Bitcoin (BTC) Miners Facing Capitulation as Hashrate Declines Post-Halving

Nearly a month after the fourth Bitcoin halving took place, the first signs of miners’ revenues decreasing are slowly emerging with one clear indicator being the drop in the network hash rate.

The recent decline in this metric potentially indicates miner capitulation, where less efficient miners are quitting due to decreased profitability.

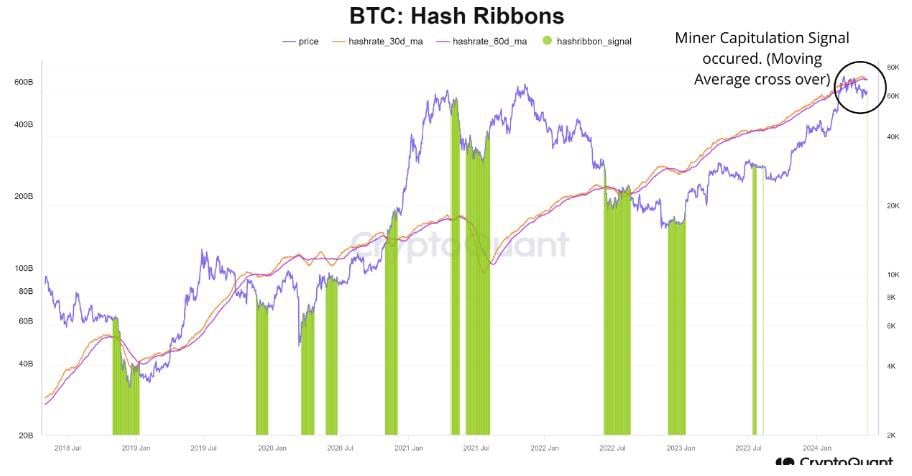

Hash Ribbons Shows Signs of Capitulation

Earlier, the 30-day moving average of the hash rate reached its peak at 630 exahashes per second (EH/s), but now it’s at 606 EH/s. Although this decrease is relatively small and brief, it’s notable because the hash rate usually goes up, indicating a pattern shift.

CryptoQuant’s findings revealed instances of rapid declines in the hash rate, which often signal “miner capitulation.”

“Miner capitulation” refers to less efficient miners exiting the process. They shut down their rigs, resulting in reduced computational power for mining. They may also relocate to other areas or sell recently mined bitcoin to cover their operational expenses.

CryptoQuant’s analysis stresses the Hash Ribbons indicator, which functions under the assumption that these conditions frequently coincide with substantial price declines for BTC, providing a chance to profit from price drops.

However, it is important to note that this doesn’t happen right away after the initial capitulation signal from Hash Ribbons, as the process of miner capitulation is steady. Instead, it happens gradually over the subsequent days and weeks as less efficient miners leave the market.

Miner Profitability Plunges

The halving event on April 20 slashed the block reward in half to 3.125 BTC, reducing mining output from 900 BTC to around 450 BTC per day. As a result, major Bitcoin miners such as Bitfarms, Cipher, CleanSpark, Core Scientific, Riot, and Terawulf experienced production drops of 6% to 12% in April, as reported by The Miner Mag.

These output reductions have coincided with a decline in profitability, or ‘hash price,’ which has decreased to $0.049 per terahash per second per day, according to HashRateIndex. This represents a drop of over 73% from the $0.182 TH/s/day level seen around the halving.

Such a scenario also spells trouble for Bitcoin’s price as sell-off concerns loom amidst increasing pressure faced by miners.

The post Bitcoin (BTC) Miners Facing Capitulation as Hashrate Declines Post-Halving appeared first on CryptoPotato.