Bitcoin Could Peak at $45K in May, Analyst Says

Featured SpeakerAlex Thorn

Head of Firmwide ResearchGalaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Featured SpeakerAlex Thorn

Head of Firmwide ResearchGalaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

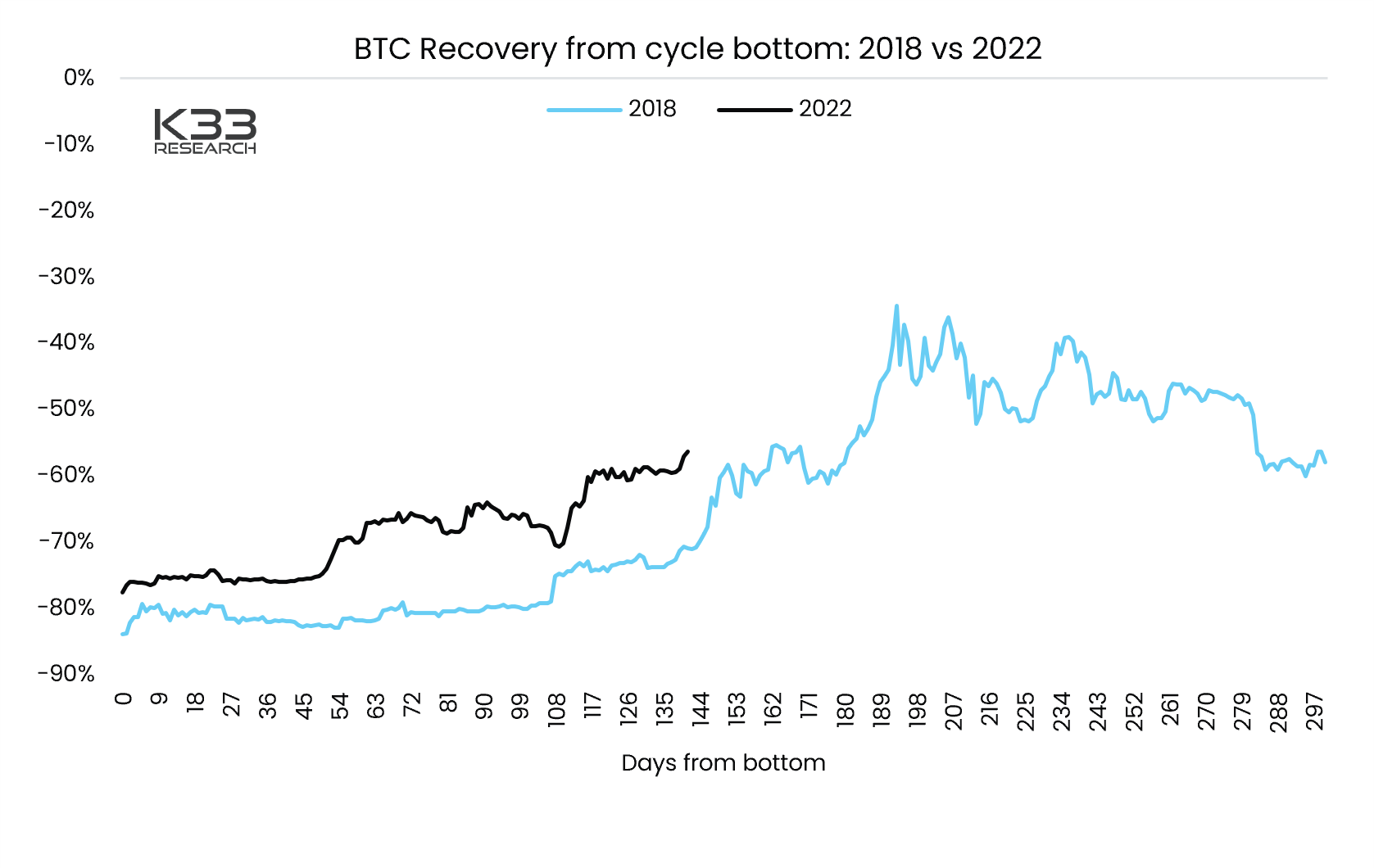

Bitcoin (BTC) is closely following its early 2019 surge and prices could peak at around $45,000 next month, according to Vetle Lunde, a senior analyst at K33 Research.

The largest cryptocurrency by market value has rallied 80% this year, beating traditional risk assets, including the tech-heavy Nasdaq index, by a significant margin. The rally comes after a 12-month decline that saw prices tank 76% and bottom out in November 2022.

The drop and subsequent recovery are analogous to the pattern seen in the 2018-19 bear market in terms of length and trajectory, according to Lunde.

“Bottoms in both cycles lasted for approximately 370 days. And the peak-to-trough return after 510 days of both cycles reached 60%,” Lunde said in a note sent to clients last week. “In 2018, the bear market rally topped 556 days after the 2017 peak, on June 29, 2019, with a 34% drawdown from the peak.”

“While history is far from likely to repeat in a similar fashion if the fractal were to continue – BTC would peak around May 20 at $45,000,” Lunde said.

Bitcoin fell 84% in 2018, with prices bottoming near $3,100 in December. The trend changed in the following months, with prices climbing to $3,700 by the start of 2019 and rising as high as $13,800 by the end of June.

(K33 Research)

Bitcoin’s year-to-date rise has been widely referred to as a “hated bullish move” among crypto observers on Twitter, considering several prominent traders were positioned for a continued sell-off in the first quarter.

A “hated” bull market typically begins during peak pessimism. It reaches a fever pitch once investors who reduced risk in anticipation of an extended slide, begin to feel underexposed and join the bullish bandwagon.

“The hated rally of 2019 ended with a significant blow-off top before BTC resumed trading at a 40-60% drawdown from its 2017 ATH,” Lunde noted. “The early 2023 rally has all the hallmarks of a hated rally.”

Bitcoin changed hands at $29,850 at press time, representing a 1.5% decline for the day, according to CoinDesk data.

Edited by Sheldon Reback.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.