Bitcoin ETFs’ First Month Is in the Books: How It Went and What Comes Next

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

The first month of spot bitcoin exchange-traded funds (ETFs) saw daily net inflows of about $125 million per day.

-

Even though Grayscale’s Bitcoin Trust (GBTC) has seen heavy outflows, it’s still a major player among the new products.

-

U.S. wealth managers and Registered Investment Advisors (RIAs) are yet to come in, but it could happen sooner than expected.

Excitement was high about one month ago, when TradFi finally got the regulatory go-ahead to launch an entirely new investment vehicle for crypto.

The process of bringing to the U.S. market a spot bitcoin ETF took more than a decade, but on Jan. 11, 10 such products finally began trading.

It’s been a hell of a ride since.

“These ETFs have done very, very well,” said Brian D. Evans, CEO and founder of BDE Ventures. “We’re seeing big inflows now, and the euphoria phase is certainly kicking in now.”

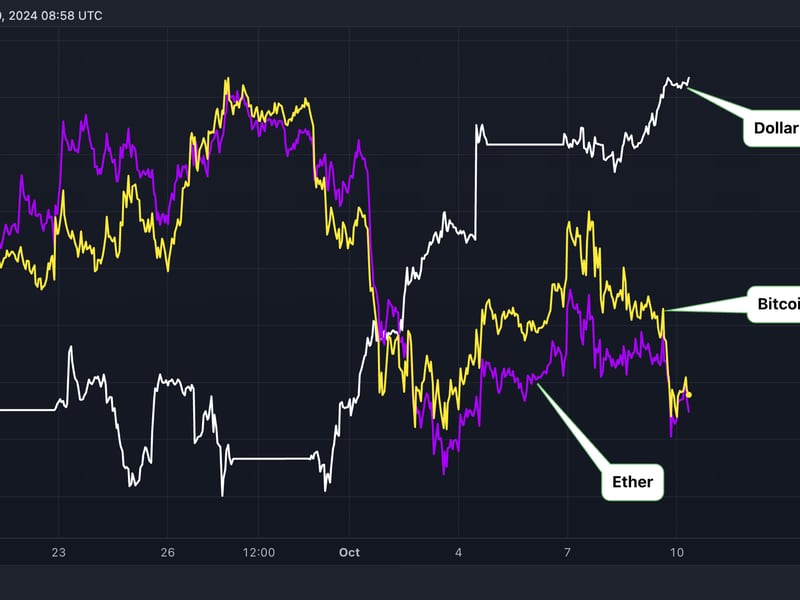

The new ETFs have added on average a net $125 million worth of bitcoin (BTC) each day over the past four weeks. This is despite heavy outflows – more than $6 billion in total – out of the Grayscale Bitcoin Trust (GBTC), which has far higher fees than the other bitcoin ETFs.

In just a month, the bitcoin funds ex-GBTC have accumulated over $11 billion worth of bitcoin, with three of the ETFs – BlackRock’s IBIT, Fidelity’s FBTC and Ark 21’s ARKB – topping the $1 billion mark in assets under management. In fact, as of the end of Monday, IBIT was nearing $5 billion in AUM and FBTC was just shy of $4 billion.

BlackRock’s fund has even made it in the top five of all (including non-crypto) ETFs based on 2024 inflows, putting it on similar levels with industry-leading indexing giants like the iShares Core S&P 500 ETF (IVV) and the Vanguard S&P 500 ETF (VOO). “[IBIT] is rubbing elbows with the biggest and the best,” said Bloomberg Intelligence’s Eric Balchunas.

The fast accumulation is affecting bitcoin’s price, which – after a brief “sell the news” tumble in the days following the first day of trading on Jan. 11 – has rebounded of late, carving out a multi-year high above $50,000 on Monday.

Whither GBTC?

In existence as a closed-end fund for many years prior to its conversion to a spot ETF last month, Grayscale’s GBTC has seen sizable and steady outflows ever since, with its AUM having been whittled down from about $30 billion to just under $24 billion as of Monday.

Many investors who bought the fund before it listed as an ETF are currently making over a 100% profit by selling it, a report by Falcon X noted.

Grayscale notably set the management fee on its converted ETF at 1.50%, more than one percentage point, or 100 basis points, higher than the most expensive of its nine competitors. In addition to profit-taking, the fund is surely seeing the exit of some money seeking lower costs.

“I don’t see GBTC going anywhere,” Matt Sheffield, senior vice president of trading at Falcon X, said in the report. “They ushered in the space, pioneered a lot of the way here, and have a strong following of crypto natives as a result.”

“We are proud that GBTC has blazed a path forward for all spot Bitcoin ETFs to come to market, and we are optimistic about the continued growth and maturation of Bitcoin and the robust ecosystem around spot Bitcoin ETFs,” a spokesperson for Grayscale told CoinDesk.

The high demand that’s made the spot bitcoin ETF launch so successful could cause some headaches in the near future. Net inflows of late are necessitating the purchase of thousands of bitcoin per day, multiples higher than the 900 fresh tokens mined each day, a number that will be reduced to 450 when the Bitcoin halving event occurs in April.

Add to this the fact it’s still only been a month since the spot ETF launch and many if not most major wealth management platforms have yet to offer the products to their clients. The success so far of the ETFs has come “with one hand tied behind their back,” as ETF Store President Nate Geraci put it, suggesting that a lot more demand will come once distribution increases.

“As firms begin covering the name, putting portfolio strategists to work determining allocations for different investor bases, the inflows are likely to exceed any ETF product before it,” Falcon X’s Sheffield wrote.

ETF insiders are well aware a large amount of U.S. wealth managers and Registered Investment Advisors (RIAs) are yet to come in, as these networks are bound by fiduciary standards to a defined period of due diligence.

This period of observance would normally mean 90 trading days to pass from the launch of a novel product like a bitcoin ETF, as well as various volume threshold and AUM criteria, amounting to about six months of lag time.

However, in this case, the wait is looking like it will be much shorter, according to Sui Chung, CEO of CF Benchmarks, an crypto indexing specialist that works with a number of spot bitcoin ETFs including BlackRock’s IBIT fund. (CoinDesk Indices competes with CF Benchmarks in the crypto index industry.)

Chung told CoinDesk his firm has been contacted by a couple of large RIA networks and wealth management companies, located in U.S. retirement hotspots like Florida and California, who are seeking to do due diligence now. “We are talking about platforms who individually count assets under management and assets under advisory in excess of a trillion dollars,” he said.

The relative success of the ETFs so far means that the people who actually gather the information to put in risk packs are doing that now, Chung said. “They know that come the 90th day these products will cross all the thresholds, and there are advisers that wish to allocate,” he said. “A very big sluice gate that was previously shut will open, very likely in about two months time.”

Edited by Stephen Alpher.