Bitcoin Crashes Below $37K to 2.5-Month Low: Over $100M Liquidated In One Hour

Bitcoin’s price took a nosedive on Thursday after stocks retraced gains made following yesterday’s Federal Open Markets Committee Meeting (FOMC). It fell to $36,520 – the cryptocurrency’s lowest price since Russia invaded Ukraine.

- At FOMC on Wednesday, Federal Reserve Chairman Jerome Powell announced the first 0.5% interest rate hike since May of 2000. He set future expectations for further 50 basis point hikes later this year.

- However, he also claimed that 75 basis point hikes were mostly off the table. Both Bitcoin and stocks responded positively at the time, each pumping by roughly 2% each.

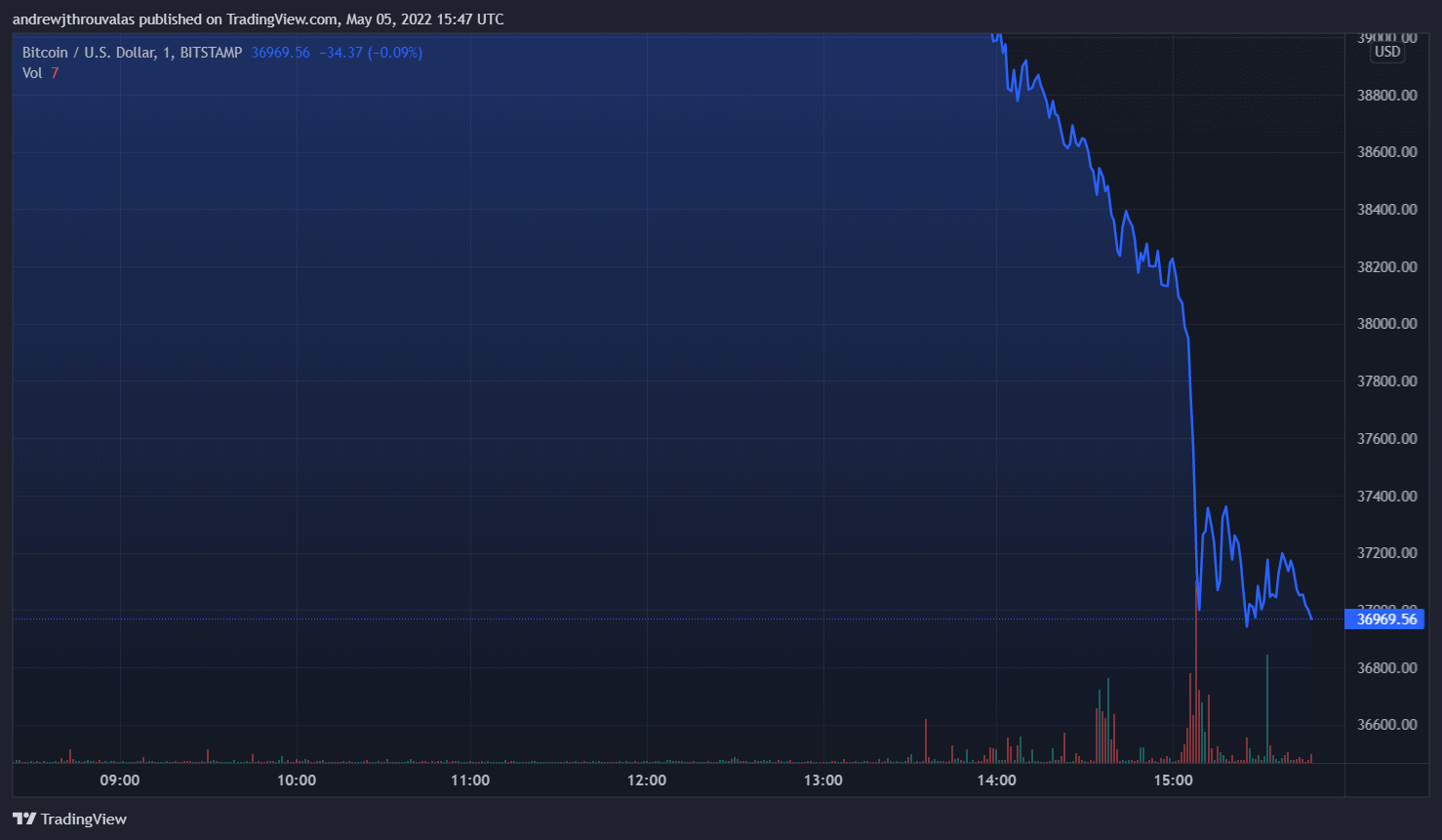

- The optimism appears short-lived, however: The S&P 500 has since lost those gains, down 3.3% on the day. Meanwhile, Bitcoin’s price began to plunge at roughly 13:20 UTC, from about $39,400 down below $37,000 in 2 hours.

- The main reason for the sharp declines seems to be that the U.S. rate futures prices the chance for a 75 basis point hike in June by 75%.

- The crash appears to have coincided with a liquidation cascade. Coinglass reports $146 million in crypto liquidations within the past hour alone, with $68 million in Bitcoin losses.

- That’s over two-thirds of the liquidations to take place in the last 12 hours, and nearly half of the liquidations over the past day.

- The last time liquidations of this size took place was in mid-April, when mid-March’s hype around Terra’s Bitcoin buys appeared to die off.