Bitcoin (BTC) Massive 100% Gains This Year: Is There More to the Story?

TL;DR

- Bitcoin’s Remarkable Performance: American entrepreneur Anthony Pompliano highlights Bitcoin’s exceptional performance, emphasizing its 100% increase in value this year amidst global chaos and uncertainty, positioning it as a favored asset for investors.

- Geopolitical Tensions and Economic Events Boost Bitcoin: Pompliano attributes Bitcoin’s recent surge to the collapses of major US banks, China’s banking crisis, and escalating geopolitical tensions, indicating that these events are driving investors toward decentralized currencies, particularly Bitcoin.

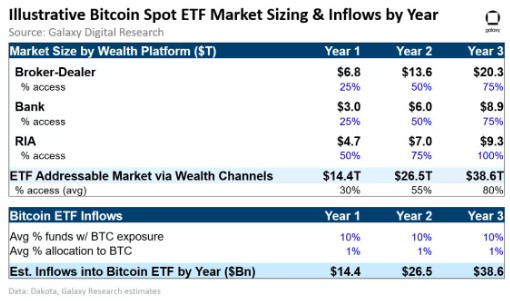

- Bitcoin ETFs and Potential Growth: Pompliano discusses the impact of Bitcoin ETF approval, citing a report from Galaxy Research estimating a minimum of $14 billion in inflows in the first year, potentially leading to a 75% price appreciation for BTC in the year following approval.

Bitcoin is The Most Disciplined Bank in the World

American entrepreneur Anthony Pompliano, known as Pomp, believes Bitcoin remains the most important asset in global finance and that the current economic chaos and social unrest is an ideal scenario that favors BTC holders.

During an interview with Squawk CNBC, Pomp stated that people forget how BTC is up over 100% this year. We could see much more price appreciation as rising geopolitical tensions, coupled with inflation and tighter monetary policies from the Fed, could lead investors towards decentralized currencies.

Bitcoin is up more than 100% to start the year.

I joined @SquawkCNBC this morning to discuss why investors are interested in the decentralized currency amid the chaos and uncertainty of the modern world. pic.twitter.com/rUNy9oAT8u

— Pomp

(@APompliano) October 25, 2023

At the time of writing, Bitcoin is trading at $34,695, 32% up in one month. Most of this growth is attributed to the hype surrounding BlackRock and other institutions’ BTC spot ETF and the series of ongoing geopolitical tensions and economic events.

The first three US banks’ collapses paved the way for BTC’s appreciation. Meanwhile, the recent banking crisis in China could’ve helped BTC similarly. The war in the Middle East could drive oil prices further, affecting the stock market considerably.

According to Pomp, this is what is sending investors right into cryptocurrencies like Bitcoin. Concerns of global inflation and geopolitical tensions favor Bitcoin’s growth, something said by multiple investors and entrepreneurs for a few months now, including David Lo, head of financials at ByBit, who thinks the next target for BTC in Q4 is $40k.

Meanwhile, if you’re interested in some other interesting BTC price predictions, we’ve recently created a video on some of the most shocking ones here:

$14B of Inflows Post-ETF

Pompliano touched on the BTC ETF hype, stating that, most likely, we’ll see a short-term price reaction should the ETF be approved. He used recent false reports as an example of how price may react if such a scenario takes place.

However, others are going further. A new report from Galaxy Research states that Bitcoin ETFs could see a minimum of $14B in inflows in year one, which could lead to at least 75% in price appreciation for BTC in the year following the approval.

The post Bitcoin (BTC) Massive 100% Gains This Year: Is There More to the Story? appeared first on CryptoPotato.