Bitcoin Dominance At a 5-Month High as Altcoins Take a Beating (Market Watch)

Bitcoin marches confidently towards new yearly highs while most alternative coins have failed in pursuit. Consequently, BTC’s dominance over the market has climbed above 65%.

Red Dominates The Altcoins

On a 24-hour scale, most alternative coins have either decreased in value or remained stagnant.

Ethereum initiated a leg up towards $470, but the bears didn’t allow any further increases. In fact, they drove ETH’s price south, and the second-largest cryptocurrency struggles at $460 as of writing these lines.

Ripple also took another swing at $0.26 but to no avail. XRP has slid since then and trades below $0.255.

Polkadot (-0.6%), Binance Coin (-0.8%), and Cardano (-0.9%) have all declined slightly from the top ten. However, Bitcoin Cash and Chainlink have lost the most value here. BCH’s 5% drop has decreased the asset to $250, while LINK (-3%) is below $12.5.

Litecoin is the only exception. LTC has pumped by 4.5% and hovers above $60.

Further losses are evident from ABBC Coin (-11.6%), Ocean Protocol (-11%), NEAR Protocol (-10%), and OMG Network (-9%). In contrast, Decred is the most significant gainer since yesterday, with a 15% price increase.

BTC’s Dominance Rises With A New YTD High

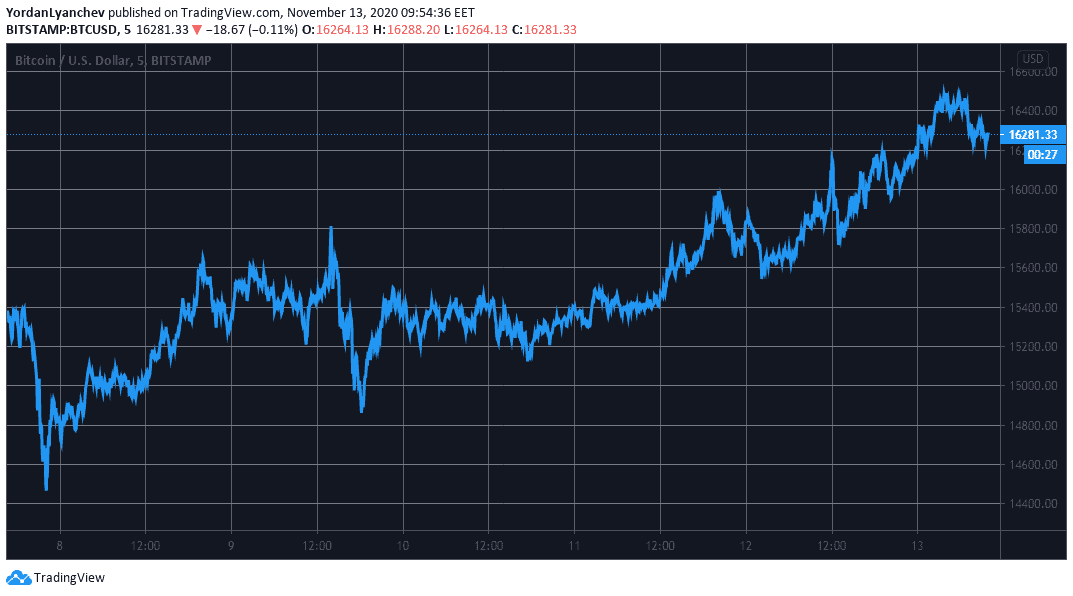

As reported earlier today, Bitcoin doubled-down on its recent impressive performance. Less than a week after sufferring a severe price breakdown that took it to $14,300, BTC overcame the $16,000 obstacle.

However, that didn’t seem enough for the primary cryptocurrency. The bulls took it a step further in the following hours, and BTC touched $16,500 – the new highest price tag since January 2018.

Although Bitcoin has retraced slightly to $16,280, this is still a 2.3% increase in a day.

Bitcoin’s dominance has increased as a result of the aforementioned price developments for BTC and the altcoins. The metric comparing the total market capitalization of the first-ever digital asset with all other coins now displays 65.2%. This is a 1.5% increase since November 11th, when most altcoins, especially DeFi tokens, were rallying.