Bitcoin Could Face a Huge Move As iFinex Stands In Court Today Regarding Tether (USDT)

Bitfinex and Tether will stand in court today as its the date for their scheduled motion to dismiss hearing. The companies have been under investigation by the New York Attorney General on allegations of an $850 million cover-up.

Tether Stands In Court

Back in April, as Cryptopotato reported, the New York Attorney General’s office started an investigation against iFinex, the parent company of both Bitfinex and Tether. Allegedly, the company covered up a loss of $850 million by giving itself access to $900 million worth of Tether’s reserves.

On May 22nd, Bitfinex, in an official announcement, revealed that the court has granted their motion for an immediate stay of the documents demands which required the companies to produce only information and documents which are relevant to the limited issue of whether or not there is personal jurisdiction over the companies in New York but also staying the document order in all of its other respects.

Moreover, back then, the court scheduled a hearing for iFinex’s motion to dismiss for July 29th, which is today.

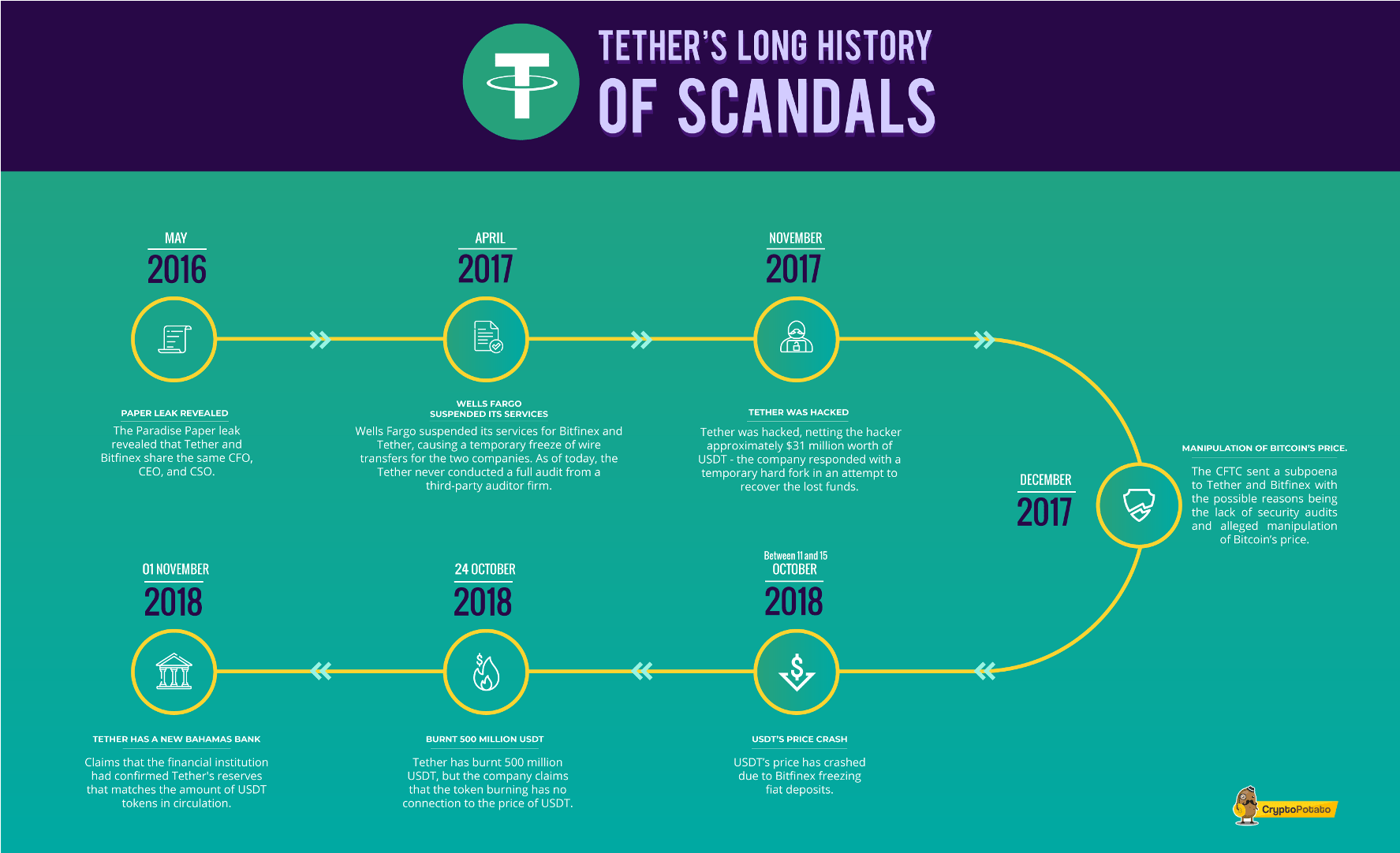

In other words, today we will see whether or not the case is going to go forward or it is going to get dismissed, which is the desired outcome for Tether. In both cases, it remains very interesting to see what the developments would be and whether or not they are going to have an impact on the overall cryptocurrency market. This is especially true given the company’s controversial past.

What Can This Mean For Crypto?

Naturally, being the owner of the issuer of the predominant stable coin, as well as one of the most popular cryptocurrency exchanges, iFinex and the way this case resolves are raising questions about the implications it might have on the cryptocurrency market.

Weighing in on the matter was Mati Greenspan, eToro’s senior analyst, who shared his thoughts in his daily newsletter. According to him, the most likely outcome of a guilty ruling for iFinex would benefit Bitcoin, as well as other cryptocurrencies.

For the short term, the most likely outcome of a guilty ruling for iFinex would be that bitcoin, and possibly other cryptos, go up. Any erosion in confidence for Tether, usually means that traders will dump their USDT and buy other cryptos. – He said.

Yet, he also outlines that he’s been in talks with a very popular member of the crypto community who shares some concerns. He seems to think that if the NYAG prevails, we would need to understand a lot more on how much unbacked USDT has been deployed in the entire market. If it’s just those alleged $700 million, the impact on the market is likely to be insignificant.

In any case, it remains particularly interesting to monitor the development of this case going forward.

The post Bitcoin Could Face a Huge Move As iFinex Stands In Court Today Regarding Tether (USDT) appeared first on CryptoPotato.