Bitcoin Crashes $5500 Below $53K Upon Severe Correction (Market Watch)

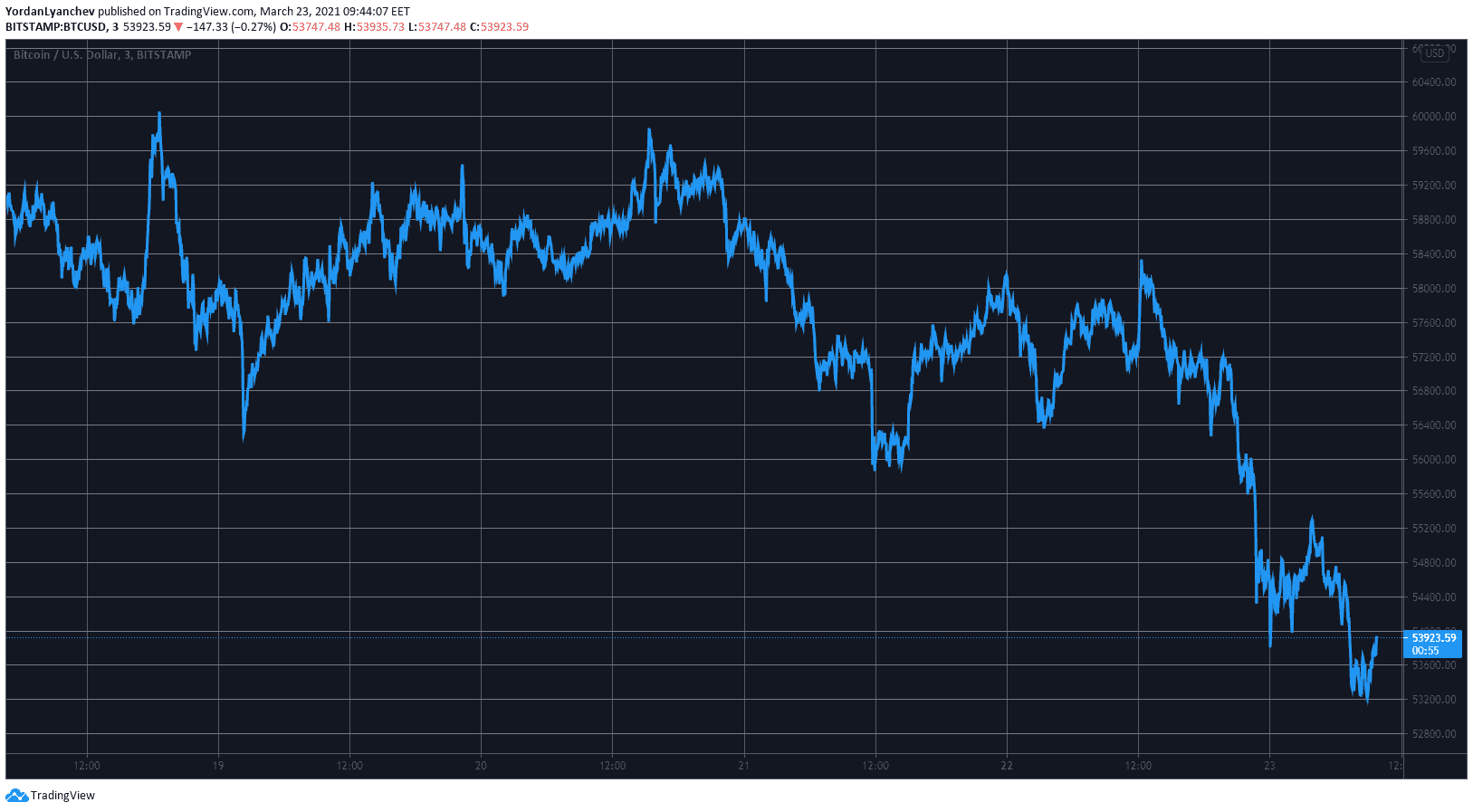

Bitcoin’s adverse trading days continue as the asset lost more than $5,000 since yesterday’s high to an intraday low of just beneath $53,000. Most alternative coins have followed along on the way down, and the crypto market cap has seen over $130 billion evaporated.

Bitcoin Fell by $5,500

Following a few unsuccessful attempts to reclaim $60,000, bitcoin remained stuck around $58,000 for a while. However, the bears took charge yesterday and changed the price trajectory rather vigorously.

After reaching a daily high of $58,500, BTC plummeted by roughly $5,500 to just below $53,000 (on Bitstamp).

Despite bouncing off and regaining several hundred dollars, the primary cryptocurrency is still about 7% down on a 24-hour scale.

The sharp price decline also harmed BTC’s market capitalization, which dipped beneath the coveted $1 trillion earlier today. As of writing these lines, though, the metric has spiked back up to that particular level.

Additionally, bitcoin’s dominance has also suffered by dropping below 60%. Approximately a week ago, the metric comparing BTC’s market cap with all other cryptocurrencies was well above 62%.

Alts in Red; But Not XRP

As it typically happens during a highly-volatile price movement in either direction, the majority of the altcoin market has followed its leader. Ethereum leads the pack with a 7% drop to well below $1,700.

A 4% drop for Binance Coin to $254 has helped Tether overcome BNB as the third-largest cryptocurrency by market cap.

Cardano (-9%), Polkadot (-6%), Litecoin (-5.5%), and Chainlink (-7.5%) are also deep in red.

In contrast, Ripple has jumped by more than 10% following reports suggesting that XRP could be relisted on US-based exchanges. As a result, the token has surged above $0.56.

THETA has doubled-down on its recent bullish run by another 15% increase to $11. Consequently, THETA surpassed LINK in terms of market cap and is currently in the top ten.

Further losses come from Harmony (-20%), Siacoin (-19%), Helium (-15%), Terra (-14%), VeChain (-14%), IOST (-13%), Nexo (-12%), Enjin Coin (-12%), Flow (-12%), Zilliqa (-12%), and more.

Ultimately, the cumulative market capitalization of all cryptocurrency assets has declined by more than $130 billion to beneath $1.7 trillion.