Bitcoin (BTC) Price Headed Toward $62K, Polygon (MATIC) Soars 12% Daily (Market Watch)

After slipping hard yesterday, bitcoin went on the offensive in the past 12 hours or so and exploded to a weekly high of just under $62,000.

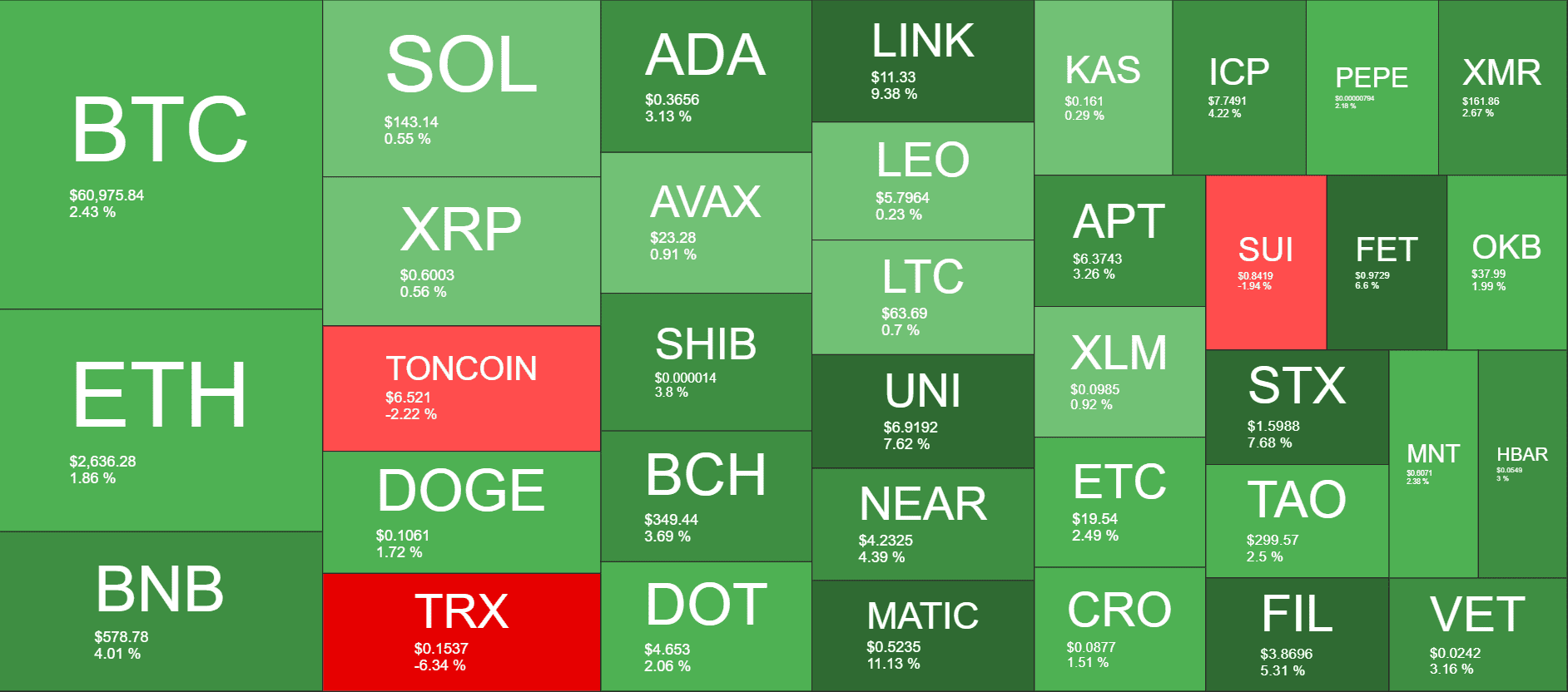

Aside from TRX and TON, the other larger-cap altcoins have followed suit with impressive gains from the likes of LINK, UNI, MATIC, and others.

BTC Eyes $62K?

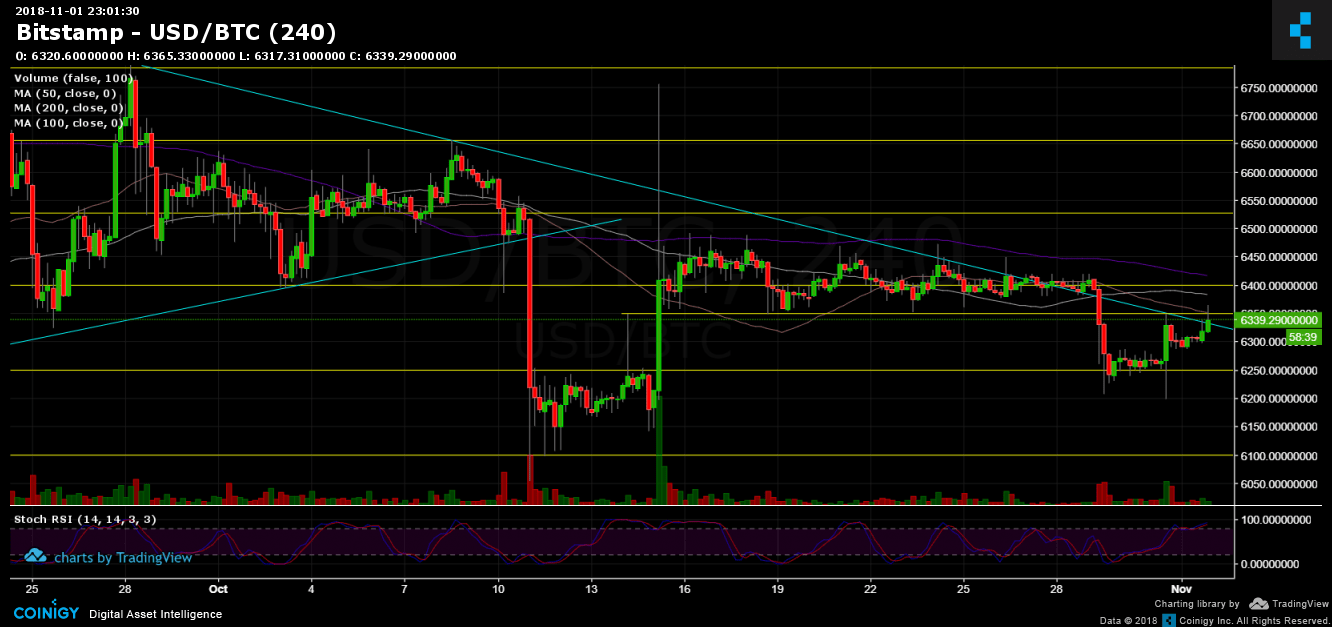

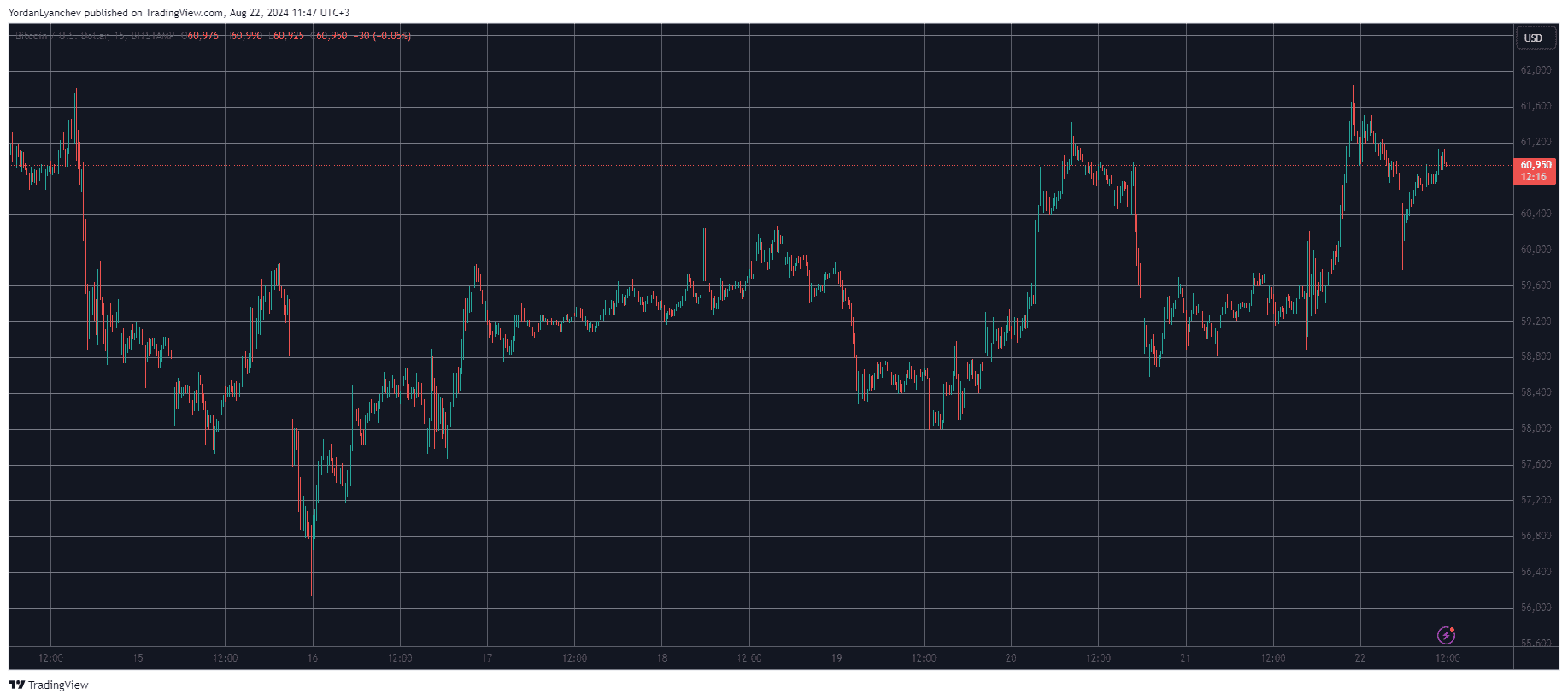

It was roughly a week ago when the primary cryptocurrency dumped hard and fell from $59,600 to $56,300. However, the bulls stepped up at this point and didn’t allow any further breakdowns. Instead, BTC headed north and spent the weekend trading sideways at just shy of $60,000.

The new business week began with another retracement that drove bitcoin south to $58,000. Yet, the cryptocurrency didn’t stay there long and shot up to over $61,000 on Tuesday.

The scenario repeated once again on Wednesday as the asset fell back down to under $59,000. More of the same followed, and bitcoin jumped to and beyond $60,000 late last night amid rumors that RFK will drop out of the US election race, which could favor pro-crypto candidate Donald Trump.

BTC peaked at $61,800, which became a weekly high, before retracing to around $61,000 as of now. Its market cap is just over $1.2 trillion, while its dominance over the alts has increased slightly to 53.6% on CG.

LINK, UNI, MATIC on the Rise

Most altcoins have turned green today. ETH has neared $2,650 after a minor 2% increase. XRP, SOL, AVAX, DOGE, and DOT have also charted similar gains.

BNB, ADA, SHIB, and BCH have posted more impressive increases of around 3-4%. However, the biggest gainers on a daily scale include LINK (10%), UNI (7.5%), and MATIC (11%). Polygon’s native token has soared past $0.5 as a result.

The most notable price performers from the top 100 alts are FTM (15%), BTT (14%), BEAM (14%), and RENDER (12%).

The total crypto market cap has recovered over $50 billion since yesterday and is up to $2.250 trillion.

The post Bitcoin (BTC) Price Headed Toward $62K, Polygon (MATIC) Soars 12% Daily (Market Watch) appeared first on CryptoPotato.