Bitcoin Consolidates Before Next Move: Augur Leading DeFi With 20% Surge (Market Watch)

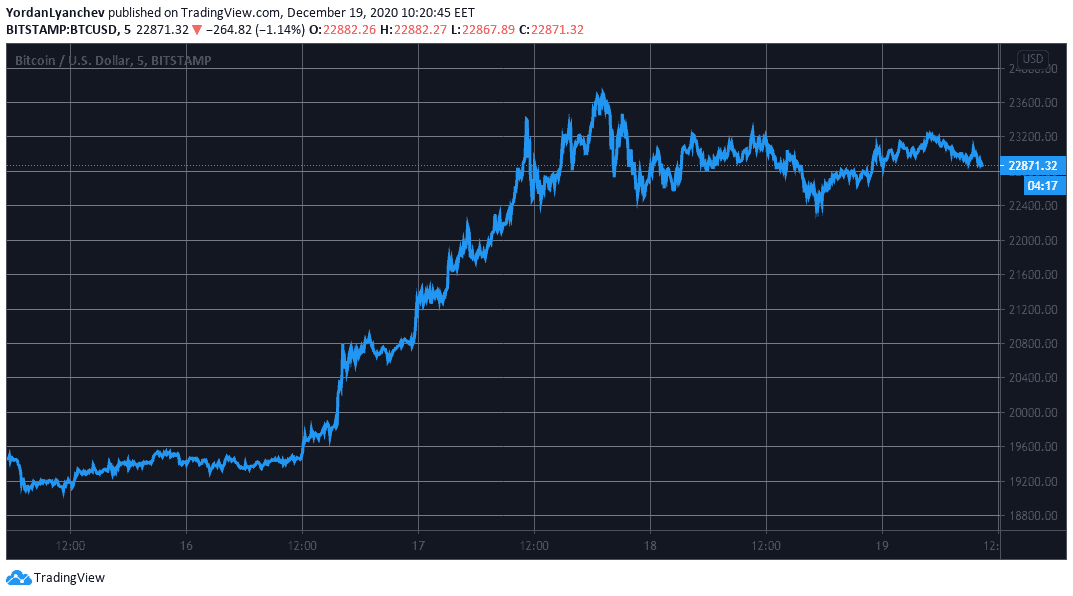

Bitcoin’s highly-volatile days continued with wild moves of almost $1,000 that took it from $23,300 to $22,400 and vice versa. Most large-cap altcoins have remained relatively calm, with Ethereum trading mostly around $650. Binance Coin, though, has increased by 5% and finally trading above $30.

Bitcoin’s Price Sideways Action

As reported recently, bitcoin initiated a massive bull-run following consolidating around $19,000 for a few days that resulted in breaking into uncharted territory above $20,000.

The primary cryptocurrency doubled-down on its bullish week and continued towards a new all-time high of nearly $24,000 on Thursday.

The high fluctuations continued in the past 24 hours as well. BTC traded around $23,300 before the bears took control and drove it down to an intraday low of beneath $22,400.

However, bitcoin refused to stay there and recovered all losses in the following hours. Nevertheless, the asset has slumped slightly since then and currently trades below $23,000.

From a technical perspective, BTC’s next resistance lines are situated at round psychological levels – $23,000, $24,000, and $25,000. In contrast, the support lines at $22,250, $21,400, and $20,700 could assist in case of a price breakdown.

BNB Breaks Above $30: Augur Soars 20%

The alternative coins followed bitcoin’s impressive run during the week and some marked yearly records. Ethereum charted $675, and despite retracing slightly, trading safely above $650.

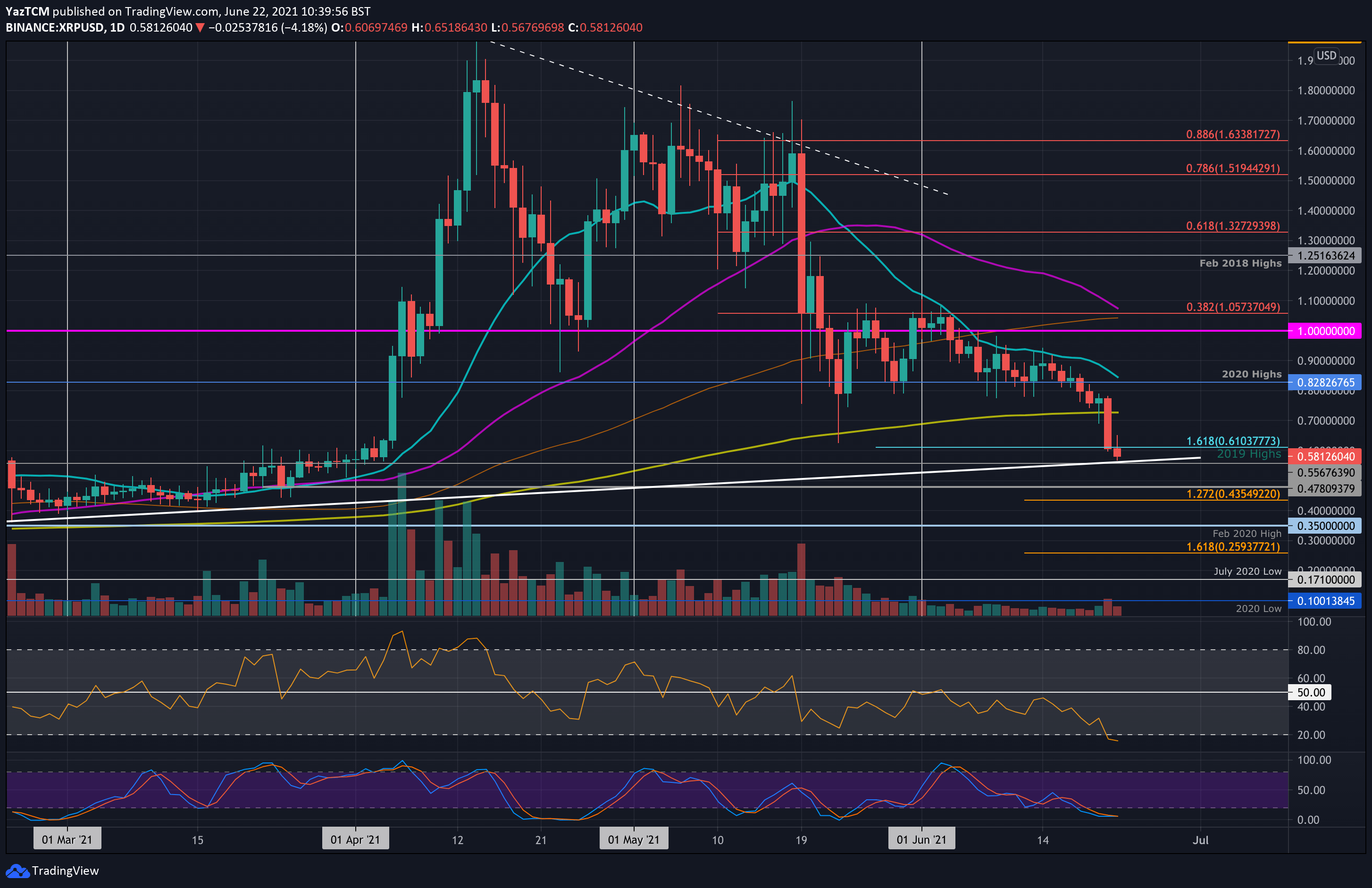

Ripple has dipped below $0.60 after a 3% decrease in the past 24 hours. Bitcoin Cash, Chainlink, and Cardano have remained essentially stagnant since yesterday. Litecoin pumped to a YTD record of $112 before losing some steam to $107.

Binance Coin has gained the most from the top ten with a 5% surge. As a result, BNB has jumped to $32.

The first ERC-20 prediction platform is up 20% over the past 24 hours, followed by a huge amount of volume – $200 million according to CoinMarketCap. Earlier today, Augur reached over $26, which represented a surge of over 60%.

NEM is the most impressive gainer on a 24-hour scale. XEM has added another 13% of value and trades above $0.30. The asset has increased by more than 30% in a week.

UNI and THETA have also surged by a double-digit percentage (around 10%) to $4.10 and $0.92, respectively. Lisk (9%), SwissBorg (8%), Nexo (8%), Aave (8%), and Terra (8%) follow.