Bitcoin Bulls Must Push Price Past $6.8K to Win Control

Bitcoin (BTC) created a key bullish pattern last week, but only a move above $6,800 would put the bulls in a commanding position, according to technical charts.

Stepping back, the leading cryptocurrency clocked a four-week high of $6,810 on Coinbase last Monday before ending the week (Sunday’s UTC close) at $6,415. Despite the pullback from the multi-week highs, BTC eked out 3.7 percent higher on the week.

Essentially, it created an inverted hammer candle last week, which is characterized by a long upper shadow – difference between the weekly high of $6,810 and the weekly close of $6,415 – and a small real body represented by the spread between the weekly opening price of $6183 and the closing price of $6,415.

The inverted hammer candlestick is considered of bullish reversal if it occurs around the bottom of the downtrend and the upper shadow is two times the size of the real body. Further, the longer the upper shadow, the more likely it is that a reversal will occur.

In BTC’s case, the candlestick has appeared close to $6,000 – a level where the cryptocurrency has likely carved out a classic bottom. However, the upper shadow is only 1.7 times the real body, meaning the probability of a bullish reversal is low.

As a result, the immediate outlook remains neutral and only a move above $6,810 would confirm a bullish breakout.

At press time, BTC is changing hands at $6,400 on Bitfinex.

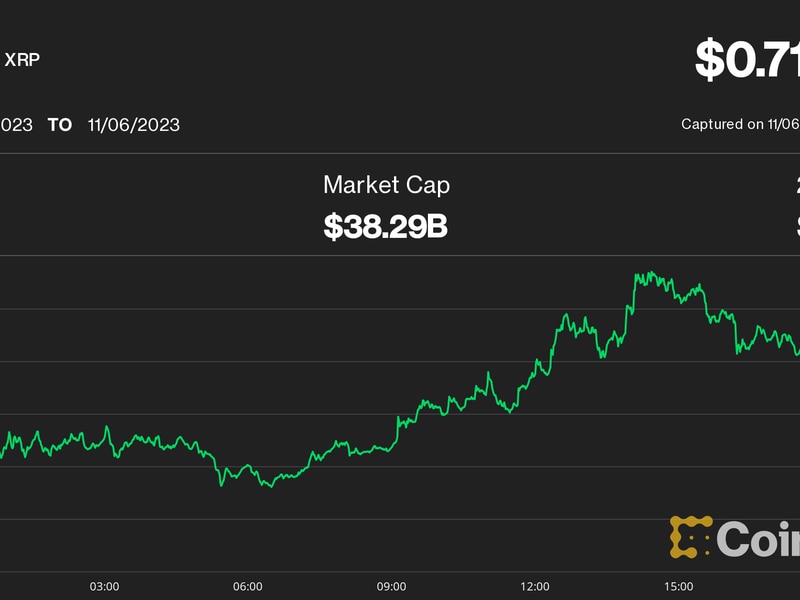

Weekly Chart

As seen in the above chart, the sell-off from the record high of $20,000 reached in December last year has likely run out of steam near $6,000.

A convincing move above $6,810 (last week’s high) would validate the bullish inverted hammer and boost the prospects of a sustained move higher toward $7,402 (September high).

Daily Chart

Over on the daily chart, the volatility, as represented by the spread between the high and low, fell to $47 yesterday – just above the 17-month low of $34 clocked on Oct. 13.

A low volatility period is often followed by a big move. Therefore, a big move could happen soon, possibly on the higher side, courtesy of the last week’s bullish hammer candle.

View

- $6,810 (high of last week’s inverted hammer candle) is the level to beat for the bulls this week.

- A break above $6,810 would raise prospects of a sustained move above $7,402 (September high).

- On the downside, the 21-day exponential moving average (EMA) of $6,121 is key support.

Disclosure: The author holds no cryptocurrency assets at the time of writing.

Bitcoin and fiat image via Shutterstock; charts by Trading View

Join 10,000+ traders who come to us to be their eyes on the charts and sign up for Markets Daily, sent Monday-Friday. By signing up, you agree to our terms & conditions and privacy policy

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.