Bitcoin ETFs Explained: What Are They & How Do They Work?

Bitcoin ETFs have been a topic of discussion in the crypto markets since the Winklevoss twins first tried to list one back in 2014. Today, Bitcoin Futures ETFs are trading on US exchanges, and we are eagerly awaiting for spot Bitcoin ETFs to hit exchanges as well.

In this guide, you will learn about Bitcoin ETFs, how they work, and which ones you can already can invest in.

This is partner content sourced from Laura Shin’s Unchained and published by CoinDesk.

What Is a Bitcoin ETF?

Bitcoin ETFs are publicly-traded investment funds that enable investors to gain exposure to bitcoin (BTC) without actually owning the cryptocurrency. Unlike cryptocurrencies that are traded on crypto exchanges, ETFs are traded on traditional securities exchanges, such as the New York Stock Exchange.

When you invest in a Bitcoin ETF, you’re not directly purchasing bitcoin itself. Instead, you’re buying shares in a fund that holds a certain amount of bitcoin. This regulated investment vehicle is designed to make it easier for traditional investors to gain exposure to bitcoin’s price movements without having to securely buy and store the digital currency, alleviating the technological hurdles of investing in crypto.

The Securities and Exchanges Commission (SEC) hasn’t yet approved a spot ETF that holds Bitcoin directly. However, Bitcoin ETFs holding Bitcoin futures contracts as their underlying asset have been approved and are trading on the New York Stock Exchange.

Bitcoin ETFs function in a way similar to the traditional exchange-traded funds you might be familiar with. An ETF issuer, typically an asset management company, purchases the underlying asset and securely stores it with a custodian. Then, it issues shares to its fund to provide investors with access to the underlying asset held in the fund.

In exchange for an annual fund management fee, the financial institution manages the purchasing, storing, and safekeeping of bitcoin on behalf of the ETF’s investors.

Investing in a Bitcoin ETF, you’re essentially buying shares in a pool of bitcoin. This process involves the creation of new ETF shares to match the demand. Conversely, when you sell your shares, they are redeemed, effectively adjusting the total number of ETF shares in circulation.

ETF Shares and Bitcoin Prices

The value of Bitcoin ETF shares reflects the performance of bitcoin. As the price of bitcoin moves, the value of the ETF shares adjusts accordingly.

To ensure that the ETF shares stay in sync with bitcoin prices, market makers actively buy and sell on the stock exchange, maintaining a balance between supply and demand. If the ETF’s price starts deviating from the actual bitcoin price, market makers step in to restore equilibrium.

Examples of Bitcoin ETFs

While we are still waiting for the approval of spot Bitcoin ETFs, you can already invest in futures-based Bitcoin ETFs. Here are three of the most prominent ones.

ProShares Bitcoin Strategy ETF (BITO)

With over $1 billion in assets under management (AUM), BITO is the largest bitcoin futures ETF. It was launched in October 2021, making it the first Bitcoin ETF on the US stock exchange. It tracks the performance of the S&P CME Bitcoin Futures Index, which is a market-weighted index of bitcoin futures contracts. BITO is an actively managed fund that provides investors with daily exposure to the price of bitcoin.

VanEck Bitcoin Strategy ETF (XBTF)

XBTF is the second-largest bitcoin futures ETF, with about $45 million in AUM. The actively managed fund was launched in November 2021. XBTF tracks the performance of the MVIS Bitcoin Futures Index, which is a rules-based index of bitcoin futures contracts.

Valkyrie Bitcoin Strategy ETF (BTF)

BTF is the third-largest bitcoin futures ETF. It was launched in 2021 and has around $30 million in AUM. BTF tracks the performance of the Valkyrie Bitcoin Futures Index, which is a passively managed fund that seeks to provide investors with exposure to the price of bitcoin.

What’s the Difference Between a Bitcoin Futures ETF And a Spot Bitcoin ETF?

The primary distinction between a Bitcoin futures ETF and a spot Bitcoin ETF lies in the underlying assets they invest in.

A Bitcoin Futures ETF invests in futures contracts that derive their value from the expected future price of bitcoin. These contracts enable investors to speculate on bitcoin’s price movements without holding the actual cryptocurrency.

A spot Bitcoin ETF invests directly in bitcoin itself. Investors in a spot Bitcoin ETF own a share of the actual cryptocurrency, and the ETF’s value is directly correlated with the price of bitcoin in the market.

Why Is a Spot Bitcoin ETF Considered Such a Big Deal?

The introduction of a spot Bitcoin ETF is considered a significant development in the cryptocurrency space for several reasons:

-

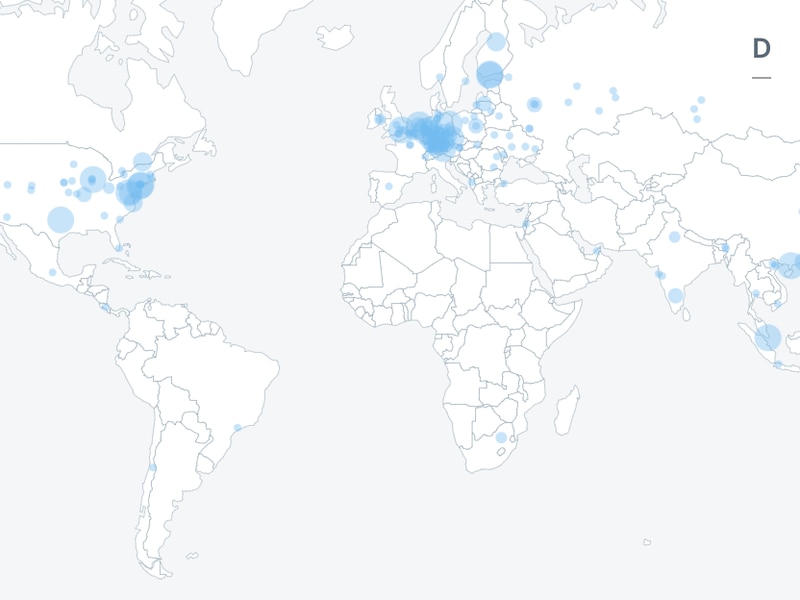

Mainstream adoption: A spot Bitcoin ETF would likely attract a broader range of investors, including institutional investors, who have been hesitant to invest directly in the cryptocurrency markets for regulatory reasons. This could lead to increased adoption of bitcoin as an investment asset.

-

Regulatory approval: The launch of a spot Bitcoin ETF requires regulatory approval from the SEC, which would provide an additional level of legitimacy and oversight to the cryptocurrency markets. This could pave the way for more regulatory clarity and acceptance of cryptocurrencies.

-

Convenience and accessibility: A spot Bitcoin ETF would make it easier for retail investors to gain exposure to Bitcoin without the technical challenges of wallet management and private key security. It offers a more user-friendly and familiar investment vehicle.

-

Market maturity: The launch of a spot Bitcoin ETF could signify that the cryptocurrency market has matured to a point where it can support regulated and standardized investment products. This could attract more institutional capital and increase market stability.

While Bitcoin futures ETFs have been available for some time, the introduction of a spot Bitcoin ETF holds the promise of further mainstream adoption, regulatory clarity, and market maturity for Bitcoin as an asset class.

What Is a Bitcoin ETF?

Bitcoin ETFs are publicly-traded investment funds that enable investors to gain exposure to bitcoin (BTC) without actually owning the cryptocurrency. Unlike cryptocurrencies that are traded on crypto exchanges, ETFs are traded on traditional securities exchanges, such as the New York Stock Exchange.

When you invest in a Bitcoin ETF, you’re not directly purchasing bitcoin itself. Instead, you’re buying shares in a fund that holds a certain amount of bitcoin. This regulated investment vehicle is designed to make it easier for traditional investors to gain exposure to bitcoin’s price movements without having to securely buy and store the digital currency, alleviating the technological hurdles of investing in crypto.

The Securities and Exchanges Commission (SEC) hasn’t yet approved a spot ETF that holds Bitcoin directly. However, Bitcoin ETFs holding Bitcoin futures contracts as their underlying asset have been approved and are trading on the New York Stock Exchange.

How Do Bitcoin ETFs Work?

Bitcoin ETFs function in a way similar to the traditional exchange-traded funds you might be familiar with. An ETF issuer, typically an asset management company, purchases the underlying asset and securely stores it with a custodian. Then, it issues shares to its fund to provide investors with access to the underlying asset held in the fund.

In exchange for an annual fund management fee, the financial institution manages the purchasing, storing, and safekeeping of bitcoin on behalf of the ETF’s investors.

Investing in a Bitcoin ETF, you’re essentially buying shares in a pool of bitcoin. This process involves the creation of new ETF shares to match the demand. Conversely, when you sell your shares, they are redeemed, effectively adjusting the total number of ETF shares in circulation.

ETF Shares and Bitcoin Prices

The value of Bitcoin ETF shares reflects the performance of bitcoin. As the price of bitcoin moves, the value of the ETF shares adjusts accordingly.

To ensure that the ETF shares stay in sync with bitcoin prices, market makers actively buy and sell on the stock exchange, maintaining a balance between supply and demand. If the ETF’s price starts deviating from the actual bitcoin price, market makers step in to restore equilibrium.

Examples of Bitcoin ETFs

While we are still waiting for the approval of spot Bitcoin ETFs, you can already invest in futures-based Bitcoin ETFs. Here are three of the most prominent ones.

ProShares Bitcoin Strategy ETF (BITO)

With over $1 billion in assets under management (AUM), BITO is the largest bitcoin futures ETF. It was launched in October 2021, making it the first Bitcoin ETF on the US stock exchange. It tracks the performance of the S&P CME Bitcoin Futures Index, which is a market-weighted index of bitcoin futures contracts. BITO is an actively managed fund that provides investors with daily exposure to the price of bitcoin.

VanEck Bitcoin Strategy ETF (XBTF)

XBTF is the second-largest bitcoin futures ETF, with about $45 million in AUM. The actively managed fund was launched in November 2021. XBTF tracks the performance of the MVIS Bitcoin Futures Index, which is a rules-based index of bitcoin futures contracts.

Valkyrie Bitcoin Strategy ETF (BTF)

BTF is the third-largest bitcoin futures ETF. It was launched in 2021 and has around $30 million in AUM. BTF tracks the performance of the Valkyrie Bitcoin Futures Index, which is a passively managed fund that seeks to provide investors with exposure to the price of bitcoin.

What’s the Difference Between a Bitcoin Futures ETF And a Spot Bitcoin ETF?

The primary distinction between a Bitcoin futures ETF and a spot Bitcoin ETF lies in the underlying assets they invest in.

A Bitcoin Futures ETF invests in futures contracts that derive their value from the expected future price of bitcoin. These contracts enable investors to speculate on bitcoin’s price movements without holding the actual cryptocurrency.

A spot Bitcoin ETF invests directly in bitcoin itself. Investors in a spot Bitcoin ETF own a share of the actual cryptocurrency, and the ETF’s value is directly correlated with the price of bitcoin in the market.

Why Is a Spot Bitcoin ETF Considered Such a Big Deal?

The introduction of a spot Bitcoin ETF is considered a significant development in the cryptocurrency space for several reasons:

-

Mainstream adoption: A spot Bitcoin ETF would likely attract a broader range of investors, including institutional investors, who have been hesitant to invest directly in the cryptocurrency markets for regulatory reasons. This could lead to increased adoption of bitcoin as an investment asset.

-

Regulatory approval: The launch of a spot Bitcoin ETF requires regulatory approval from the SEC, which would provide an additional level of legitimacy and oversight to the cryptocurrency markets. This could pave the way for more regulatory clarity and acceptance of cryptocurrencies.

-

Convenience and accessibility: A spot Bitcoin ETF would make it easier for retail investors to gain exposure to Bitcoin without the technical challenges of wallet management and private key security. It offers a more user-friendly and familiar investment vehicle.

-

Market maturity: The launch of a spot Bitcoin ETF could signify that the cryptocurrency market has matured to a point where it can support regulated and standardized investment products. This could attract more institutional capital and increase market stability.

While Bitcoin futures ETFs have been available for some time, the introduction of a spot Bitcoin ETF holds the promise of further mainstream adoption, regulatory clarity, and market maturity for Bitcoin as an asset class.