Bitcoin Drops Below $28K; JPMorgan Takes Over Embattled First Republic Bank

:format(jpg)/www.coindesk.com/resizer/KnsJr2e_U9xZpD2ZQMUcfS-ZspM=/arc-photo-coindesk/arc2-prod/public/ZEPFGG2W5BBFRJUO5WS4CTRCPA.jpeg)

Jocelyn Yang is a markets reporter at CoinDesk. She is a recent graduate of Emerson College’s journalism program.

Bitcoin (BTC) kicked off the U.S. trading week edging below $28,000 – the continuation of a downward spiral that started on Sunday as federal regulators prepared to seize control of First Republic Bank.

The largest cryptocurrency by market capitalization was recently trading at about $27,800, down over 5% over the past 24 hours, according to CoinDesk data. BTC had been hovering around $28,500 as U.S. markets opened and it was announced banking giant JPMorgan had won the auction to purchase First Republic assets.

Edward Moya, senior market analyst for foreign exchange Oanda, suggested in a note that the fast response to First Republic’s implosion showed the banking sector was prepared to address these types of crises. Wall Street may have grown confident that wider banking risk has been “removed from the table,” Moya wrote.

“It is looking like the U.S. banking system has a playbook to deal with the next banking crisis when it emerges, which is somewhat dampening the case for cryptos,” he added.

San Francisco-based First Republic is the fourth bank to fail in the past two months, following Silvergate, Silicon Valley and Signature banks.

Ether (ETH), the second-largest cryptocurrency by market capitalization, followed a similar pattern to bitcoin, dropping more than 4% to change hands at around $1,813 Monday afternoon.

Equities were closing lower Monday, with the S&P 500, Wall Street’s benchmark equity index, down 0.04%. Both the Dow Jones Industrial Average (DJIA) and tech-heavy Nasdaq Composite recently slid 0.1%.

Investors will be eyeing the Federal Open Market Committee (FOMC) monetary policy meeting, which begins Tuesday to decide whether to boost interest rates and by how much. The CME’s FedWatch tool currently sets the probability of a 25 basis point (bps) increase at more than 94%, which would boost the target range to between 5% and 5.25%.

Some analysts expected the decision may cause price fluctuations in the crypto market.

“After a breakout (BTC above ~$25,000), it’s important to pay attention to pullbacks to gauge the buy strength remaining,” bitcoin mining equipment and hosting provider Blockware Solutions Analysts wrote in a newsletter on Friday. “In this case, BTC flashed some pretty bullish signals, as buyers quickly stepped in at the 50-day [simple moving average].”

Blockware Solutions’ analysts said BTC has strong resistance between $30,000 and $31,000, although they noted that “it’s not unreasonable to assume that the FOMC policy decision could make or break current BTC strength.”

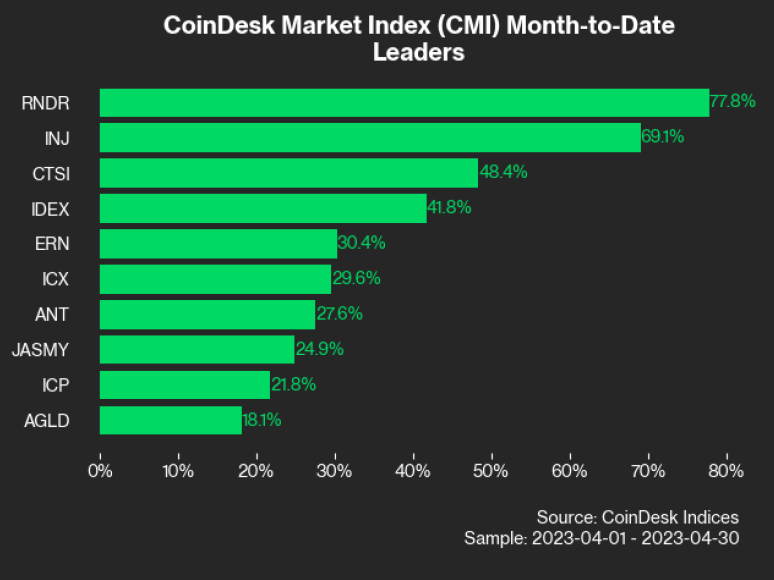

After soaring in March, bitcoin rose a more modest 2.5% in April amid crypto regulatory, banking and other macroeconomic uncertainties, according to the CoinDesk Market Index (CMI), which measures the crypto market’s overall performance. Ether climbed 4.4%, much of its gains coming when the successful Ethereum Shanghai upgrade did not lead to a mass ETH sell-off, as some market observers had expected.

Blockchain-based distributed rendering service Render Network’s utility token RNDR was the best-performing asset in the CMI, rising 77%, and was followed by the decentralized finance (DeFi) platform Injective Protocol’s INJ token, which jumped 69%.

(CoinDesk Indices)

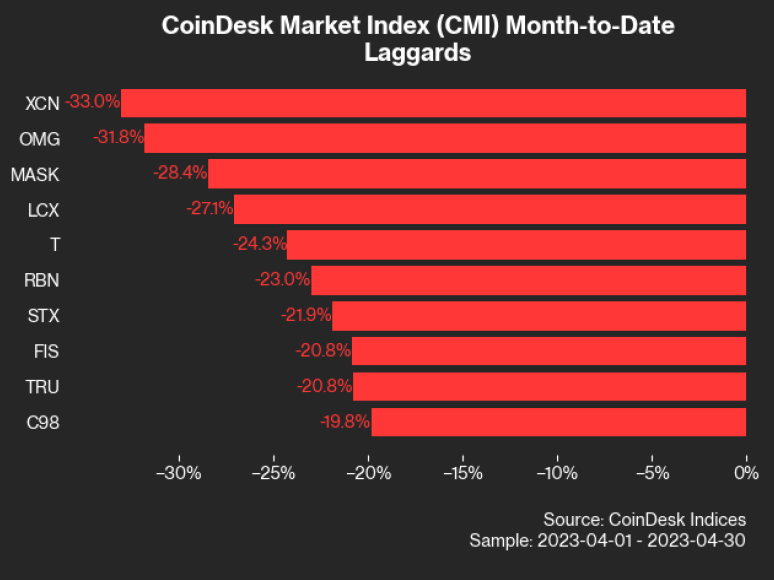

Chain’s XCN token in the CMI’s Currency sector was among the biggest CMI laggards, plunging over 33% in April. It dropped over 53% in March.

(CoinDesk Indices)

But regulation remains a major stumbling block for the industry. In the U.S., exchange giant Coinbase (COIN) demanded that a federal court force the Securities and Exchange Commission (SEC) to clarify whether existing securities laws apply to digital assets, and the European Union finalized legislation that aims to clarify the region’s regulatory approach to the sector. The next steps for the industry worldwide could affect prices in the months ahead, a number of analysts believe.

Edited by James Rubin.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/KnsJr2e_U9xZpD2ZQMUcfS-ZspM=/arc-photo-coindesk/arc2-prod/public/ZEPFGG2W5BBFRJUO5WS4CTRCPA.jpeg)

Jocelyn Yang is a markets reporter at CoinDesk. She is a recent graduate of Emerson College’s journalism program.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/KnsJr2e_U9xZpD2ZQMUcfS-ZspM=/arc-photo-coindesk/arc2-prod/public/ZEPFGG2W5BBFRJUO5WS4CTRCPA.jpeg)

Jocelyn Yang is a markets reporter at CoinDesk. She is a recent graduate of Emerson College’s journalism program.