop to the December low of $3,122. On the way lower, BTC may find support at the 200-week moving average of $3,298.

Bitcoin (BTC) has recovered slightly from six-week lows seen yesterday and could see a short-term corrective bounce to $3,500.

The leading cryptocurrency is currently trading at $3,416 on Bitstamp, having hit a low of $3,322 on Tuesday – a level last seen on Dec. 17.

The 2.8 percent recovery could be associated with the oversold readings on the short duration technical indicators seen 24-hours ago. Moreover, Monday’s high-volume range breakdown and the drop to multi-week lows had pushed the relative strength indices on the hourly and 4-hour charts below 30.00

With the minor rally, however, those RSIs have moved back to undersold territory and are now in line with the bearish view put forward by a convincing break below $3,500 seen on Monday.

Even so, the drop to December lows near $3,100 may not happen immediately as stronger signs of temporary bearish exhaustion have emerged on the longer duration charts.

Daily and 4-hour chart

As seen above, BTC has reported losses in the last five trading sessions – the longest losing streak since mid-November.

Notably, the ascending triangle breakdown on the 4-hour chart confirmed on Monday signaled a resumption of the sell-off from the Jan. 10 high of $4,036. The 5- and 10-day MAs are trending south and the 14-day RSI is reporting bearish conditions with a sub-50 reading.

So, the doors look to have been opened for a drop to December lows near $3,100.

The cryptocurrency, however, may test bears’ resolve by rising to the bearish 10-day MA of $3,511, as the long-tails attached to the previous three daily candles signal a lack of conviction on the part of the bears.

A long-tailed candle occurs when there is a big gap between the daily low and UTC close, that is, when sellers fail to secure a close near the lowest point of the day.

3-hour chart

The bullish divergence of the RSI and the falling channel breakout indicate the sell-off from the high of $3,658 has likely paused. BTC, therefore, could rise to $3,500 and above.

The outlook, however, will remain bearish as long as BTC is held below $3,658 (the high of Saturday’s bearish reversal candle).

Disclosure: The author holds no cryptocurrency at the time of writing.

Bitcoin image via CoinDesk archives; charts by Trading View