Bitcoin Dipped Below $40K, Gold at 8-Month High on Ukraine Tensions: This Week’s Crypto Recap

The past week hasn’t been so favorable for the cryptocurrency market, the capitalization of which dropped below $2 trillion once again. This is likely to have to do with the global macro tensions between Ukraine and Russia. But let’s start with Bitcoin.

The leading cryptocurrency dipped below $40K today for the first time since February 4th. At the time of this writing, BTC managed to recover above the coveted level, but the volatility is considerable. All in all, it hasn’t been a good week for the cryptocurrency, which charted a decrease of around 8.7% in the past seven days.

This happened as it failed to successfully overcome the resistance at $44K, despite attempting to do so a few times and even consolidating around that level for a bit. The bull’s indecision resulted in a sell-off that saw BTC lose about $4K in a couple of days.

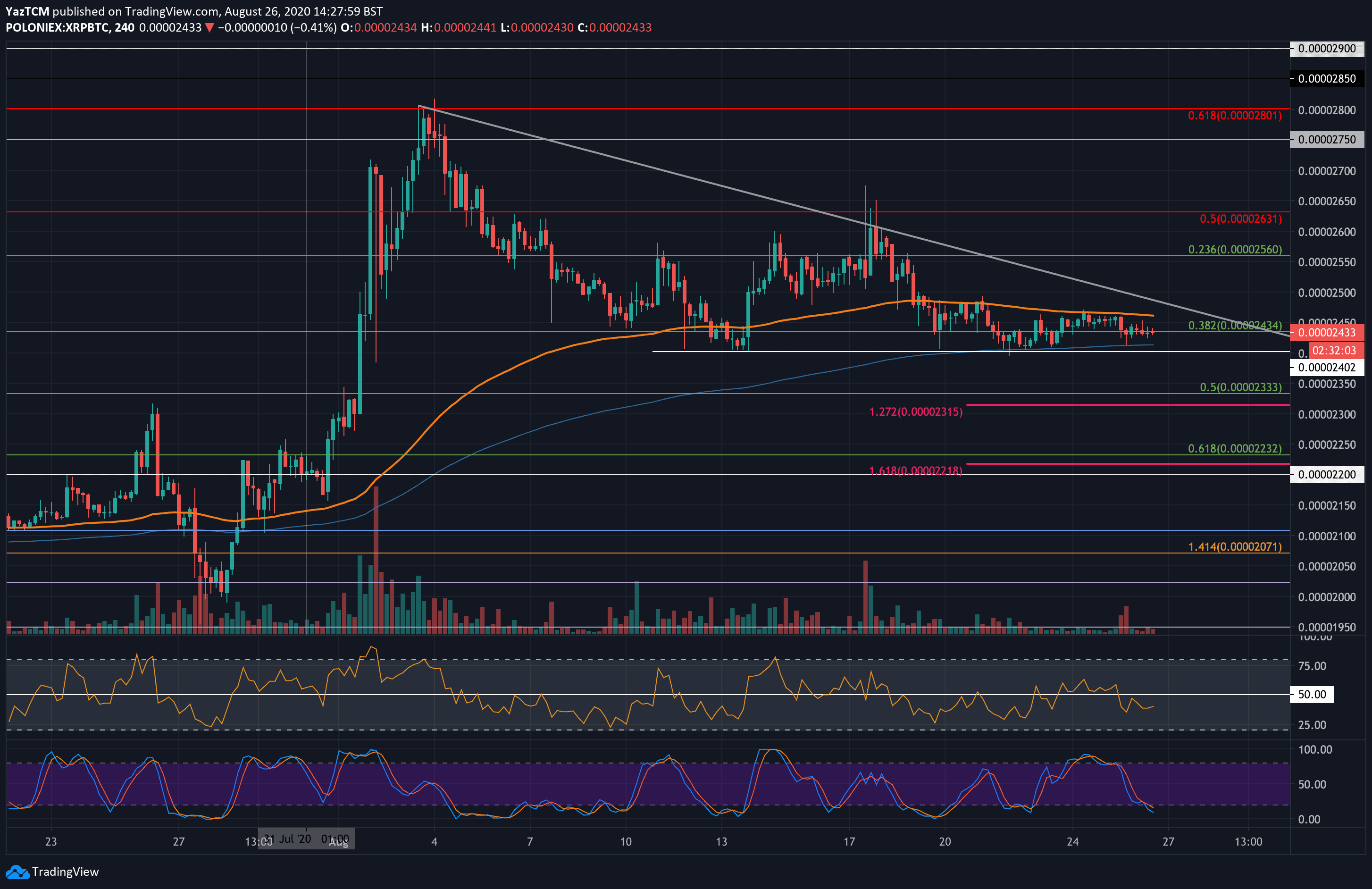

Needless to say, the entire cryptocurrency market followed suit. Ethereum is down roughly the same as BTC, while BNB lost 4.3%. XRP is down 7.5%. Going further, ADA and SOL shed some 13% of their capitalization, similar to Polkadot.

On the other hand, however, gold saw some notable gains, and it’s even trading at an 8-month high. The precious metal rose 1% on Thursday, trading at $1,902 per ounce, whereas traditional markets represented mostly by the S&P 500 took a beating by falling over 2%.

This could be expected, to some extent. Political and macroeconomic turmoil, such as what we’re seeing amid the tension between Russia and Ukraine, typically results in considerable volatility in the stock market as the uncertainty of potential outcomes looms over investors. In situations like these, they tend to seek safety in the stability of the precious metal.

In any case, it’s interesting to see what the coming week has in store for the cryptocurrency market. Upholding the $40K resistance might be critical for the short-term market momentum.

Market Data

Market Cap: $1,939B | 24H Vol: 93B BTC Dominance: 39.7%

BTC: $40,600 (-8.7%) | ETH: $2,865 (-8.5%) | ADA: $1.02 (-13%)

US Justice Department Names Head Of Newly Formed Crypto Enforcement Team. The Justice Department of the United States has appointed Eun Young Choi to lead their brand new “National Cryptocurrency Enforcement Team.” Choi is a former cybersecurity prosecutor and the new entity aims to crack down on digital currency schemes.

USDC Issuer Circle Valued at $9 Billion, Aims to Go Public by December 2022. The issuer of the second-biggest stablecoin by total market capitalization USDC – Circle – aims at going public through a SPAC this December. The company is now valued at a whopping $9 billion following a new agreement with Concord.

Mastercard to Hire 500 Professionals to Expand Crypto Consulting Arm. Payment processing giant Mastercard is set to onboard over 500 professionals in 2022 as part of its plans to expand its data and services unit. In addition, the company also aims to broaden its cryptocurrency consulting arm.

Twitter Fully Incorporates Ethereum Tipping And Wallet Support. The micro-blogging social media platform, Twitter, has incorporated Ethereum tipping and wallet support. This is part of the company’s push for cryptocurrency adoption.

What if You Mined Bitcoin For a Day in 2010? How Much Would it Be Worth Now? A conversation between Satoshi Nakamoto and an early Bitcoin miner revealed that the latter was able to produce 5 blocks in a day and receive 250 BTC in rewards for them. This is currently worth around $11 million – 12 years later.

Here’s How I Turned $2K Into Almost $500K Flipping NFTs: Trader Shares. The story of a non-fungible tokens (NFTs) trader who managed to turn $2,000 into over $500,000 in a few months. He reveals his secrets and the most important principles he followed to be successful.

Charts

This week we have a chart analysis of Ethereum, Ripple, Binance Coin, Cardano, and Polygon – click here for the full price analysis.