Bitcoin (BTC) Price Prediction for Q4 2023: Analyst Names Major Targets

TL;DR

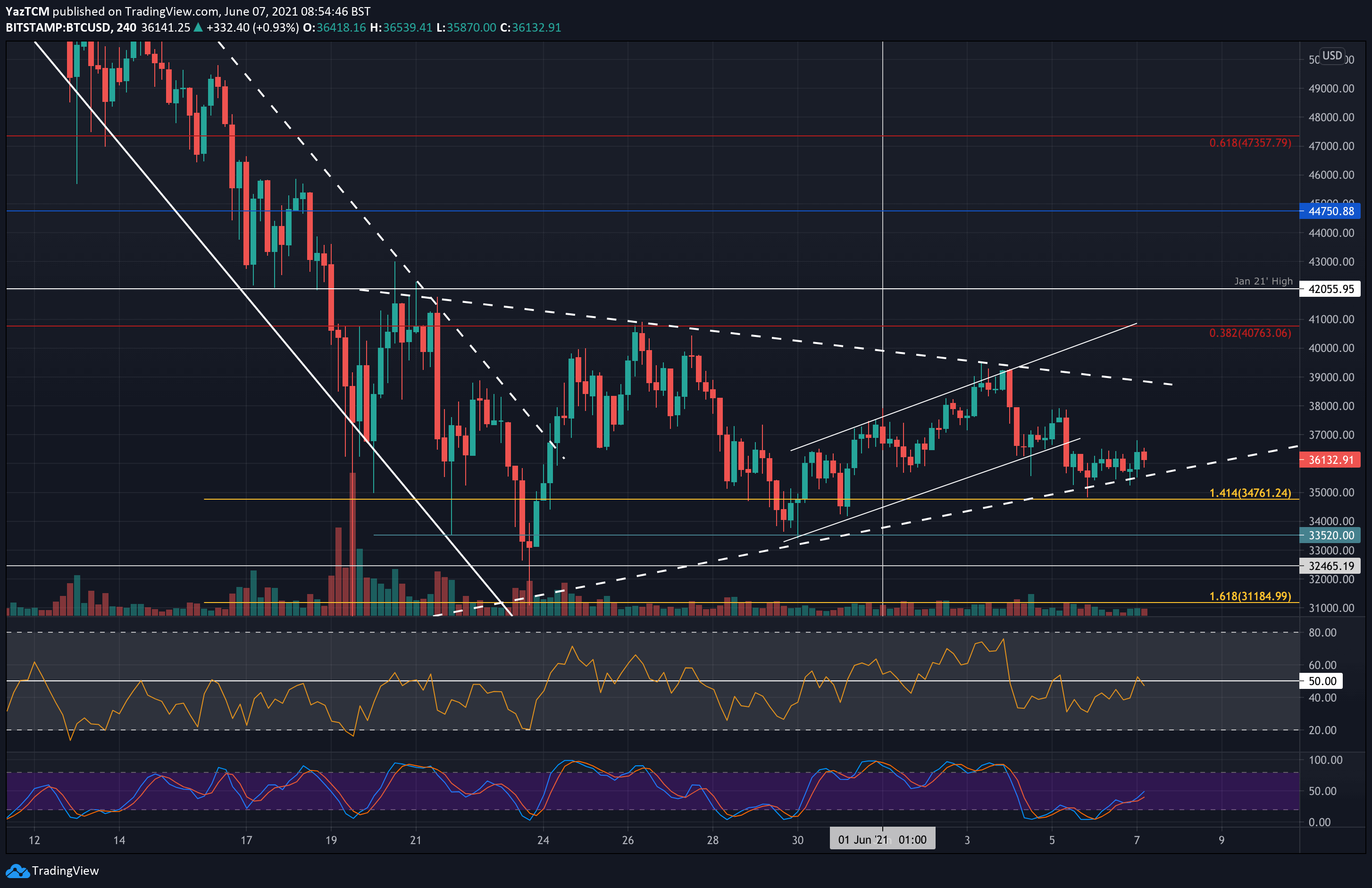

- Bitcoin Heading Toward $48K? Bitcoin price handily cleared $34,000 this week. However, according to technical analysis by one strategist, BTC could keep going higher and trade as high as $48,000 by New Year’s Day.

- Another Bull Run Coming? The recent price rally that saw BTC gain over 20% within days has prompted many to assert that the asset is primed for another bull run.

- Bitcoin Dominance at 2.5-Year High: The metric overseeing BTC’s dominance over the altcoin has been on a steady rise for weeks and recently exceeded 53% for the first time in over two years.

Bitcoin Technicals Sharp for an Uptrend

Bitcoin hasn’t traded above $30,000 since July. Moreover, its spot price hasn’t been above $32,000 since May 2022, when it was on a steep downward trend.

In comments emailed to MarketWatch, Kempenaer said the next major resistance level for BTC sits at the $47,000 to $48,000 range. He said he expects Bitcoin to test that range before the end of the year.

Of course, past performance is no guarantee of future results, but Bitcoin’s price history backs up Kempenaer’s predictions.

Analysts at crypto derivatives platform Deribit wrote that rallies like Tuesday’s breakout have historically “predicted unbelievable upward momentum.”

The last time Bitcoin breached $32,000 on an upward trend was in July 2021. That preceded a blowout price rally to Bitcoin’s all-time high price of $69,000 in November 2021.

If you want to check out some of the other recent price predictions, take a look at our video here:

Upcoming Halving and Lower Fed Rates Buoy BTC

Markets are heating up over the increasing likelihood of an SEC approval for a Bitcoin ETF product.

A recent court ruling that the Securities and Exchange Commission’s rejection of a spot Bitcoin ETF application is inconsistent with its approvals of futures ETFs has emboldened BTC traders.

Meanwhile, the commission’s softening stance toward Ripple Labs, following a string of court victories for the blockchain company this year, has buoyed cryptocurrency markets.

Furthermore, the high-profile FTX fraud trial has bolstered Bitcoin’s selling proposition as a decentralized blockchain beyond the manipulation of any one leader. That’s evidenced by the soaring Bitcoin dominance metric as the leading crypto rallies.

But beyond these tailwinds, markets are trading on a multi-year Bitcoin market cycle. The halving next spring will cut new BTC supplies by half for the next four years.

Markets are anticipating lower Fed rates in the near future to boot. As the City Index has it:

“With Bitcoin entering an historically bullish period of its 4-year halving cycle and major central banks seemingly nearly done raising interest rates, there are bigger picture tailwinds for the price of the world’s largest cryptoasset as well.”

As we head closer to the literal winter season for the northern hemisphere, strong tailwinds and bullish technicals are melting the frost off of a long crypto winter.

The post Bitcoin (BTC) Price Prediction for Q4 2023: Analyst Names Major Targets appeared first on CryptoPotato.