Bitcoin Extends Rally as Trading Volume for CME Futures Hits Three-Week High

Bitcoin Extends Rally as Trading Volume for CME Futures Hits Three-Week High

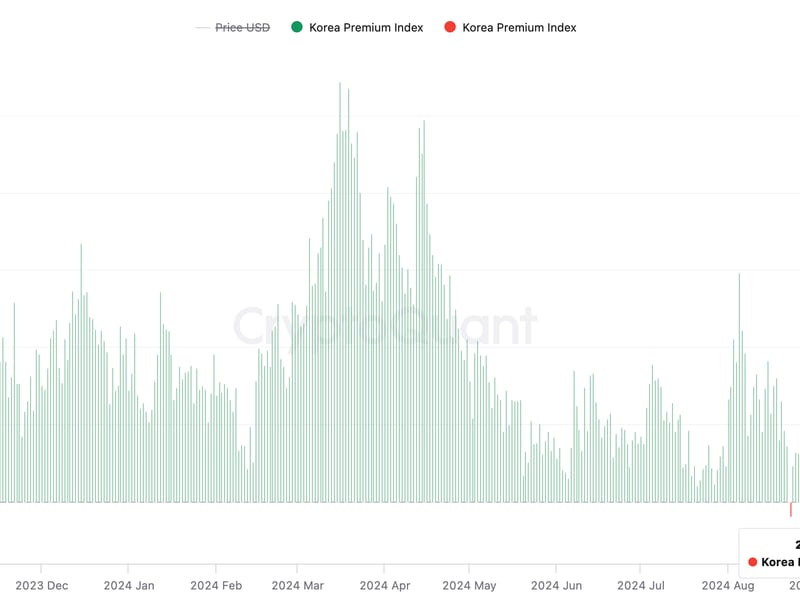

Trading activity for bitcoin (BTC) futures listed on the Chicago Mercantile Exchange (CME) has picked up pace as bitcoin has extended its recent rally to levels above $7,200.

CME traded $347 million worth of futures contracts Thursday – the highest since March 16. On that day, futures witnessed a trading volume of $414 million, according to data provided by research firm Skew.

Thursday’s spike in trading volumes marked a 294

percent rise from the preceding day’s tally of $88 million.

Open interest or open positions on futures ticked higher to $170 million on Thursday to hit the highest level since March 11. While open interest denotes the number of contracts that are open or active, volumes represent the number of contracts traded during a specific period.

Institutional interest in the derivatives space, which began heating up in the fourth quarter of 2019, surged in the first six weeks of this year. For instance, daily trading volume for bitcoin futures on CME rose from $176 million on Jan. 2 to a record high of $1.1 billion on Feb. 18.

By March 6, however, volumes had dropped to $88

million. Open interest also declined from the record high of $338 million to

$113 million in the five weeks to March 20.

Other exchanges also saw a similar drop in the

activity. The aggregate or total open interest in futures listed across the

globe fell below $2 billion in March, having hit highs above $5 billion in

mid-February, according to Skew data.

The sudden slowdown in the activity coincided with the global dash for fiat, primarily U.S. dollars, triggered by the coronavirus-led slide in the global equity markets. Institutions likely took a break from the crypto derivatives market amid the crisis.

As CME is again witnessing higher numbers, activity on other exchanges, too, is picking up, as evidenced by the rise in aggregate daily volumes to $19 billion, the highest since March 23.

Rally return

The volume numbers have improved alongside a recovery in bitcoin’s price. The top cryptocurrency by market value rose above $7,200 on Thursday – a level last seen on March 12, when bitcoin’s price had collapsed by nearly 40 percent, according to CoinDesk’s Bitcoin Price Index.

At press time, bitcoin is trading near $6,950, representing a 2.4 percent gain on the day.

From a fundamental perspective, the rally from lows under $4,000 seen in March could continue as on-chain metrics have recently bounced out of, or are currently sitting in, zones that have historically signaled bottoms, blockchain intelligence firm Glassnode noted in its weekly newsletter.

Technical charts, too, are biased bullish.

Daily chart

Bitcoin closed above the upper edge of a pennant pattern Thursday, signaling a continuation of the rally and opening the doors for $8,000 – a level last seen on March 12.

The cryptocurrency bounced up from the upper end of the pennant (former hurdle-turned-support) early Friday, reinforcing the breakout. As a result, bitcoin may soon test the resistance of Thursday’s high near $7,200.

However, if buyers fail to keep prices above $7,000 for the second day in a row, a pullback to $6,200 could be seen. The cryptocurrency has already failed three times in the last two weeks to establish a foothold above $7,000.

Disclosure: The author holds no cryptocurrency at the time of writing.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.