Bitcoin Correlation to Wall Street Persists, Market Calms Down Following Terra Demise: This Week’s Crypto Recap

In the wake of Terra’s devastating collapse, the cryptocurrency market is taking a shot at recovery. In the past seven days, the total capitalization is up to $1.350 trillion, gaining roughly around $70 billion. Most cryptocurrencies trade well in the green, so let’s unpack.

Starting with Bitcoin, the cryptocurrency seems rangebound between $28K and $30K. At the time of this writing, it trades slightly above the latter on shaky volume where buyers appear indecisive. Bulls attempted a more convincing attempt to push the price forward and even brought it above $31K. Unfortunately, their push was for not, as sellers interrupted the advance and pushed BTC back towards $29K.

The price action of Bitcoin and of most altcoins, for that matter, can be categorized as an unfavorable chop where a direction is yet to be convincingly determined.

Speaking of altcoins, most of the top ones trade will in the green. Ethereum is up 3.8% over the past seven days, and BNB gained 16.4% – the same as Solana. The largest weekly gainer seems to be Decentraland’s MANA, that’s up a whopping 56%, followed by KuCoin’s native token – KCS (up 43%). On the other end of the spectrum, we have LUNA and UST (not surprisingly) – down 88% and 81%, respectively.

Elsewhere, Wall Street also saw a week full of tumultuous and unconvincing price action where major indices shed some value. The S&P 500 is down 2.55% since Monday, while the DJI is down 2.69%. Correlation between traditional markets and crypto remains at multi-month highs, which indicates that the relatively new industry continues to be completely unable to decouple.

It’s been a calmer week compared to the last one, but it’s undoubtedly very exciting to see what the next seven days have in store.

Market Data

Market Cap: $1,341B | 24H Vol: $88B | BTC Dominance: 42.8%

BTC: $30,151 (+3.5%) | ETH: $2,029 (+3.2%) | ADA: $0.52 (+11.2%)

This Week’s Crypto Headlines You Can’t Miss

First Time in History: Bitcoin Closes in Red 7 Consecutive Weeks. For the first time ever, Bitcoin’s price closed seven consecutive weeks in the red. This also pushed the overall market sentiment into extreme fear. In fact, the metric dropped to a low that we hadn’t seen since the COVID crash in March 2020.

Global Watchdogs to Regulate Stablecoins Following TerraUSD (UST) Fiasco. The sudden collapse of the entire ecosystem of the Terra protocol wreaked havoc on the broader cryptocurrency market. This, in turn, caused global regulators to consider taking steps to regulate stablecoins.

The High Bitcoin and Ethereum Correlation With Wall Street Continues. The decline within the cryptocurrency field in recent weeks hasn’t been an isolated event – in fact, it followed the broader stock market. Data shows that the correlation between the two is currently at a multi-month high.

SEC Chair Predicts Other Cryptocurrencies Will Mimic Terra’s Downfall and Harm Investors. The Chairman of the United States Securities and Exchange Commission (SEC) – Gary Gensler – thinks that there might be more cryptocurrencies like LUNA that will collapse in the near future. This would, in turn, harm more investors the way many people were burned throughout the Terra fiasco.

FTX US Launches Stock Trading for Select Users. One of the leading cryptocurrency exchanges – FTX – revealed its latest expansion intentions. The company aims to allow users to trade stocks aside from just cryptocurrencies, and they’ve already launched the service, which is only available to select traders.

Bitcoin is the Internet’s Only Money, Jack Dorsey Says. The former CEO of Twitter and current chief of financial services company – Block – Jack Dorsey, said that Bitcoin is the only money for the internet. The tech mogul and multi-billionaire has long been a BTC bull, and his latest comments further cement his position.

Charts

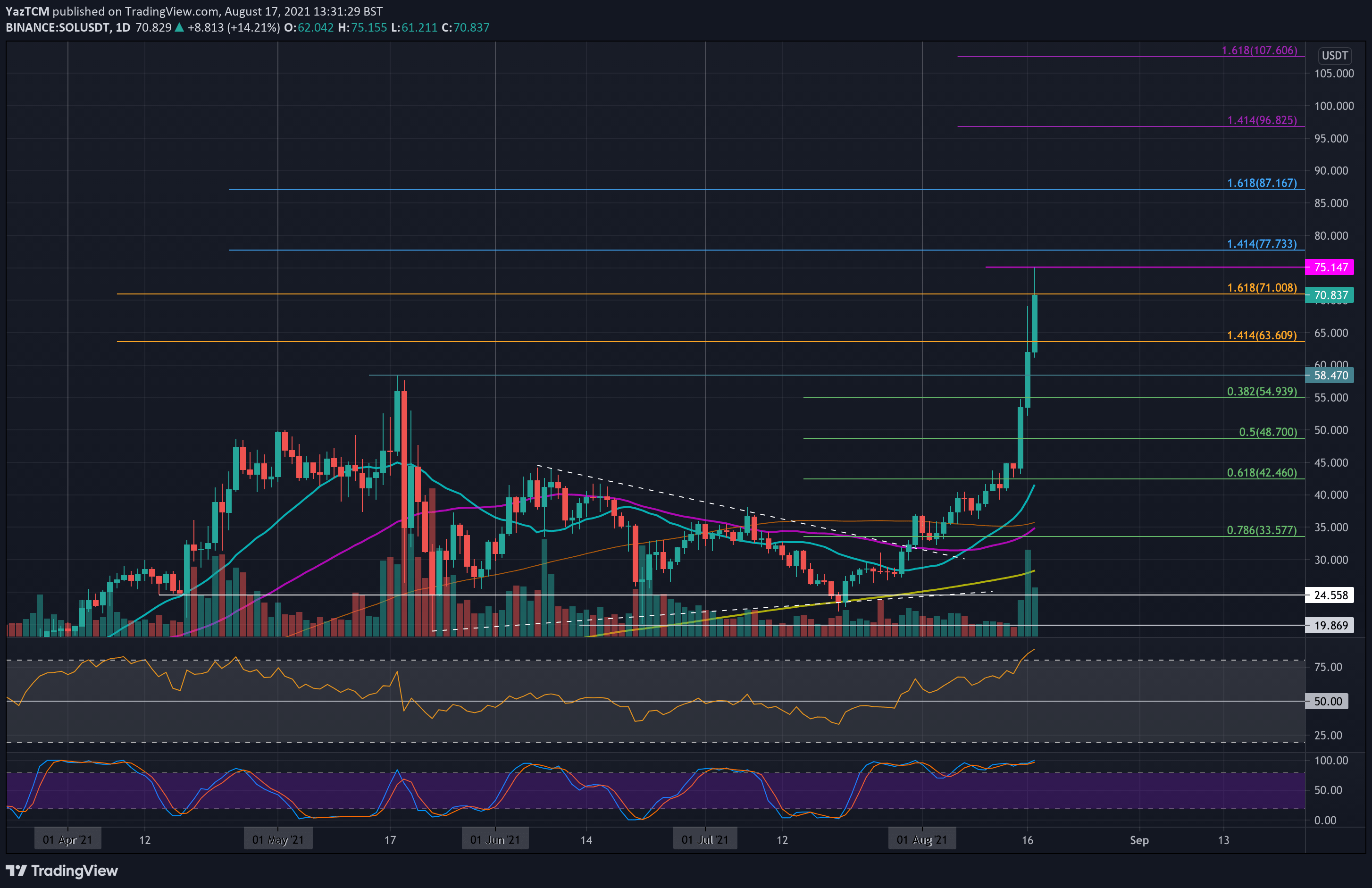

This week we have a chart analysis of Ethereum, Ripple, Cardano, Solana, and Polkadot – click here for the full price analysis.