Bitcoin Bulls Revisit $100K Year-End Target as BTC Spikes Over $62K

-

Bitcoin surged over $62,000 briefly before retreating, following a broad market rally that reversed steep losses from earlier in the week.

-

Some analysts predicted a $100,000 target for the cryptocurrency later this year.

-

The rally was influenced by favorable stock market sentiment and expectations of bitcoin mirroring its past market cycles, with liquidated short positions contributing to the surge.

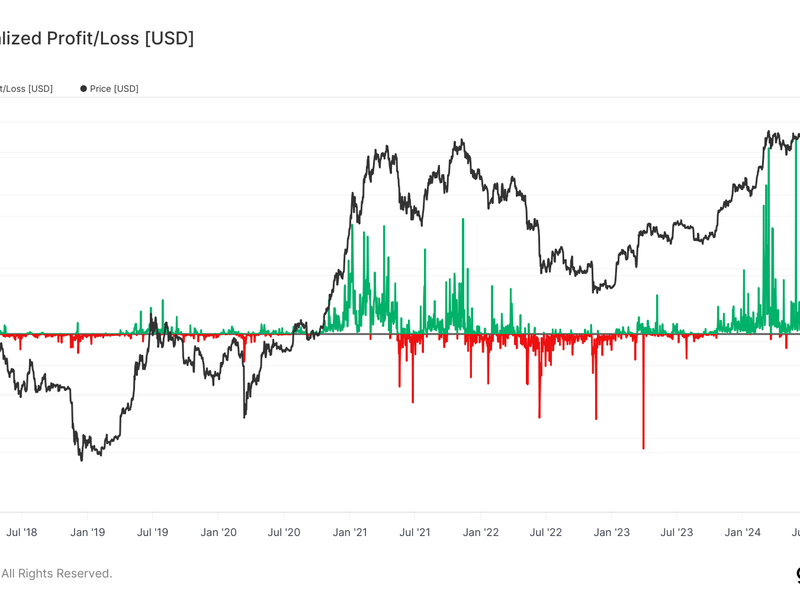

Bitcoin (BTC) briefly spiked over $62,000 before retreating during the Asian morning hours on Friday as the broader market rallied to reverse a steep rout from earlier in the week. The recovery has some bitcoin bulls revisiting their $100,000 year-end target.

U.S. markets rallied on Thursday with the S&P 500 marking its best day since November 2022 and the tech-heavy Nasdaq 100 rising 3.1%. This helped reverse losses from a Monday rout, which saw major losses across stock indexes and cryptocurrencies.

BTC jumped 7.2% in the past 24 hours, one of its biggest single-day percentage gains in recent months. The move liquidated nearly $100 million in shorts, or bearish bets, on bitcoin-tracked futures. The $100 million liquidation was the fourth largest hit for bitcoin bearish bets this year.

Some market watchers attributed the gains to favorable stock market sentiment and expectations of BTC mirroring its past market cycles.

“Now that the Bank of Japan has indicated they will not raise interest rates further — and Jump Trading will run out of coins to sell, just like Germany did a few weeks ago — I do not see the price going much below $50,000 (other than a quick wick), perhaps ever again,” Transform Ventures founder Michael Terpin told CoinDesk in an email Friday.

“Regardless of the next 60 days, the bull market will continue along traditional four-year cycle lines with solid gains in October and November,” he added.

“If Trump wins, a rush of new buyers could take the bitcoin price over $100,000,” Terpin said, adding that the six months after the halving have had pullbacks — and this fifth bitcoin cycle is no exception. “October and November are historically strong months for bitcoin, especially in the year of the halving and the year after,” he said.

BTC’s rise revived gains among major tokens. Ether (ETH) and toncoin (TON) surged 10%, Solana’s SOL and Cardano’s ADA rose 5%. XRP slightly dropped after a 17% surge on Thursday, likely on profit taking.

The broad-based CoinDesk 20 (CD20), a liquid index tracking the largest tokens by capitalization, minus stablecoins, zoomed 5.35%.

Edited by Parikshit Mishra.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/6c6bb5af-692c-4fcf-9f8b-a75d0549effd.png)

Shaurya is the Deputy Managing Editor for the Data & Tokens team, focusing on decentralized finance, markets, on-chain data, and governance across all major and minor blockchains.

Follow @shauryamalwa on Twitter