Bitcoin, Ether Drop Spurs $500M in Liquidations, But BTC Entering “Never Seen Before” Era

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

Monday’s trading session saw crypto futures traders lose over $500 million in liquidations positions as steep volatility impacted highly leveraged longs and shorts, with some majors dropping as much as 12%.

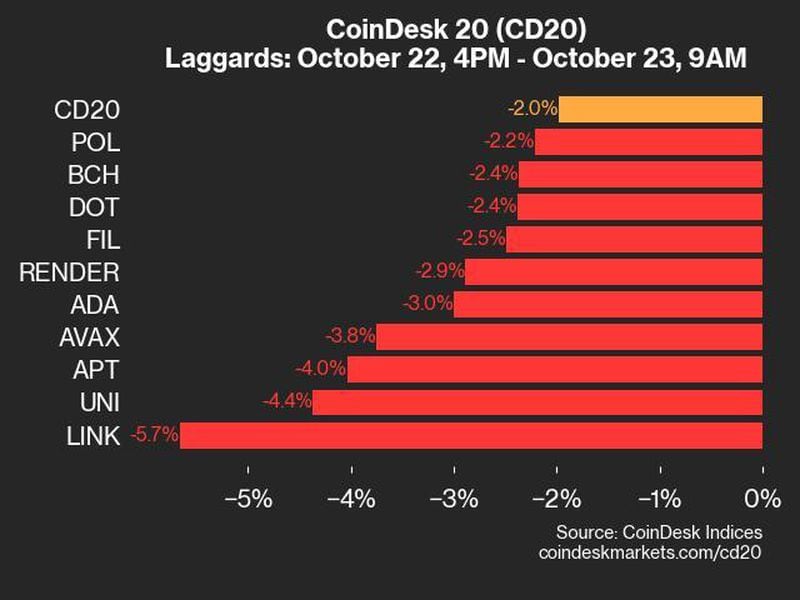

Bitcoin (BTC) whipsawed from $43,000 to as low as $40,300, data shows, leading drops across major tokens such as Chainlink (LINK), Cardano’s ADA and Solana’s SOL, which dropped over 8% before slightly recovering.

Generally riskier bets shiba inu (SHIB) and dogecoin (DOGE), two dog-themed meme tokens, fared slightly better with a 5% drop. Meanwhile, BNB Chain’s BNB, Avalanche’s AVAX, and Celestia’s TIA showed strength with gains of as much as 20% – unaffected by weakness in bitcoin.

Nearly $475 million in longs, or bets on higher prices, and $73 million in shorts, or bets against, booked losses amid a general unwinding of leveraged bets as high funding rates set the stage for a shaky market environment.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/6KEZVKCTYBH2NNA3OI62R43PCY.png)

Data shows that most liquidations took place on OKX at $190 million, followed by Binance at $148 million and Huobi at nearly $60 million.

The largest single liquidation order happened on Bitmex, a chainlink (LINK) futures position that was worth over $33 million.

Liquidations occur when an exchange forcefully closes a trader’s leveraged position owing to a partial or total loss of the trader’s initial margin. It happens when a trader cannot meet the margin requirements for a leveraged position, that is, when they don’t have sufficient funds to keep the trade open.

Meanwhile, some market watchers told CoinDesk that bitcoin’s recent rally was backed by strong fundamentals – one that catapults it to a “never seen before” era.

“Momentum has been consistently building in the Bitcoin builders space all year, and we are now seeing the markets reflect the excitement around the increased activity,” shared Muneed Ali, founder of Bitcoin development firm Trust Machines, in an email to CoinDesk. “Due to the rise of Ordinals and Bitcoin L2s, there are reasons to be bullish on the Bitcoin ecosystem. We are entering an era of Bitcoin that we have never seen before.

“I expect the interest in Bitcoin to increase a lot in 2024 with potential ETF approvals, the halving event and the influx of new developers,” Ali added.

Edited by Sam Reynolds.