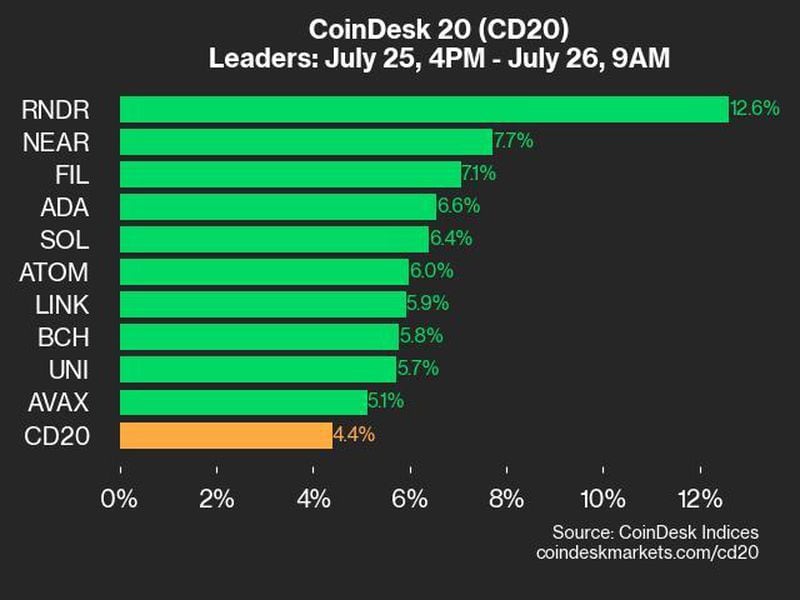

Bitcoin ETFs Remove Nearly Five Times Daily Supply as Ethereum ETFs See Strong Rebound

-

Bitcoin ETFs recorded $136 million in inflows, with BlackRock’s IBIT contributing $98.9 million, equivalent to 1,548 BTC.

-

Ether ETFs saw $62.5 million in inflows, led by BlackRock’s ETHA with $59.3 million, third-largest day for Ether ETF inflows since launch.

Bitcoin (BTC) exchange-traded funds (ETFs) listed in the U.S. are doing their bit to boost supply scarcity in the crypto market.

According to the latest data from Farside Investors, bitcoin {{btc}} exchange-traded funds (ETFs) saw an inflow of $136.0 million on Sept. 24. Leading this surge was BlackRock’s IBIT ETF, which experienced a significant inflow of $98.9 million, marking its largest inflow since Aug. 26. This brings IBIT’s total net inflows to over $21 billion, reinforcing its number one position in the market. Other notable contributors included Fidelity’s FBTC, with $16.8 million in net inflows, and Bitwise’s BITB, which attracted $17.4 million.

More importantly, the inflows on Sept. 24 were equivalent to 2,132 BTC, with IBIT accounting for 1,548 BTC, per HeyApollo data. Given that the current daily issuance of Bitcoin is around 450 BTC, these inflows represent nearly five times the daily mined supply being removed from the market.

Overall, bitcoin ETF inflows have reached $17.8 billion, underscoring continued investor interest in these investment vehicles.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/3WCOTSSSIJA6TPGBC6PW4HAF6E.png)

Ether (ETH) ETFs recorded $62.5 million in total inflows on Sept. 24, making it the third-largest day for Ether ETF inflows since launch. BlackRock’s ETHA led the charge with a $59.3 million inflow, its largest since Aug. 9. This rebound came just a day after Ether ETFs saw their largest outflows since July, underscoring the volatility inherent in the crypto markets.

Despite the intense inflow day, total outflows from ether ETFs stand at $624.4 million, reflecting the broader uncertainty investors face with ether compared to bitcoin.

As of press time, bitcoin is trading at $63,803, while ether is trading at $2,624, according to CoinDesk data.

Edited by Omkar Godbole.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/coindesk/7fe88428-ae49-4453-ab19-5cfbf125689b.png)