Bitcoin Does Latin America: LocalBitcoins Volume Keeps Increasing Drastically Since 2017

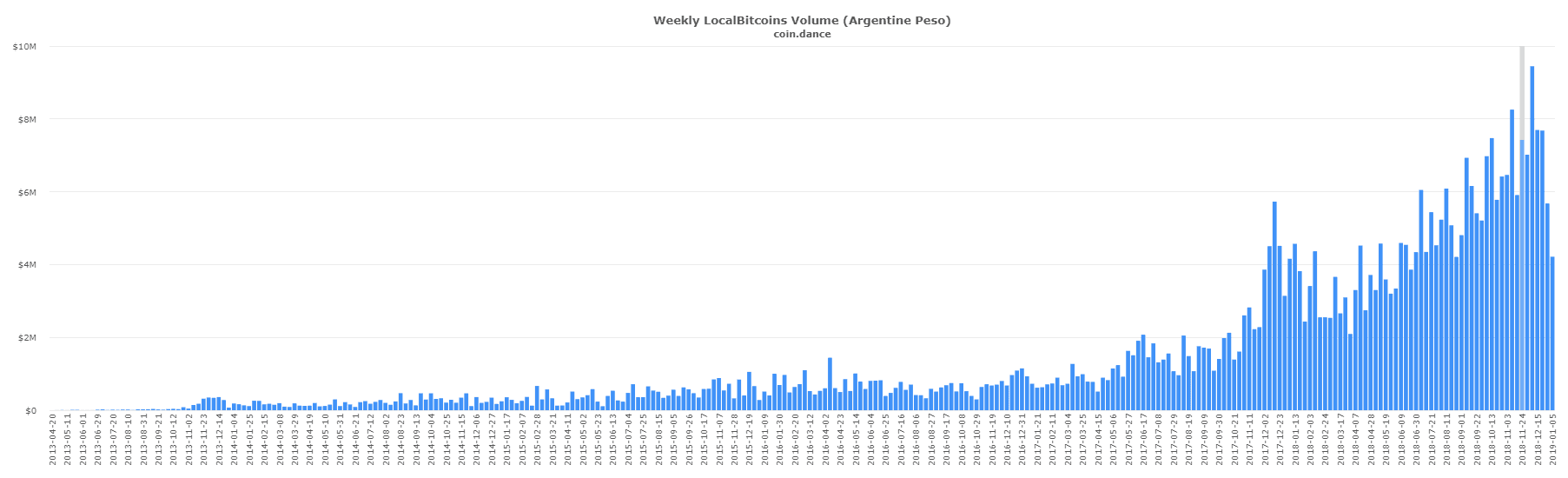

The citizens of Latin American countries – from which many are experiencing hyperinflation in regards to their national fiat currencies – are trading a surging number of BTC. According to Coin.Dance, the trading volume of Localbitcoins users in Venezuela – that is in the midst of an economic crisis -, Argentina, Uruguay, Colombia, and Chile has drastically increased since January 2017.

A growing crisis

Among all Latin American countries, Venezuela is the one that is suffering the most. According to the International Monetary Fund (IMF), the Venezuelan Bolivar’s (VES) extreme inflation is projected at 1 million percent. Experts state that the situation is not expected to change in the near future with the economic crisis continuing its downfall.

Argentina has also become a victim of hyperinflation. Three years ago, nearly 14 Argentinian Peso (ARS) equated the price of a dollar, but at the moment of writing this article, the fiat currency has inflated so much that 1 USD is worth now 37.6 ARS. Furthermore, the country is facing increasing social unrest due to the austerity measures that are expected to “fix” the ruined economy of the country.

The hyperinflation of the ARS and VES also affected other Latin American countries, including Uruguay, Colombia, and Chile. Since the start of 2017 – comparing the fiat currency to one USD -, the Uruguayan Peso (UYU) went up from 28.6 to 32.7. Colombia’s and Chile’s national currencies remained relatively stable. But still, Localbitcoins stats show that the citizens of the two countries are showing an increased interest in buying BTC using the P2P service.

The drastic increase

Let’s look at the charts on Coin.Dance about each country. Venezuela that has the biggest crisis of all have bought 4.6 times more BTC than in January 2017. While the situation was the following in the other Latin American countries: Argentinians spent 4.5 times, Colombians 16 times, and Chileans 3.5 times more fiat currencies to buy crypto on Localbitcoins.

These stats show that in Venezuela and Argentina where the hyperinflation is the highest, the citizens of both countries are increasingly exchanging their national currencies to crypto as the inflation of the coins is much lower (even in this continuous bear market). On the other hand, the citizens of the other three Latin American countries could be purchasing more coins as they want to avoid any inflation that could occur in the future in regards to their national currencies.

The post Bitcoin Does Latin America: LocalBitcoins Volume Keeps Increasing Drastically Since 2017 appeared first on CryptoPotato.