Bitcoin Erases Losses As Fed Raises Interest Rates By 0.75% In Largest Hike Since 1994

FOMC Chair Jerome Powell assured investors that the Fed is ‘not trying to induce a recession’ in the United States.

The Federal Open Markets Committee (FOMC) raised its target interest rates by 75 basis points on Wednesday, the largest rate hike since 1994.

The raise came in line with market expectations that foresaw a more hawkish committee in action as latest inflation figures came above expectations, marking a new 40-year high at 8.6%. FOMC Chair Jerome Powell, who also serves as chair of the Federal Reserve, had said in the beginning of May that the committee would enact a 50 basis point raise in June had market data such as the consumer prices index (CPI) come as expected.

Powell explained the reasoning behind a change in course in a press conference held following the release of the FOMC monetary policy decision on Wednesday by leaning on inflation – which he said had “again surprised to the upside.”

“Over the coming months we’ll be looking for evidence that inflation has been turning down,” Powell said. “Hikes will continue to depend on incoming data, but either a 50 basis points or 75 basis points increase seem more likely for the next meeting.”

Powell highlighted once again that the main goal of the Fed and its FOMC is to bring inflation down to its 2% target. Notably, the committee’s latest statement removed a line from its past statement that read, “With appropriate firming in the stance of monetary policy, the Committee expects inflation to return to its 2 percent objective and the labor market to remain strong.” However, the FOMC appended a line to that paragraph that stated it is “strongly committed” to curbing inflation to the target rate.

The committee also released its new summary of economic projections, a document that puts together the analysis and forecasts of all FOMC members for gross domestic product (GDP) growth, unemployment rate and inflation for this year and the next two.

Participants now expect interest rates to reach 3.4% by the end of the year and 3.8% by the end of 2023 before decreasing in the following years.

Powell reiterated that, in line with member’s projections, the committee does not expect a U.S. recession to ensue. Rather, he said the FOMC is watching closely the most important economic information to be nimble when it comes to monetary policy.

“We’re not trying to induce a recession,” Powell said.

The Fed chair navigated his speech between what he calls things monetary policy can influence and things it cannot. He explained that while most of the Fed’s work moving forward will be an attempt to re-balance supply and demand, policymakers can only deal with the demand side and most to blame about inflation currently is on the supply side.

Powell mentioned the rising commodity prices due to the war in Ukraine and broader supply chain disruptions as two key issues currently affecting inflation and thus monetary policy.

“Our objective really is to bring inflation down to 2% while the labor market remains strong,” Powell said. “What is becoming more clear is that many factors that we don’t control are going to place a big role in saying if that’ll be possible or not.”

“When demand goes down, you could see…inflation coming down,” Powell stated, adding that it wasn’t guaranteed such a reduction in demand, which is theoretically in the power of the Fed, would be successful.

When it comes to the labor market, Powell explained that a slight rise in unemployment wouldn’t invalidate an eventual ability to bring inflation down.

“If you were to get inflation on its way down to 2% and get unemployment at 4%, that’s still historically low levels,” he said. “I think that would be a successful outcome. We don’t seek to put people out of work, of course, but you cannot have the kind of labor market we want without price stability.”

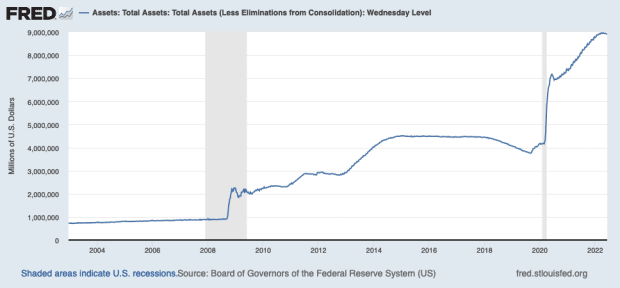

Notably, the Fed’s balance sheet appears to be already reducing as quantitative tightening began on June 1 – as said in the committee’s previous meeting.

Bitcoin plunged ahead of the release of the new monetary policy statement but started recovering as soon as Powell went live. The peer-to-peer digital currency rose 7.42% to $21,900 while the chair of the Fed spoke. Bitcoin is trading at around $21,700 at press time.