Bitcoin Could Hit $69K by Mid-2024 as It Enters Acceleration Phase, Analyst Says

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

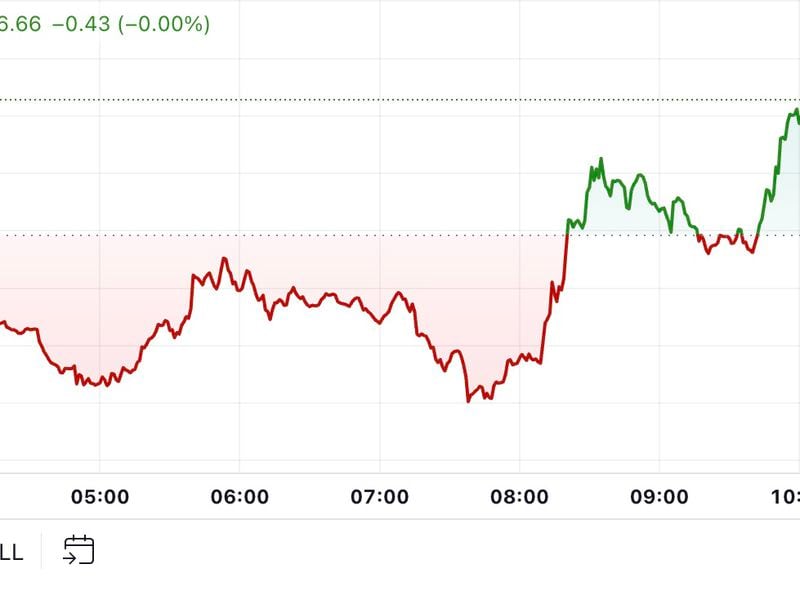

Bitcoin (BTC) prices could regain their lifetime peak price of over $69,000 by mid-2024 as they undergo an “acceleration phase” marked by volatility and a sharp rally, some traders expect. That is an 88% gain from current prices of $36,500.

“Bitcoin uptrends tend to move quickly once they get going, moving hundreds of percent often in less than a year,” shared Cory Mitchell, an analyst with Trading.biz, in a Friday note to CoinDesk. “This is called the acceleration phase.’

According to Mitchell, “really big gains” happen a year and a half after the bottom, meaning the near-90 degree price surge could resume sometime around mid-2024. The cryptocurrency bottomed out in November last year.

“In 2013, bitcoin rallied 1200% in approximately 100 days; in 2017, it rallied 1900% in just under a year; in late 2020, it rallied 400% in about 140 days,” Mitchell said, warning of several pullbacks and price dumps on the way to a retake of highs.

Over the past year, the world’s largest asset by market capitalization has seemingly shaken fears stemming from multiple bankruptcies of prominent players in the industry and a generally bearish economic environment by gaining almost 116%.

Recent bullish sentiment has been largely buoyed by spot bitcoin exchange-traded fund (ETF) filings in the U.S., bumping expectations that regulated offerings could open the gates to widespread institutional demand.

Demand and usage for regulated instruments have grown in tandem with prices. On Thursday, bitcoin futures trading on the Chicago Mercantile Exchange (CME) registered the highest volumes worldwide, toppling those of industry leader Binance.

Open interest, or the amount of unsettled futures, stood at roughly $4.07 billion, up some 4% in the past 24 hours and representing a 24.7% market share. In contrast, open interest on Binance stood at $3.8 billion, down 7.8% during the same period.

Market observers told CoinDesk they considered the rise as indicative of institutional demand for bitcoin products.

“Given the CME is a venue used almost exclusively by large traditional financial institutions, it shows how much interest there has been from this audience in crypto,” David Lawant, head of research at trading platform FalconX, told CoinDesk in a Thursday note.

Edited by Omkar Godbole.