Bitcoin (BTC) Price Drops to $42K as US Fed Keeps Interest Rates at 23-Yeah High (Market Watch)

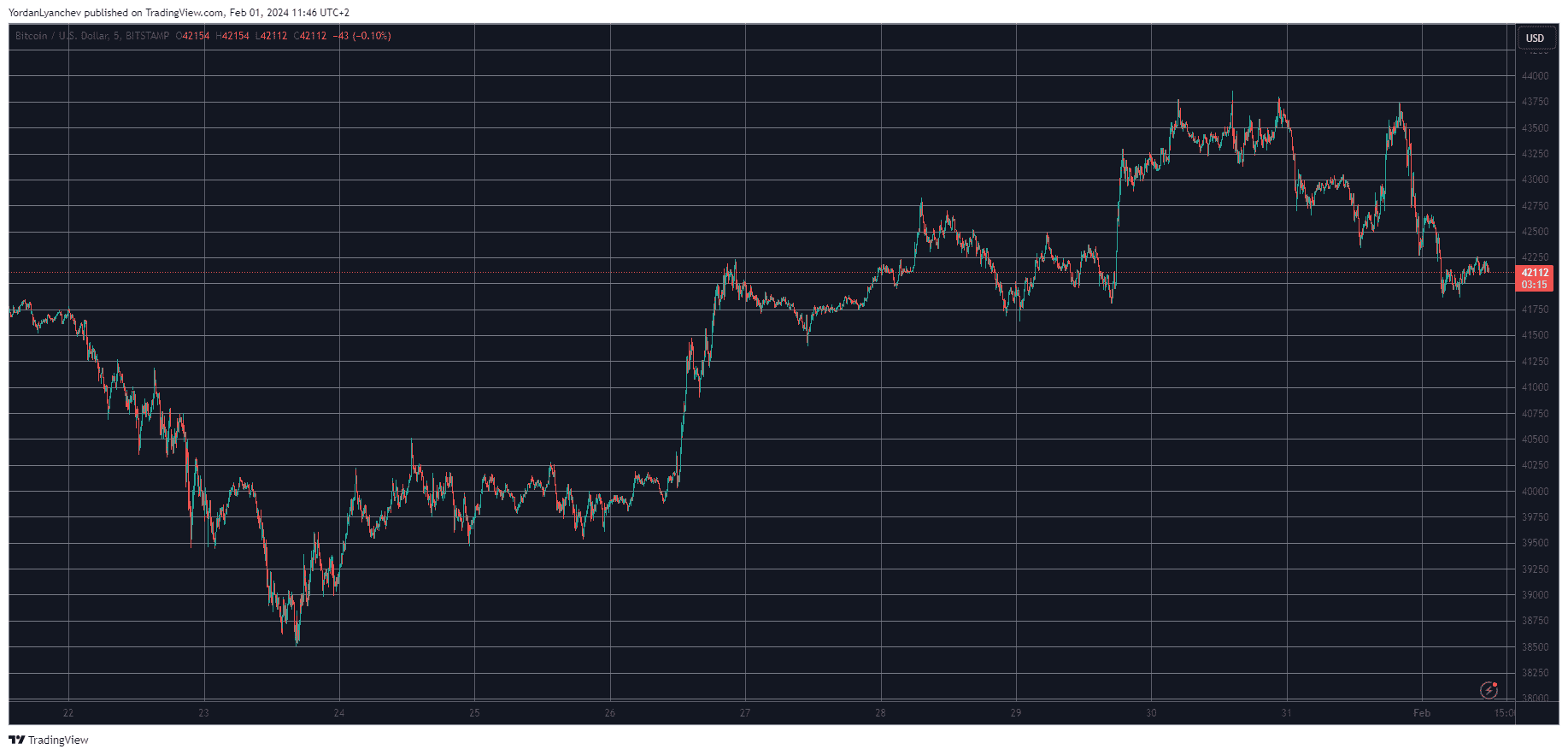

Bitcoin jumped to almost $44,000 yesterday but was violently rejected and pushed back down to $42,000 as the US Federal Reserve refrained from making changes to its monetary policy.

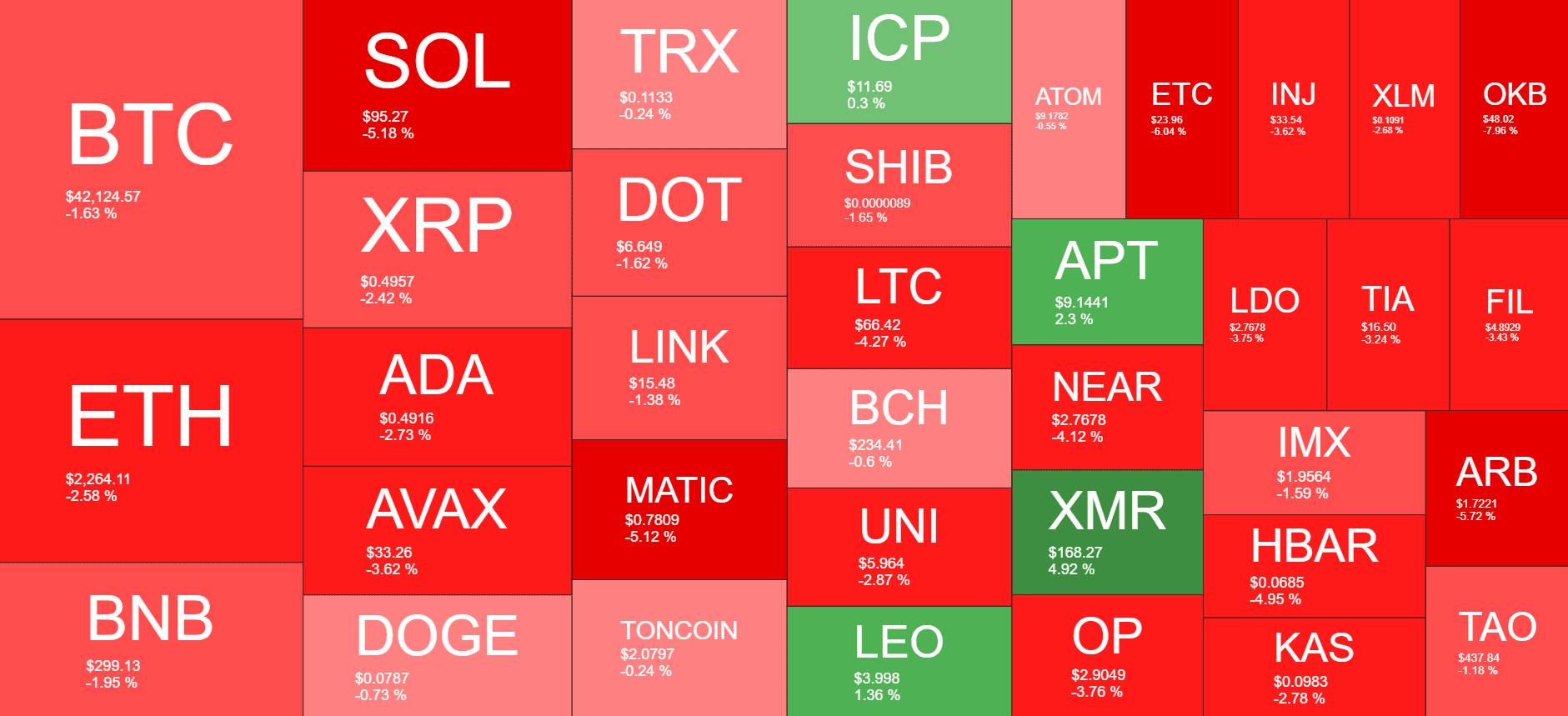

Solana is among the poorest performers within the same timeframe, having dropped by 5% and trading at $95.

BTC Drops to $42K

It was precisely a week ago when BTC bottomed at $38,500 as the hype around the ETF approvals faded. Since then, the bulls have remained mostly in control and propelled several price increases.

The culmination came at the start of this business week when Bitcoin jumped to $43,750. It failed there at first, but went on the offensive once again yesterday. However, the bears managed to intercept the move at the same price point and didn’t allow a challenge for the $44,000 level.

This came as the US Federal Reserve’s Chair – Jerome Powell – announced there will be no major changes in the central bank’s monetary strategy when it comes down to the interest rates. As such, they will remain at a multi-decade high of over 5%.

BTC dropped to $42,000 but has managed to defend that level and trades inches above it now. Its market cap stands at $825 billion, and its dominance over the alts is just over 51%.

SOL Heads South

Most alternative coins are also in the red today, with ETH down by 2.5% and trading way below $2,300. BNB has slipped beneath $300 following a minor daily decline as well. Ripple, Cardano, Avalanche, Polkadot, and Chainlink have posted daily losses as well.

Solana and Polygon have declined the most from the larger-cap alts. Both assets are down by over 5%. As a result, SOL struggles at $95, while MATIC is under $0.8.

Most other lower- and mid-cap alts are with similar losses. Consequently, the total crypto market cap has seen another $30 billion gone and is down to $1.620 trillion on CMC.

The post Bitcoin (BTC) Price Drops to $42K as US Fed Keeps Interest Rates at 23-Yeah High (Market Watch) appeared first on CryptoPotato.