Bitcoin Bulls Target $69K Lifetime Highs Ahead of Halving

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

Euphoric sentiment, institutional buying demand, and historical gains linked to bitcoin’s (BTC) halving event are putting the asset on track to cross its lifetime highs of $69,000 in March, some traders say.

Bitcoin halving has always been associated with bull rallies, with the asset’s prices increasing by several hundred percent in the months following previous events. Halvings happen about every four years and decrease the block rewards to miners. The next halving is expected in mid-April, a countdown clock shows.

Prices tend to rise with fewer new bitcoin on the open market as long as demand remains constant or increases. Historical price action may not be repeated in the future, but the anticipation of a rally may push investors to put outsized bets on the asset.

“The anticipation always leads to increased buying activity or ‘FOMO’ for lack of a better term,” Bryan Legend, CEO of Hectic Labs, told CoinDesk in a Telegram message. “Investors expect a reduction in supply to drive up prices, and a pre-halving rally which contributes to a new bull market with a refreshed bullish sentiment.”

“However, the rally leading up to the actual halving event is a great time to realize short-term gains,” Legend added.

Meanwhile, some traders expect bitcoin to top its lifetime peak of $69,000 in March, saying institutional demand and the early success of spot bitcoin exchange-traded funds (ETFs) are likely to push prices.

“With 54 days left before the bitcoin halving and the expectation of the Fed’s interest rate cut in the middle of the year, bitcoin prices have a support level at $50,000 and may fluctuate to hit historical highs in March,” Ryan Lee, chief analyst at Bitget Research, told CoinDesk in a message.

“The trading volume of nine bitcoin ETFs in the U.S. also reached a new high of $3.2 billion last week, indicating institutions have a strong bullish sentiment,” Lee added.

Bitcoin ETFs traded a cumulative $2 billion on Tuesday. BlackRock’s IBIT recorded over $1.3 billion in daily trading volume for the second consecutive day.

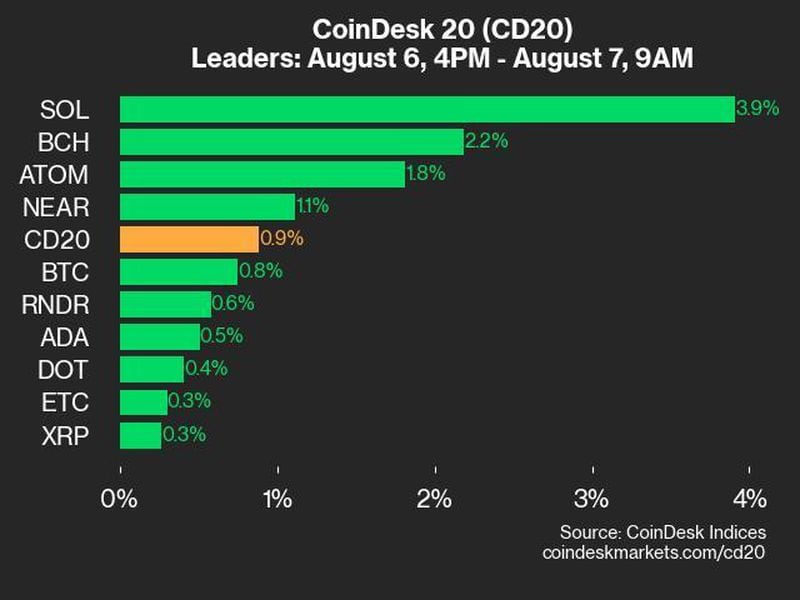

Bitcoin was trading just above $57,200 in Asian morning hours on Wednesday, adding 1.5% in the past 24 hours. The CD20, a broad-based index, is up nearly 1%.

Edited by Parikshit Mishra.