Bitcoin Chalks Out ‘Head and Shoulders’ Pattern Ahead of U.S. Nonfarm Payrolls: Valkyrie Investments

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

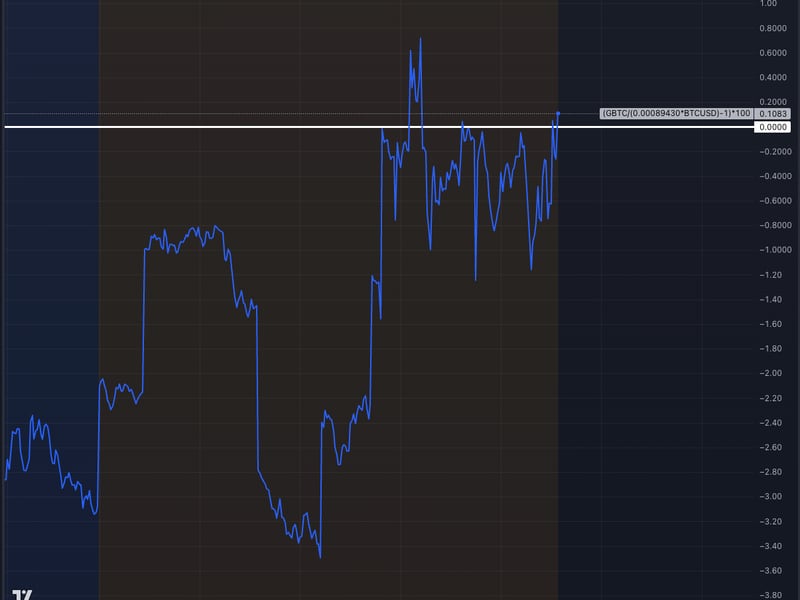

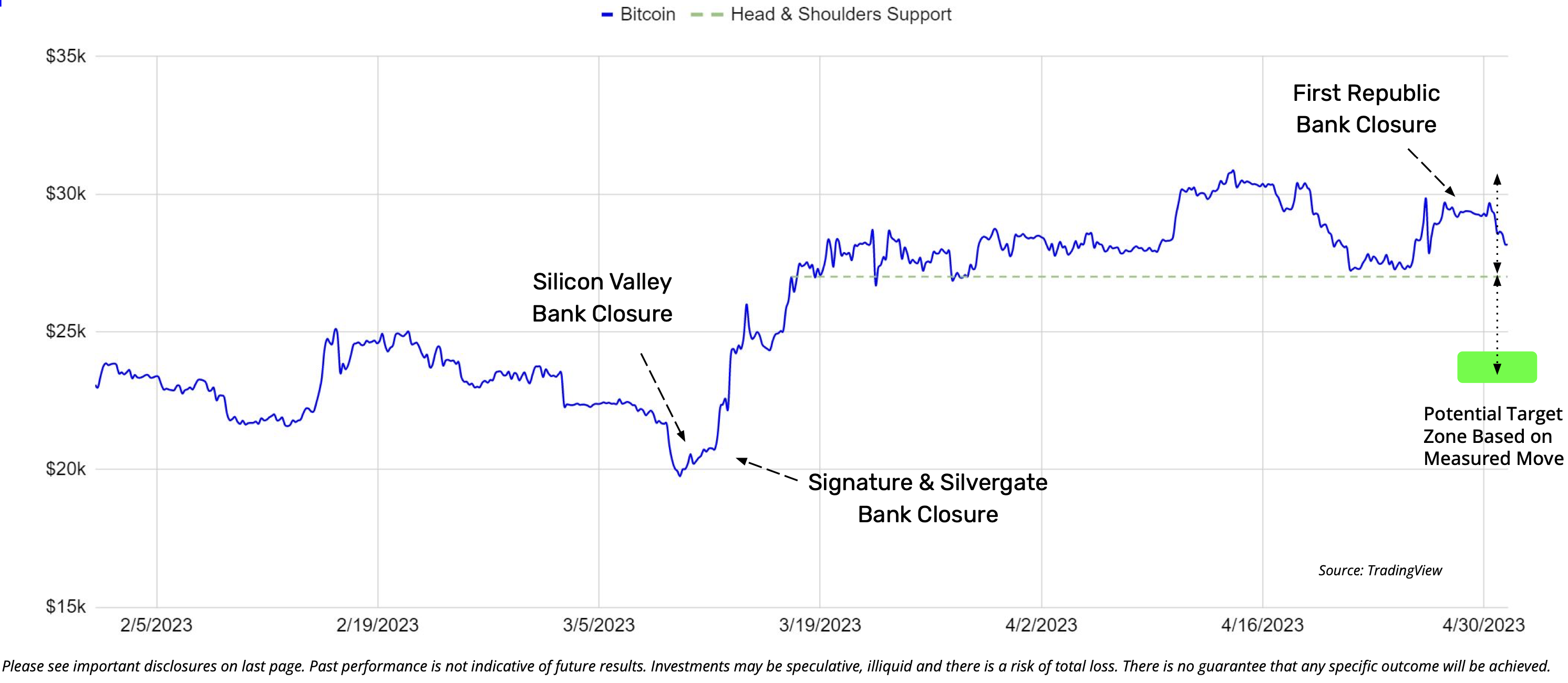

Analysts at alternative asset management firm Valkyrie Investments are closely monitoring what looks like a “head and shoulders (H&S)” bearish reversal pattern on bitcoin’s (BTC) daily chart.

The popular technical analysis pattern is characterized by two rallies or shoulders flanking a bigger one, representing the head. Chart analysts see it as a sign of an impending bullish-to-bearish shift in the market trend, with traders often taking bearish bets once prices drop under the trendline connecting the first and second troughs.

“High timeframe trend metrics remain firmly bullish, a near-term [bearish] reversal chart pattern has emerged. Although not classically meeting the textbook criteria of a head and shoulders, price action since March 19 has painted an extreme high with flanking lower highs,” Valkyrie’s analysts, led by chief investment officer Steven McClurg, wrote in a note to clients early this week.

“If price breaches below the neckline, a suggested target zone of $24,000 is possible based on the measured depth of the pattern extended below the neckline,” the note added.

A head and shoulders pattern has emerged on bitcoin’s daily chart, signaling near-term pain for the leading cryptocurrency. (Source: Valkyrie, TradingView) (Valkyrie, TradingView)

A UTC close under the neckline support at around $27,300 would confirm a H&S breakdown, opening the doors for a deeper decline.

While a graphical representation of price action in the form of lines or candlesticks helps illustrate psychology, the patterns are a subjective form of analysis and often do not work as intended. In other words, a breakdown of the head and shoulders may not always lead to a more profound price drop and can trap traders on the wrong side of the market.

Macroeconomic developments can make or break trends and invalidate patterns. In other words, bitcoin may rally, invalidating the H&S if Friday’s U.S. nonfarm payrolls data signal labor market weakness. That would strengthen the case for the Federal Reserve (Fed) to pivot in favor of liquidity-boosting interest rate cuts.

Early this week, Federal Reserve’s Chairman Jerome Powell opened the doors for a potential pause in the rate hike cycle, but at the same time, stressed that the next move depends largely on the incoming data. The Fed has raised rates by 500 basis points since March 2022—the tightening cycle aimed at controlling inflation roiled cryptocurrencies last year.

According to a Reuters estimate sourced from FXStreet, the data due at 12:30 UTC is likely to show the economy added 179,000 jobs in April following a better-than-expected 236,000 additions in March. The unemployment rate likely held steady at 3.5%. The average hourly earnings are forecast to have risen 0.3% month-on-month and 4.2% year-on-year, matching March’s pace.

The odds of bitcoin witnessing a head-and-shoulders breakdown soon will increase if the wage growth and payrolls figure blows past expectations, putting a bid under the heavily shorted U.S. dollar.

Edited by Parikshit Mishra.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.