Bitcoin (BTC) Could Dump to $51K If it Breaks Below This Support Line: Expert

With the Bitcoin halving just days away, the cryptocurrency has been highly volatile leading up to the event. In fact, BTC lost almost 7% on Tuesday alone, fluctuating from $66,000 to the current price of $63,225, extending weekly loss to more than 12%.

Bitcoin has so far wiped all the monthly gains and is now consolidating within a parallel channel. However, there are new resistance and support levels that investors need to watch out for.

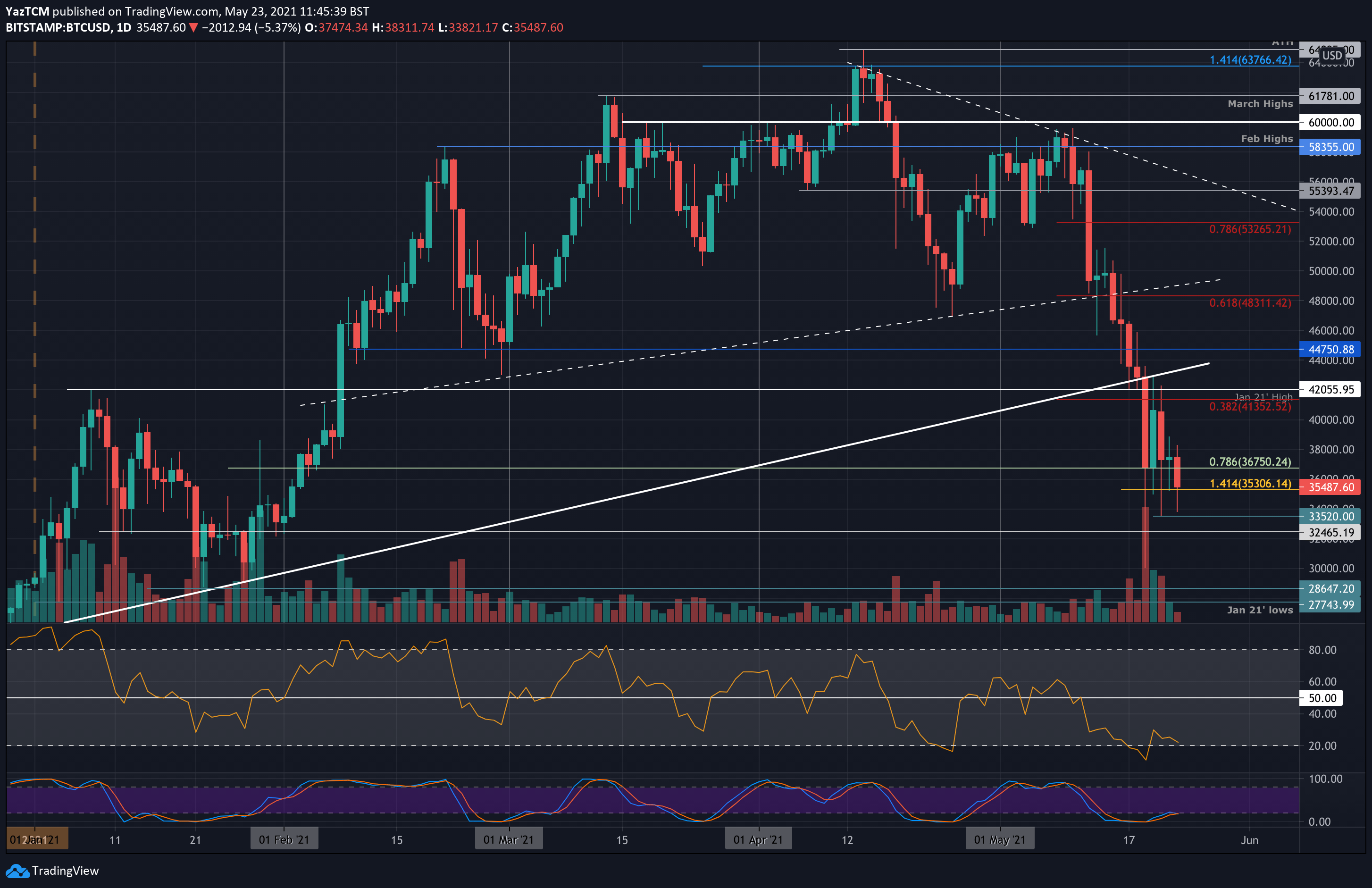

Key Support and Resistance Levels

According to the latest findings by the popular crypto analyst Ali Martinez, Bitcoin has been consolidating in a parallel channel, within which he identified $61,000 as the crucial support level. Meanwhile, $72,400 has been deemed as the most important resistance level.

Martinez warned that a breach below the support line may trigger a descent towards $56,200 or even $51,600. On the other hand, a break beyond the resistance barrier in question could catapult Bitcoin towards ambitious targets, setting sights on $79,000 and $86,000.

“Let’s keep it simple and only focus on support and resistance! By the looks of it, Bitcoin has been consolidating in a parallel channel, which makes $61,000 the most important support level and $72,400 the most important resistance level. If BTC breaks below support, it could drop to $56,200 or $51,600. But if BTC can break past resistance, the next price targets are $79,000 and $86,000.”

It is important to note that certain whale entities have ramped up their holdings despite the chaotic price action partially spurred by escalating geopolitical tensions.

Since March 1st, Bitcoin whale wallets holding 100 to 1,000 BTC bought 43,489 coins (valued at around $2.75 billion), as per data by Santiment. In the same period, wallets with 1,000 to 10,000 BTC amassed 80,544 coins (approximately $5.1 billion), mirroring a trend seen in wallets holding 10,000 to 100,000 BTC, which gathered 91,732 BTC (worth around $5.8 billion).

Bitcoin’s Trajectory Uncertain or Normal Occurrence?

The latest downturn has worried many crypto investors. However, CryptoQuant revealed that this decline aligns with historical trends seen during previous halving events.

In past halving cycles, similar price drops were witnessed before significant surges.

For instance, during the second halving, there was a 40% drop before Bitcoin skyrocketed to $19,600. Similarly, in the third halving, over 20% decrease preceded a peak of $69,000. The current cycle’s decline also mirrors these patterns, indicating “a normal and anticipated occurrence.”

The post Bitcoin (BTC) Could Dump to $51K If it Breaks Below This Support Line: Expert appeared first on CryptoPotato.