Bitcoin Dominance is Growing: What does it mean for the long term?

Once again, the crypto markets have seen a significant drop in prices, with the total market cap going below $200billion for the first time since November 2017.

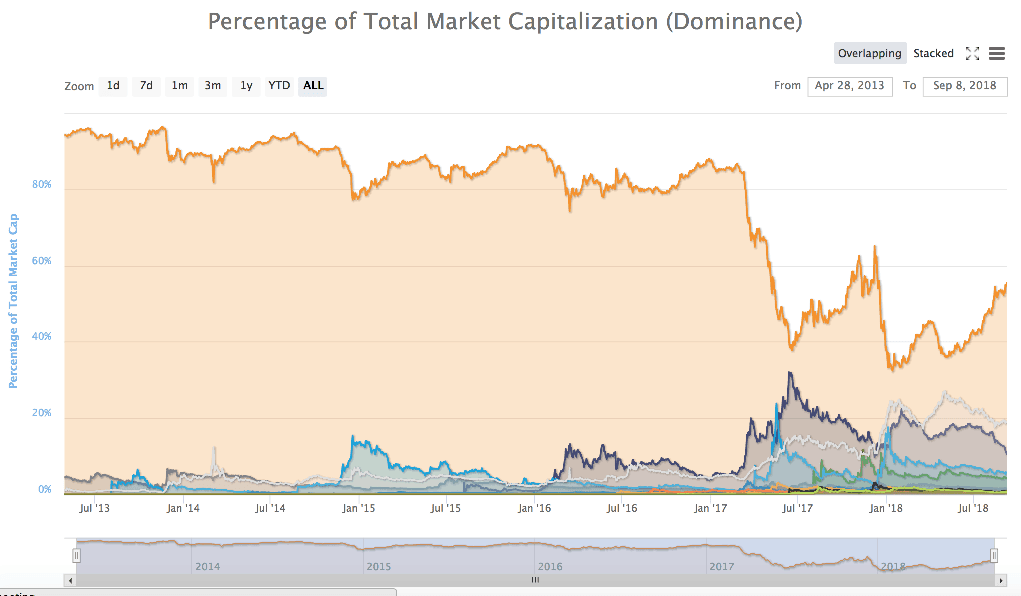

It is during these low points that we observe the relative dominance of Bitcoin compared to other coins in the market. Today, the leading cryptocurrency shows 55% dominance over all the other altcoins:

The price of Bitcoin has always been a leading indicator for how well the crypto markets as a whole are doing. From 2009 to 2016, Bitcoin was still the primary cryptocurrency by far, with altcoins not yet in existence or only holding a very small presence in the industry. Then in 2017, with the rise of ICOs, altcoins began to grow in dominance, reaching their peak in July of 2017, where Bitcoin’s dominance was only 37.82%, while Ethereum, the main blockchain in which most ICOs were being launched, was at 30% dominance of the whole crypto market.

Fast forward to September 2018, the vast majority of ICO tokens have lost close to 90% of their value, Ethereum is now priced at under $200, and the dominance ratio between Bitcoin and the rest of the crypto market only continues to widen while Bitcoin gains dominance.

In a highly speculative market, where prices have been determined by hype over actual utility, Bitcoin’s growing dominance should not surprise anyone. Bitcoin still remains the go-to cryptocurrency for storing and transferring money, which is what its core value proposition has always been. Despite its scaling challenges, Bitcoin’s level of global support from miners and awareness from broader society has kept the currency relatively strong on the demand side in spite of waning interest from retail investors this year.

Altcoins, on the other hand, exist to solve other problems that aren’t directly related to banking and finance using blockchain technology. Some are focused on scalability and being a foundation for Dapps, while others are trying to disrupt specific industries like supply chain, real estate, IoT, etc.

The challenge of maintaining the same level of dominance experienced in 2017 is in part caused by the difficulty of altcoins being utilized for their intended purpose, as opposed to being traded as speculative investments.

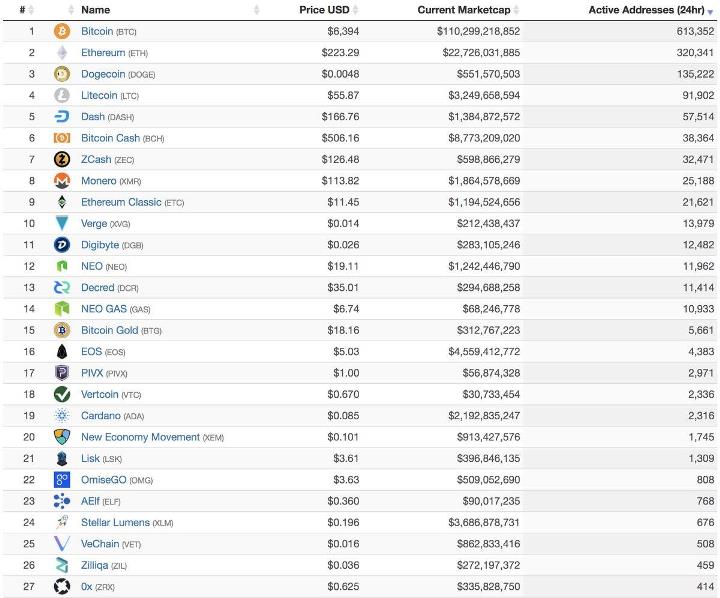

According to onchainfx.com, only 27 cryptocurrencies had over 400 active addresses in a single day:

This is probably due to the fact that most people choose to leave their coins on exchanges instead of storing them in their digital wallets. If the majority of purchased altcoins are being stored on exchanges, that only proves that buyers are more interested in speculating on their price, than actually spending them on what they were meant to be used for.

Bitcoin is not exempt from being seen as nothing more than a speculative asset for many. However, the reality is that Bitcoin has gone much further than all the other cryptocurrencies for institutional, retail, and enterprise adoption. Today, there are more businesses than ever accepting Bitcoin (over 12,000), more people are spending it, and more people are storing it in their cold and hot wallets as opposed to trading on exchanges.

On the speculative side, the vast majority of investors and traders who trade altcoins do so to accumulate more Bitcoin. Wealth within the crypto space is still primarily defined by how much Bitcoin one holds, which is a testament to the dominance Bitcoin continues to have in the industry.

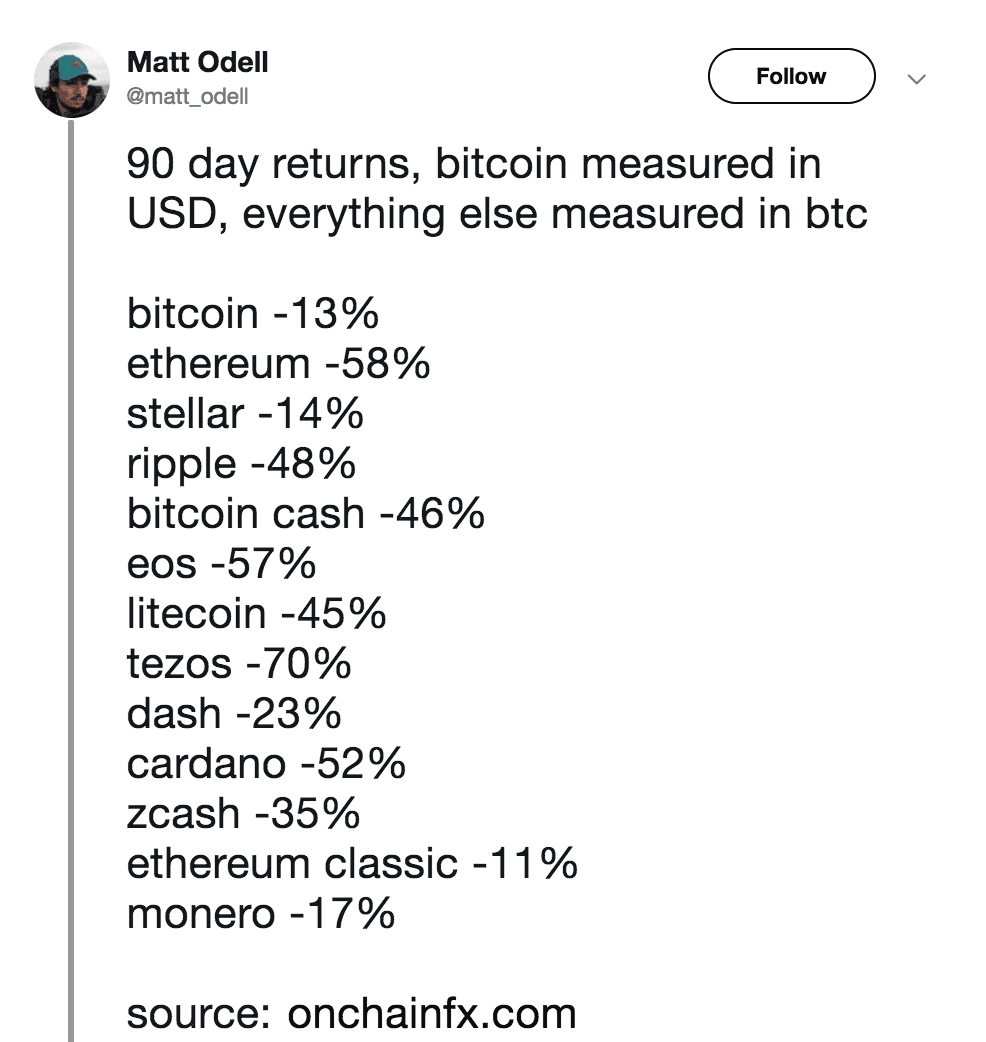

Furthermore, as an investor, it’s clear that holding Bitcoin over the past 90 days would have led to the least amount of losses:

This only further supports the notion that Bitcoin is better at retaining value during up and down market cycles due to a combination of real-world utility and market dominance.

Conclusion

In the past year, thousands of new cryptocurrencies have emerged to try and solve problems using blockchain technology. The majority seem to be failing, while some are showing slow signs of progress. What will probably occur in the future is that only a handful of altcoins will develop to the point where people buy them for their actual utility as opposed to speculation. Then slowly, these coins will be viewed as alternatives to BTC, instead of secondary currencies that should be traded in order to accumulate more BTC. Currently, Litecoin, Dash, and Bitcoin cash are being seen as the closest alternatives to Bitcoin. However, coins like Zcash or Stellar may achieve those positions in the near future.

Ultimately, the crypto space is still in the very early stages of fruition. Bitcoin was the first and most likely will always be the most recognized cryptocurrency, yet there is still room for altcoins to compete as long as they can convince buyers to store and spend them for their intended purpose just as many around the world do with Bitcoin today.

The post Bitcoin Dominance is Growing: What does it mean for the long term? appeared first on CryptoPotato.