Bitcoin Ends The Week Bullish Above $9000, Despite Global Markets’ Crash: The Crypto Weekly Market Update

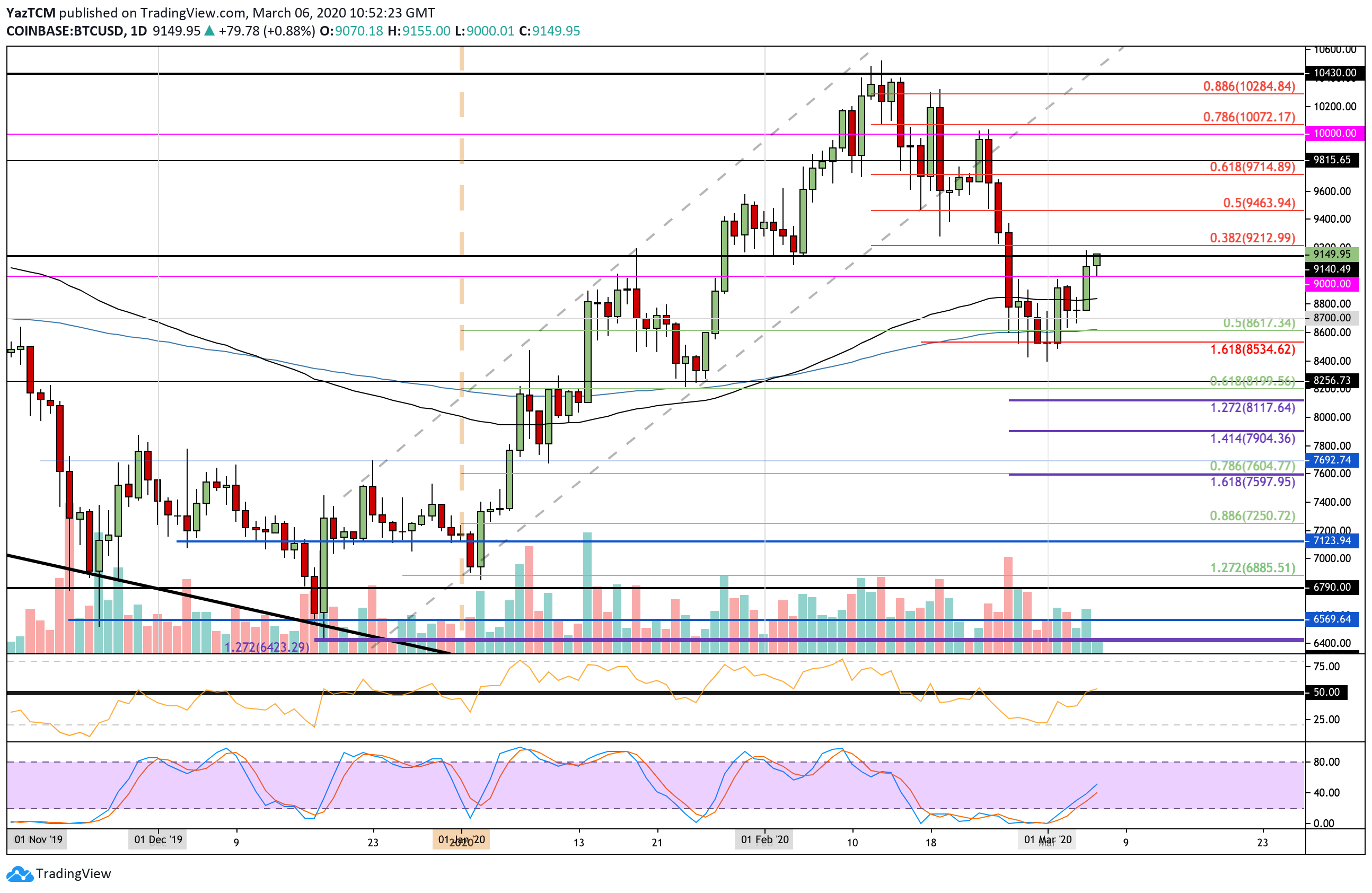

This week has been somewhat positive for the cryptocurrency community. Starting with Bitcoin’s price, which began trading at $8,600 but, since then, it has risen to the current stance of above $9,000.

Following its increase, Bitcoin is starting to escape the correlation it recently demonstrated with the traditional financial world markets.

As the coronavirus outbreak keeps expanding into new territories, the stock market struggles again. Despite recovering slightly at the start of the week, the Dow Jones Industrial Average noted a 600 points drop during today’s opening. The S&P 500 futures and Nasdaq-100 futures are following tightly with steep losses.

Price aside, good news came this week from two Asian countries. Firstly, the Supreme Court of India lifted a 2018 RBI ban on cryptocurrency usage in the country. South Korea also made a considerable step to adopt virtual assets as they have recently been legalized.

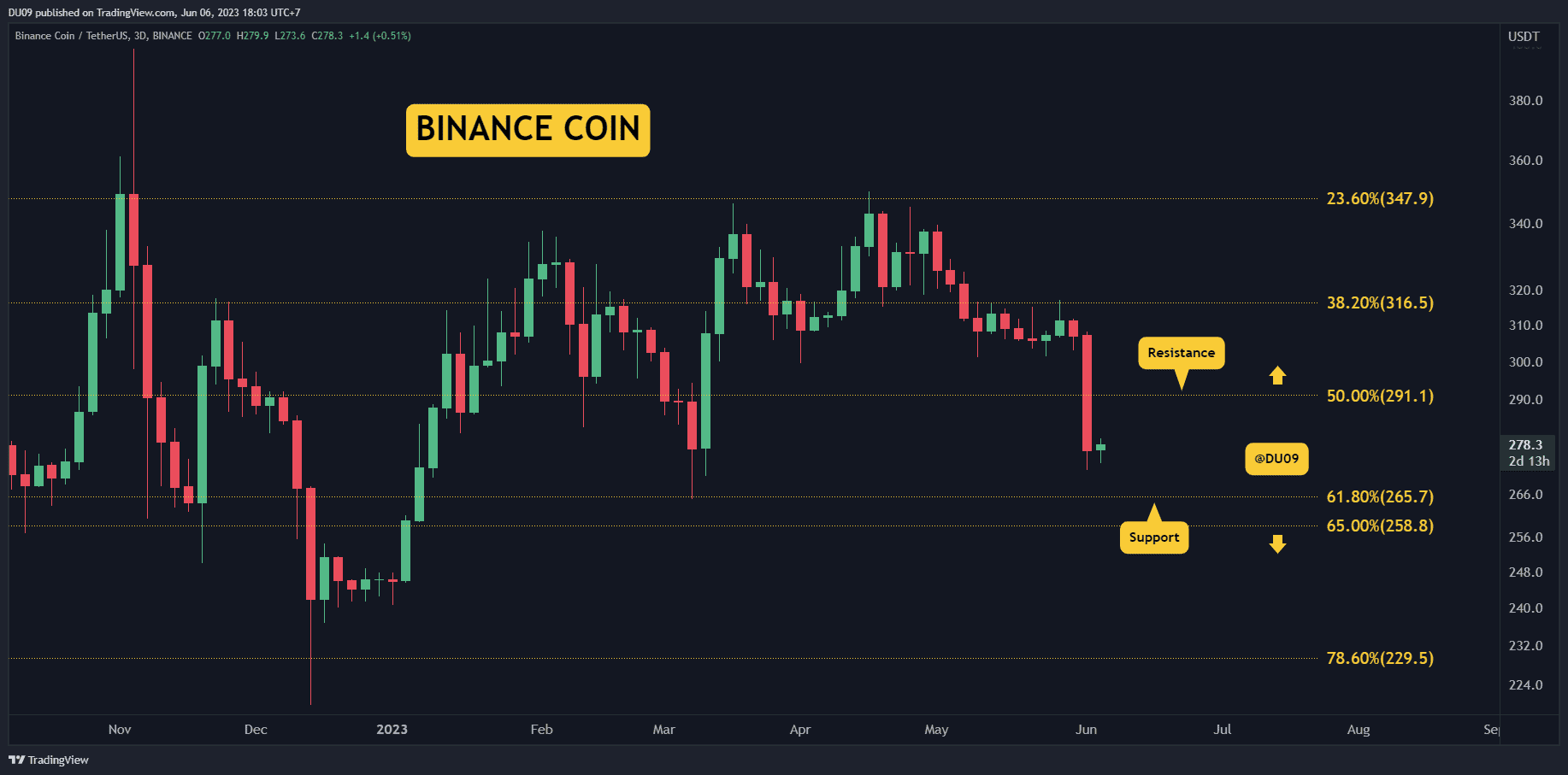

The altcoin market has also felt Bitcoin’s increase. All the major cryptocurrencies are trading in the green throughout the past seven days. The most significant gainers appear to be Tezos, Binance Coin, and Chainlink, to name a few. All of them marked gains of over 10%.

Bitcoin’s dominance dipped by about 0.6% over the last week, meaning that altcoins start to regain some grounds. It’s interesting to see how the market will develop in the coming weeks as we are getting closer to the Bitcoin halving event.

Regarding the price of Bitcoin, breaking the $9,000 mark meant that it turned from a significant resistance to a support level. $9,300 is the next obstacle that Bitcoin has to overcome, which is also the 50-days moving average. Contrary, if BTC is to break below the psychological point of $9,000 again, the 200-day MA at $8,700 will be the most vital support.

Market Data

Market Cap: $263B | 24H Vol: $142B | BTC Dominance: 63.5%

BTC: $9,150 (+4.8%) | ETH: $240 (+5.4%) | XRP: $0.245 (+3.35%)

Crypto World News

Crypto Is Now Legal In South Korea: Parliament Passes Landmark Cryptocurrency Bill. South Korea seems to be following in the footsteps of India when it comes to legalizing cryptocurrencies. The country’s regulators passed a new amendment, making cryptocurrency trading and holding legal.

India’s Supreme Court Lifts The Cryptocurrency Trading Ban by RBI From 2018. After years of uncertainty on the matter of cryptocurrencies, the Supreme Court of India officially lifted the ban on both trading and operating with digital assets. A bench of three judges quashed the directive that the Reserve Bank of India had issued earlier in 2018.

Change Of Plans? Facebook’s Libra To Host Multiple Central Banks’ Digital Currencies. Regulatory pressure towards Facebook’s Libra caused the social media mogul to change its plans. According to a recent report, the project’s partners consider adding multiple different coins, including central bank digital currencies.

The STEEM Network’s Takeover by TRON: Huobi Admits Controversial Involvement. The recent reversal of Steemit’s soft fork caused a lot of controversy within the crypto community. Many believed that it was a hostile takeover of the blockchain by Tron and Steemit themselves. Cryptocurrency exchanges such as Huobi have admitted involvement and consider undoing the vote.

Top EU Financial Authority Says Cryptocurrencies Are Financial Instruments. The German Federal Financial Supervisory Authority (BaFin) recently issued guidelines on cryptocurrencies. The authority has now classified them as financial instruments, which is a serious push in the right direction, in terms of legislation.

The Fed’s Interest Cut And Global Markets’ Crash Might Lead To Bitcoin & Crypto Surge, Says Coinbase CEO. The US Federal Reserve recently cut interest rates with 50 basis points, following major market tumbles on Wall Street. According to Brian Armstrong, CEO at Coinbase, this could be a turning point for the cryptocurrency market as investors may start looking at it as a reserve currency instead of as a venture bet.

Price Analysis Weekly Overview

This week’s charts of Bitcoin, Ethereum, Ripple, Tezos, and Chainlink.

The post Bitcoin Ends The Week Bullish Above $9000, Despite Global Markets’ Crash: The Crypto Weekly Market Update appeared first on CryptoPotato.