Bitcoin Cash Trading Volume on Upbit Skyrockets as BCH Soars 120% Weekly

The leading South Korean cryptocurrency exchange – Upbit – has recorded a trading volume of more than $350 million for the Bitcoin Cash (BCH)/Korean Won (KRW) pair for the past 24 hours. In comparison, trades involving Bitcoin (BTC) have been three times less.

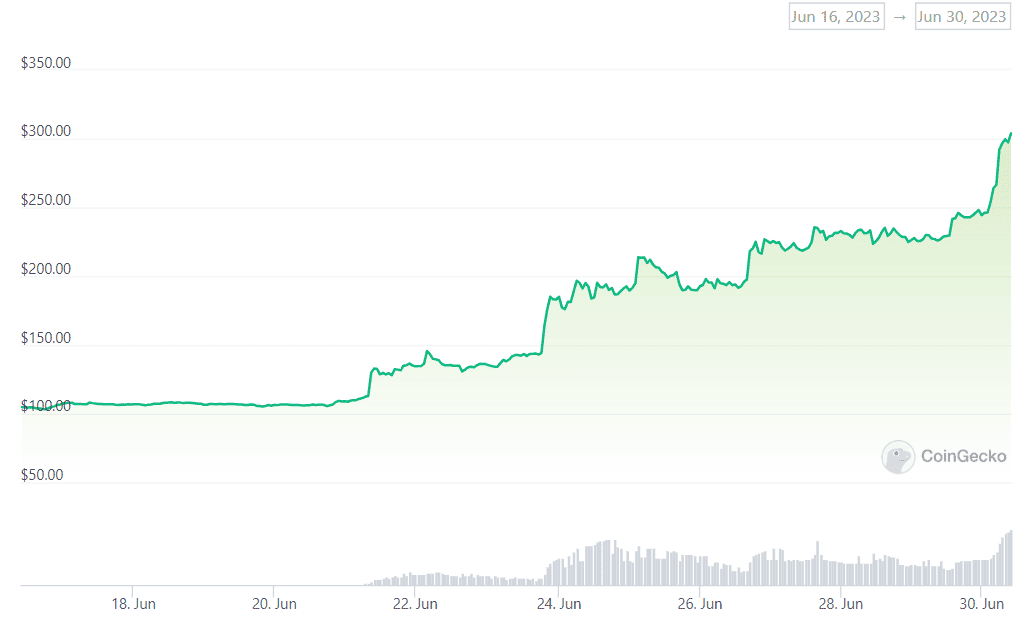

BCH has been among the best performers in the crypto market lately, with its USD valuation up over 180% for the past two weeks.

BCH Grabs the Attention of Koreans

As revealed by Wu Blockchain, BCH/KRW trades on South Korea’s biggest cryptocurrency exchange have accounted for approximately 24% of the total trading volume for the past day.

South Korea may be the reason for the BCH PUMP. In the past 24h, the largest exchange in South Korea, Upbit, has recorded a trading volume of over $350 million for the BCH/KRW, contributing to 23.58% of the total trading volume for BCH. It is also the 3x the trading volume of the…

— Wu Blockchain (@WuBlockchain) June 30, 2023

According to CoinGecko’s data, the latest figures are even more impressive, with BCH/KRW trading volume for the last 24 hours equaling over $560 million. Trades with Solana (SOL) rank second with 8.4%, whereas Bitcoin (BTC) is third, contributing 7.8% to the total volume.

Bitcoin Cash has been highly popular on other Korean crypto platforms, too. BCH/KRW trading volume on Bithumb on a daily basis has surged to $39 million. Trades involving BTC are first, with a mere $300,000 lead.

Bitcoin Cash’s Recent Rally

The asset recently surpassed the $300 mark, a price last seen in April 2022. What’s more impressive is that its USD valuation was hovering at approximately $100 just two weeks ago.

One possible reason behind the increase could be the launch of the Wall Street-backed crypto exchange EDX Markets, which went live on June 21. The platform, supported by finance giants such as Fidelity Digital Assets, Citadel Securities, and Charles Schwab, offers services with four cryptocurrencies, with BCH being one of them.

Bitcoin Cash was also not included in the SEC list of alleged unregistered securities when filing lawsuits against Binance and Coinbase earlier this month.

The overall revival of the cryptocurrency market could be another factor. The industry was boosted with optimistic news, such as BlackRock’s filing to launch a Spot Bitcoin exchange-traded fund (ETF) in the United States and the Federal Reserve’s decision to halt interest hikes for the first time since March 2022.

As mentioned above, the blockchain journalist Colin Wu believes another factor that could be behind BCH’s massive surge is the

The post Bitcoin Cash Trading Volume on Upbit Skyrockets as BCH Soars 120% Weekly appeared first on CryptoPotato.