Bitcoin Dipped to 14-Day Low: Avalanche Soars 9% (Market Watch)

Bitcoin’s adverse price movements continued in the past 24 hours, and the asset fell to a two-week low of $45,500. Most altcoins also suffered, with the apparent exception of Avalanche, which has soared by nearly 10% on a daily scale.

Bitcoin’s 14-Day Low

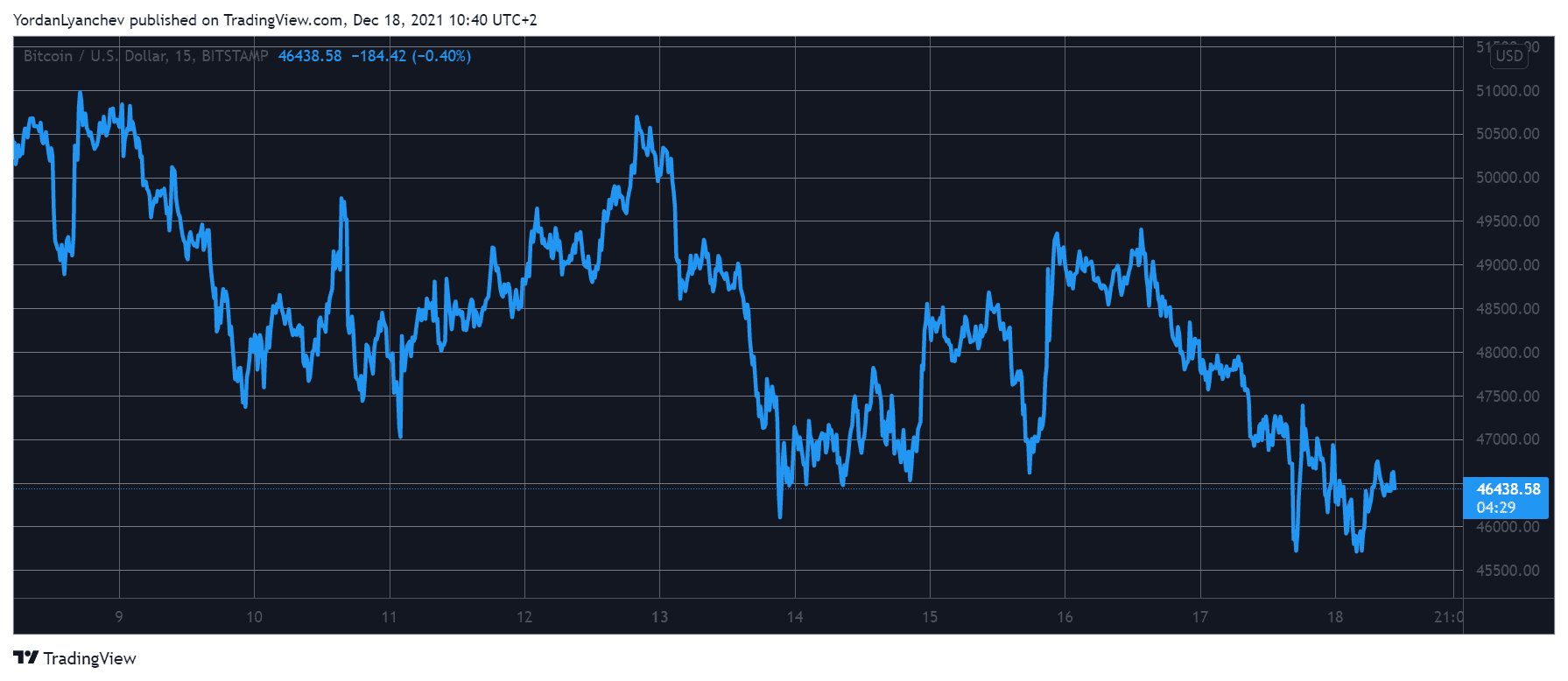

It was just two days ago when the US Federal Reserve said it will leave the interest rates unchanged, which caused a substantial price surge for bitcoin.

The cryptocurrency traded at $46,500 and skyrocketed to $49,500 in just minutes. As the community raised hopes that BTC will finally be able to overcome its $50,000 nemesis decisively, the bears came back to play.

Bitcoin began to gradually lose value, as reported yesterday, but the landscape only worsened in the following hours. This time, the asset fell to $45,500 – the lowest price tag since the massive December 4th crash.

Despite recovering around a thousand dollars since then, BTC is still slightly in the red, and its market capitalization is well below $900 billion.

AVAX Spikes 9%

Similar to bitcoin, most altcoins also headed south yesterday but have recovered most daily losses. As a result, most stand still on a 24-hour scale.

Ethereum, Binance Coin, and Ripple are slightly in the green. Nevertheless, ETH still trades below the coveted $4,000 mark, Binance Coin is below $530, and XRP is just over $0.8. In contrast, Solana, Cardano, Polkadot, and Shiba Inu have marked minor losses.

Avalanche is the most significant gainer once again. AVAX is up by another 9% and now trades well above $110. Moreover, the asset is up by 40% since the blockchain platform behind it announced USDC support earlier this week.

More gains come from a few DeFi tokens, led by a 25% increase by YFI, a 15% surge from Curve DAO Token, and a 13% jump from Aave.