Bitcoin Bull Run Delivers Admirable Q1 Results For Invictus

Promoted: As the world’s number one decentralized currency continues its relentless bull run, Invictus Capital is showing everyone why it pays to bet on Bitcoin.

This is a promoted article provided by Invictus Capital.

As the world’s number one decentralized currency continues its relentless bull run, Invictus Capital is showing everyone why it pays to bet on Bitcoin and crypto.

With the first quarter of 2021 having ended several weeks ago, a thorough accounting of Invictus’ successes during this historic bitcoin rally became possible. The company published findings around its performance in a comprehensive quarterly report, detailing the pattern of the company’s recent growth and the stellar performance of its seven innovative investment funds.

For one, the total assets under management (AUM) held by Invictus Capital went up by a whopping 50%, peaking at $112 million, and ending the quarter with over $100 million.

The report details the quarterly performance of the full range of seven unique funds, providing useful metrics and charts as well as concise commentary. Incorporating various metrics tied to the success of the broader crypto asset industry, these funds allow customers to manage risk and reward in a number of ways, helping them to approach investments in bitcoin and the crypto industry from an angle that offers favorable risk-adjusted returns. With every one of its cryptocurrency funds increasing by 42% or more, and much higher gains from its flagship index products like Crypto20 (221%), Invictus has proven that returns from the cryptocurrency market can stretch far above the substantial climb of even bitcoin.

The report also draws attention to Invictus’ community token, ICAP, which has seen its value increase by nearly six times since its launch on the back of the aforementioned ballooning AUM. This is important for valuing ICAP, since its value is derived from around 10% of Invictus fund fee earnings being allocated to buying ICAP and lifting prices. The company has also been investing in a decentralized liquidity mining program to support the feasibility of trading ICAP on the decentralized exchange Uniswap, with liquidity already having grown significantly. Providing liquidity in the ICAP-ETH pool currently offers substantial annual yields of around 22%.

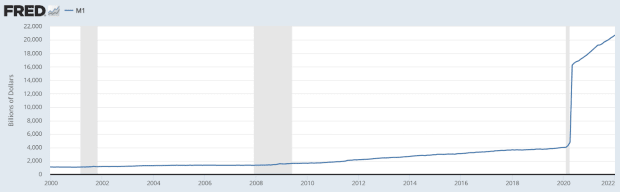

The Invictus analyst team also provides broad market commentary, covering both traditional financial markets, as well as crypto assets, and the linkages between the two — particularly important in the context of unprecedented monetary policy propagating around the globe. A wide number of topics with relevance to Invictus funds are honed in on, including renewable energy and the prospects of the burgeoning decentralized finance (DeFi) industry.

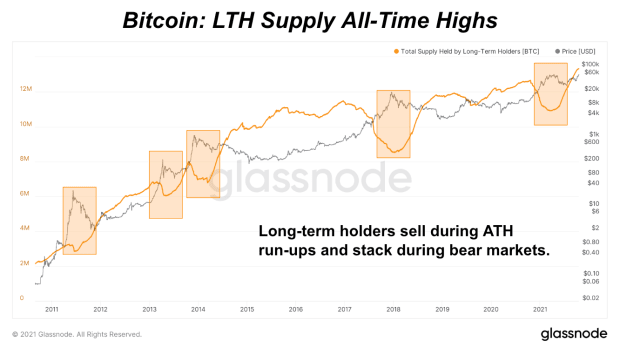

The stumbling gold price, while bitcoin boomed, was a key point of interest (despite a falling gold price, the Invictus Gold Plus fund, or IGP, continued to extend outperformance over pure gold exposure on the back of the yield generation the fund offers). As traditional market participants began to more clearly recognize bitcoin’s technical superiority over gold as a store of value, it is becoming clear that gold demand is increasingly coming under threat. Gold was compared both to bitcoin and a number of other traditional assets, to establish a correlation between them and external factors such as the COVID-19 vaccine rollout.

In short, although there are likely to still be difficulties ahead, with gold continuing to offer value as a more stable and mature asset class, bitcoin has proved its worth during the economic turmoil of the last year, and will continue to grow in importance, moving into a new global economic era where crypto assets play an increasingly key role. Invictus Capital will be backing the sector to the hilt.