Bitcoin Dips Below $27K, Reversing Post-CPI Rally

:format(jpg)/www.coindesk.com/resizer/KnsJr2e_U9xZpD2ZQMUcfS-ZspM=/arc-photo-coindesk/arc2-prod/public/ZEPFGG2W5BBFRJUO5WS4CTRCPA.jpeg)

Jocelyn Yang is a markets reporter at CoinDesk. She is a recent graduate of Emerson College’s journalism program.

Bitcoin (BTC) dipped below $27,000 Wednesday midday, reversing a morning jump following the release of mildly encouraging U.S. inflation data.

The BTC/USD trading pair on Coinbase traded as low as $26,800 before regaining some ground, according to TradingView data. The largest cryptocurrency by market capitalization was recently trading at around $27,400, down more than 4% in the past hour and 1.8% in the past 24 hours.

(TradingView)

Coinglass data showed that traders who bet on a price shift liquidated over $47 million in BTC long positions over roughly the past hour versus just over $5 million in BTC short position liquidations. These types of long squeezes tend to push prices lower.

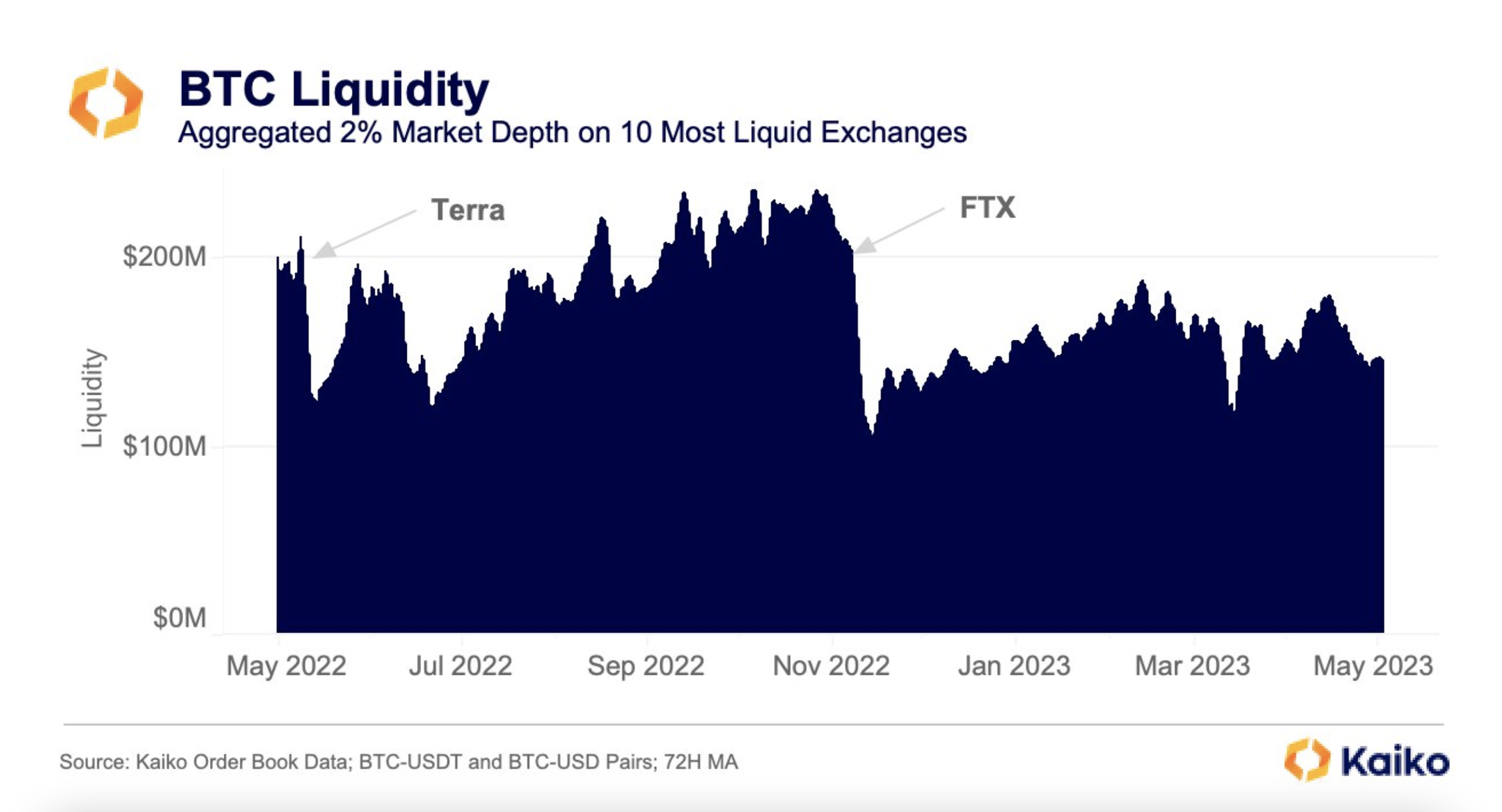

Riyad Carey, research analyst at crypto data firm Kaiko, pointed out that there are still concerns about low liquidity in markets, with BTC’s aggregated 2% market depth – a metric for assessing liquidity conditions – hasn’t recovered since crypto exchange FTX’s collapse last November.

It’s “a symptom of illiquidity,” he told CoinDesk.

(Kaiko)

BTC’s price initially jumped after Wednesday morning’s Consumer Price Index (CPI) report, released by the Bureau of Labor Statistics, showed that annual inflation slowed to 4.9% in April from 5% in March and less than the forecast 5%. The CPI rose 0.4% on a monthly basis, aligning with expectations and higher than 0.1% in March.

Ether (ETH), the second-largest cryptocurrency by market capitalization, followed a similar pattern, dropping by 1% in the past 24 hours to change hands at around $1,860. The CoinDesk Market Index (CMI), which measures the overall crypto market performance, was down 1% over the past 24 hours.

Equities were mixed on Wednesday midday (ET), with the S&P 500 trading down 0.1% but the tech-heavy Nasdaq edging 0.5% higher. The Dow Jones Industrial Average (DJIA) was down 0.6% for the day.

“The sell-off coincided with a drop in stocks so it could be partially correlation-led,” Lucas Outumuro, head of research at blockchain analytics firm IntoTheBlock, told CoinDesk.

UPDATE (May 10, 2023, 18:37 UTC): Adds Carey comments.

Edited by James Rubin.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/KnsJr2e_U9xZpD2ZQMUcfS-ZspM=/arc-photo-coindesk/arc2-prod/public/ZEPFGG2W5BBFRJUO5WS4CTRCPA.jpeg)

Jocelyn Yang is a markets reporter at CoinDesk. She is a recent graduate of Emerson College’s journalism program.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/KnsJr2e_U9xZpD2ZQMUcfS-ZspM=/arc-photo-coindesk/arc2-prod/public/ZEPFGG2W5BBFRJUO5WS4CTRCPA.jpeg)

Jocelyn Yang is a markets reporter at CoinDesk. She is a recent graduate of Emerson College’s journalism program.