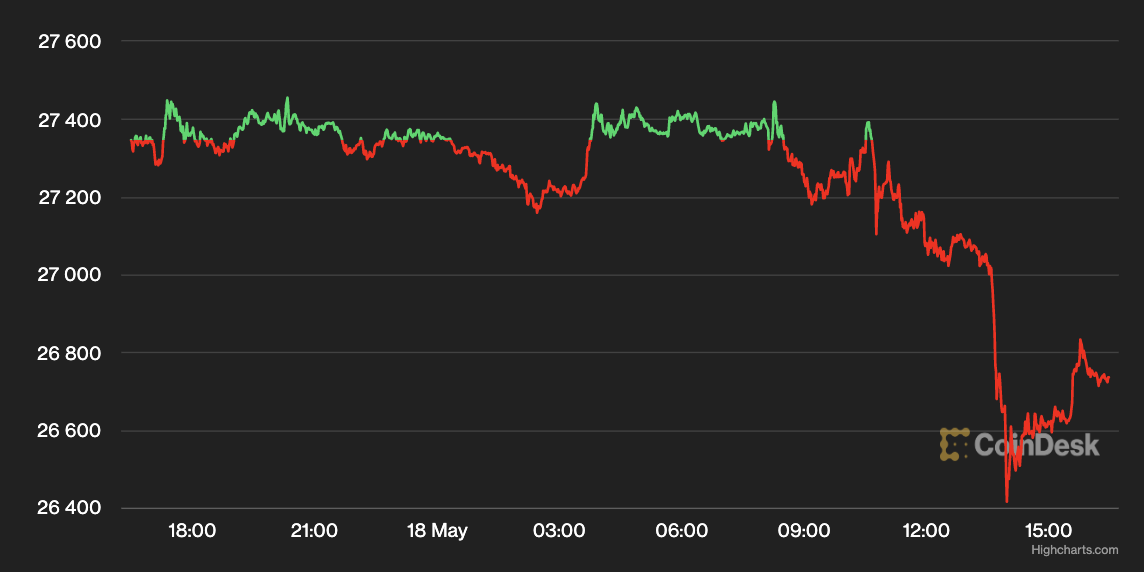

Bitcoin Drops Below $27K as Investors Continue to Weigh Debt Ceiling Talks, Regulatory Actions

Bitcoin (BTC) tumbled back below $27,000, reversing its advance from a day ago as investors continued to weigh the ongoing debt ceiling talks in Washington, D.C. and the latest regulatory moves.

The largest cryptocurrency by market capitalization was recently trading at around $26,700, down 2.1% over the last 24 hours, according to CoinDesk data. BTC had challenged $27,500 Thursday morning, but a quick pullback early in the afternoon took the price down to nearly $26,400.

“Bitcoin is hovering near its recent lows as investors await regulatory clarity and whether Wall Street believes any use-case arguments will be made anytime soon,” Edward Moya, senior market analyst for foreign exchange market maker Oanda, wrote in a Thursday note. “This frustrating trading range has turned off many investors and if the crypto fundamentals don’t improve anytime soon, downward pressure could resume,” he continued.

Over $20 million of BTC futures were liquidated in the past four hours, with 87% of them being long positions, or bets on higher prices, according to Coinglass data.

Ether (ETH), the second-largest cryptocurrency by market capitalization, followed a similar trend, down 1.6% to change hands at around $1,795 on Thursday afternoon. The CoinDesk Market Index (CMI), which measures the overall crypto market performance, was down 2.2% on Thursday.

Equity markets closed higher Thursday afternoon, with a late rally pulling the Nasdaq higher by 1.5% the S&P 500 by 0.95%, and the Dow Jones Industrial Average by 0.35%.

Alex Tapscott, managing director of the digital asset group at Ninepoint Partners, told CoinDesk in an interview that BTC has recently performed more like “a technology stock” than “a pure store of value.”

“Last year, almost all assets weakened against the US dollar,” Tapscott said. “We were in the midst of a real liquidity crunch where rates were going up so much that people were deleveraging. The most liquid and most safe assets a lot of people considered were U.S. Treasuries and U.S. dollars.”

“The Nasdaq and other tech-focused investments have played a little bit of catch-up” this year, he added. “At the same time, we’re seeing bitcoin consolidating around [near] between $27,000 to $30,000 level.”

While some analysts argued that the debt ceiling debate could boost “safe-haven” assets such as gold and bitcoin, Tapscott said he’s not convinced that BTC’s price will go up in the event of a government default.

Noelle Acheson, a market analyst and former head of research at Genesis Trading and CoinDesk (both subsidiaries of Digital Currency Group), pointed out in her newsletter on Thursday that if the debt ceiling ended up being raised, there could be “a sharp withdrawal of monetary liquidity as the Treasury issues a ton of debt in order to replenish its treasury.”

The issuance of debt to top-up coffers means that “money will move out of cash and risk assets into US government bonds, especially as yields on these instruments rise to offset the increase in supply,” Acheson wrote, adding that this could be unfavorable for bitcoin and gold as both tend to fall in price when yields are rising.

Bitcoin’s 2024 halving cycle

While the market wavers during these debt ceiling talks, Ninepoint Partners’ Tapscott suggested that investors will soon be pivoting their attention toward BTC’s 2024 halving cycle that “typically precedes a bull market in crypto.”

Messari Research Analyst Sami Kassab told CoinDesk in an email that when examining price charts from the last three halvings – 2012, 2016, and 2020 – “it becomes apparent that bitcoin has consistently entered a bull market within 12-18 months prior to each halving event.”

Kassab said the current price action of BTC appears to be in line with these previous cycles, suggesting that “the pattern is still holding.” He reminded, however, that past performance is not a guarantee of future results.

Charlie Morris, chief investment officer at ByteTree Asset Management, said the halving likely isn’t fully priced in. He told CoinDesk that “miner selling pressure literally halves next April which is buoyant. Moreover, the 4-year cycle normally sees bitcoin end the cycle above the average price for that cycle.”

Edited by Stephen Alpher.