Bitcoin Coinbase Premium Dumps to 3 Year Low

The BTC premium on the largest US-based cryptocurrency exchange has plummeted to negative levels last seen nearly three years ago. This comes amid the broader market correction and suggests that whales and larger players have used Coinbase to sell substantial portions of their bitcoin holdings.

Bitcoin Coinbase Premium Dumps Hard

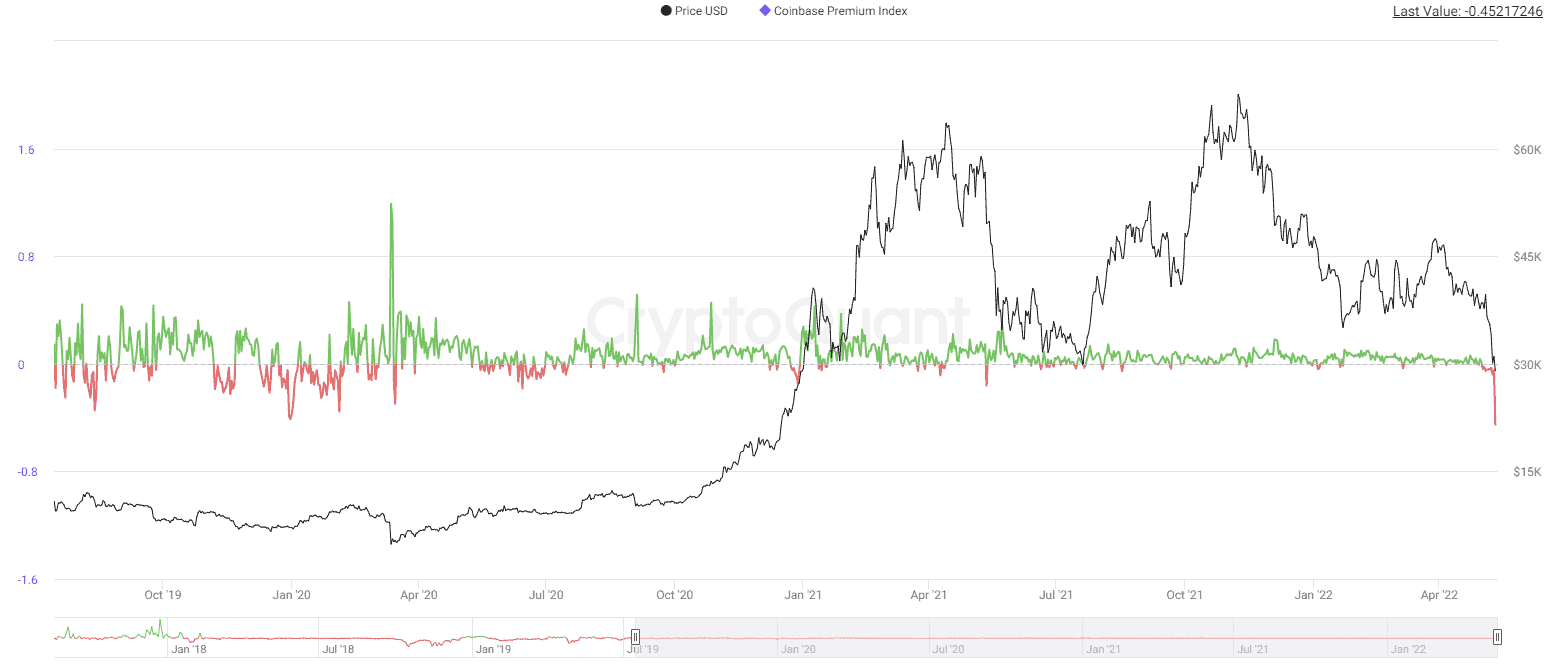

The blockchain analytics company CryptoQuant compares the BTC price on two of the largest crypto exchanges – namely, Binance and Coinbase – against Tether and USD, respectively, to determine whether there’s a difference, labeled “Coinbase Premium.”

This metric tracks the BTC movements of institutions and larger-cap players (whales) on Coinbase (and Coinbase Pro), typically regarded as the go-to platform for such investors. Essentially, this means that the higher this Premium goes, the more institutional demand exists, and vice-versa.

According to CryptoQuant, this metric has fallen sharply since the start of the month. It was well in the “green,” as the chart below demonstrates, for consecutive months, but dropped to its lowest position in 35 months. The analytics resource attributed it to larger investors disposing of their assets on Coinbase.

CryptoQuant’s analyst wrote:

“Financial markets are currently trading risk-off, so this is not surprising. I would expect investors from the traditional finance sector, in particular, to reduce exposure to bitcoin in such a situation.”

The Bitcoin Meltdown

The Coinbase Premium Index turning negative came as the entire cryptocurrency market, led by BTC, headed straight south. Just a few days after the first signs of significant sales on Coinbase, the primary digital asset dumped by $4,000, from $40,000 to $36,000.

However, its price kept tumbling in the following days, resulting in a massive price drop to $25,300 (on Bitstamp) earlier today. This became BTC’s lowest price point since late December 2020. The alternative coins are in even worse shape with double-digit declines.

This only supports the theory that whales and institutions were most likely the fuel behind the recent correction. As such, it would be intriguing to follow how the Coinbase Premium will perform in the next week or so.