Bitcoin (BTC) Consolidates at $86K, Pi Network (PI) Plummets by 12% (Weekend Watch)

The cryptocurrency market has shown no significant volatility in the last 24 hours, with many leading digital assets stabilizing at the levels observed on March 8.

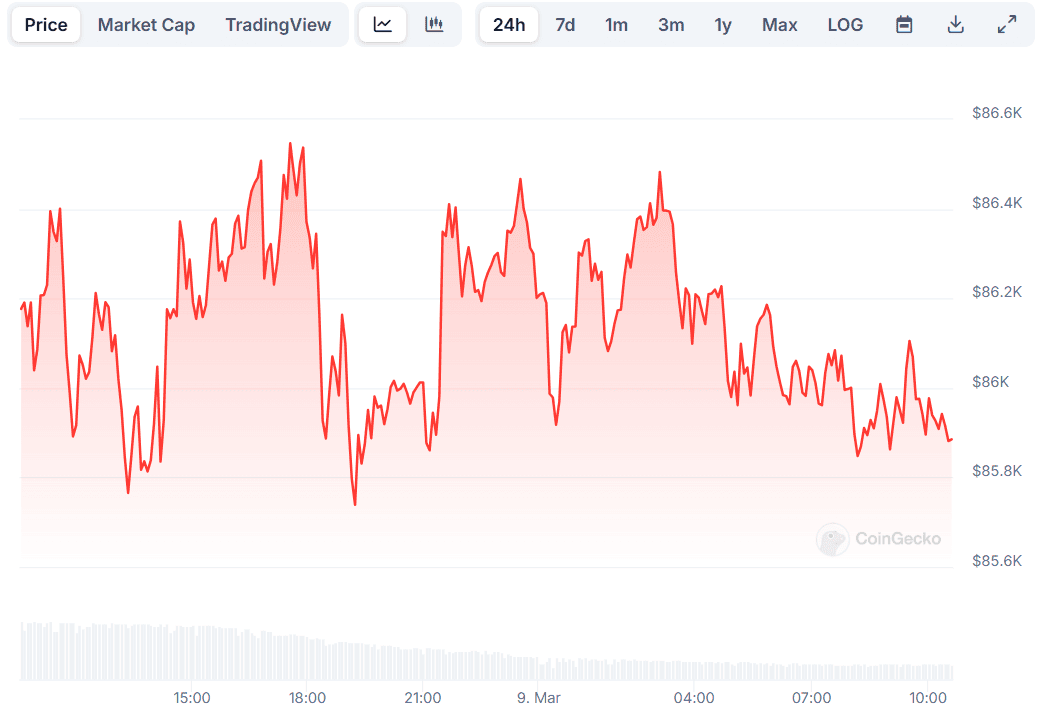

Bitcoin (BTC) has been dancing around $86,000, representing a mere 0.4% decline on a daily scale.

The Calm Before the Storm?

The past several days have been quite turbulent for the primary cryptocurrency, whose valuation has been trading in the wide range between $78,000 and $95,000. Some developments that have potentially affected its performance were the escalating trade war launched by US President Donald Trump and the major announcement concerning establishing a strategic BTC reserve in America.

On March 7, the Republican hosted a historic crypto summit at the White House, which was attended by well-known crypto executives and relevant members of his administration. During the event, Trump doubled down on his promise to establish such a reserve and assured that the US would follow a “never sell your BTC” plan.

Multiple industry participants previously predicted that the gathering would trigger huge volatility for the leading digital asset. However, this was not the case, and in fact, BTC tumbled below $85,500 before rebounding to around $86,000.

It is worth noting that some market observers assumed that the event could lead to a “sell the news” scenario. In addition, Trump’s executive order didn’t introduce anything new for investors and offers minimal practical benefits for BTC and the other coins included in the Digital Asset Stockpile, as the US government will not invest money to purchase them.

In the following 24 hours, BTC fluctuated between $85,700 and $86,500, eventually consolidating at the current $86,000.

We have yet to see whether the start of the business week will offer a new doze of turbulence or the price will remain relatively stable. One element that may propel enhanced volatility is the upcoming release of the US CPI data scheduled for March 12.

The report is closely monitored by the Federal Reserve which takes the inflation figures into consideration to determine whether to raise, cut, or keep the interest rates unchanged. Historically, these efforts have been followed by increased volatility for BTC.

Meanwhile, the asset’s market capitalization stands at around $1.7 trillion, whereas its dominance against the altcoins is the same as on March 7 – approximately 58.2%.

How are the Alts Doing?

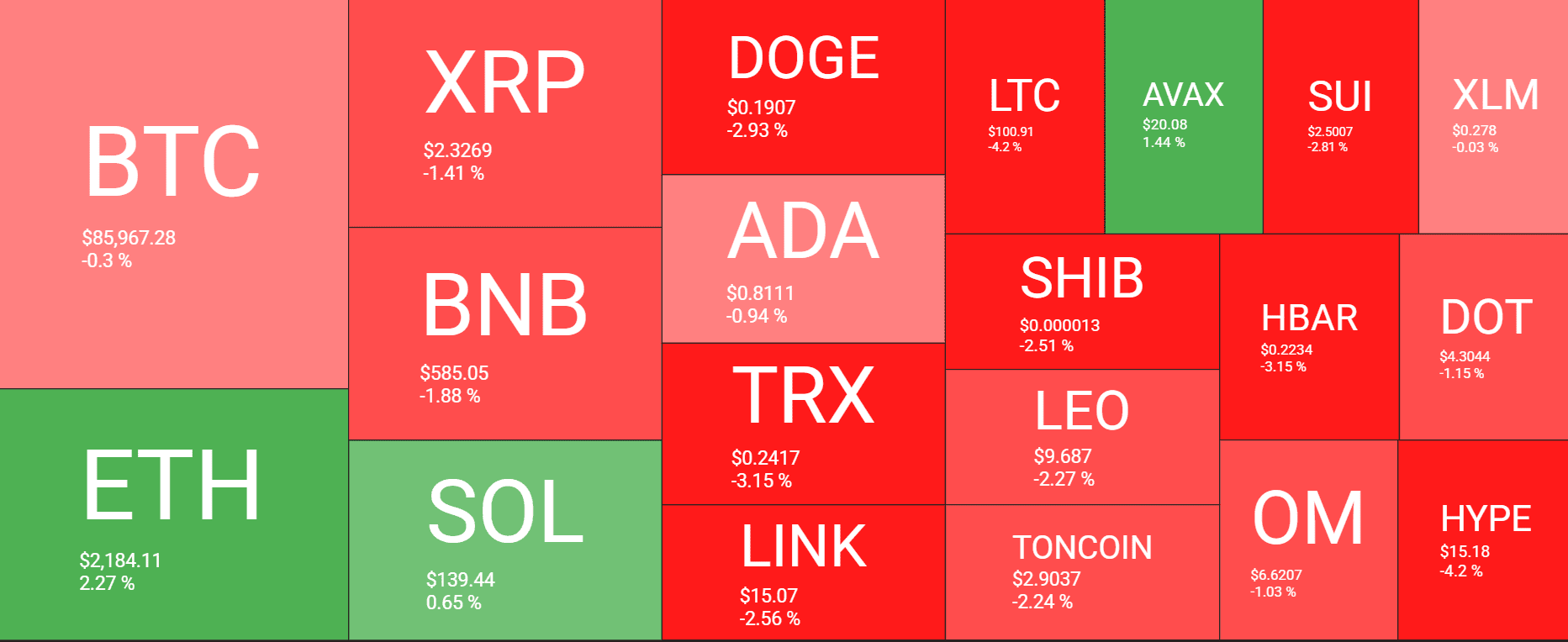

There is nothing dramatic with the leading alternative coins, too. Those recording minor gains in the past 24 hours include Ethereum (ETH), Solana (SOL), Avalanche (AVAX), and Uniswap (UNI).

Ripple (XRP), Binance Coin (BNB), Cardano (ADA), Dogecoin (DOGE), Tron (TRX), and Shiba Inu (SHIB) are on the opposite corner, with their prices slightly retreating for that timeframe.

The biggest loser from the top 100 club is Pi Network (PI), whose valuation has tumbled by 12%. Currently, it trades at approximately $1.57, far from the all-time high of almost $3 registered at the end of February.

The total cryptocurrency market capitalization currently stands at roughly $2.92 trillion, representing a 1.8% decrease for the day.

The post Bitcoin (BTC) Consolidates at $86K, Pi Network (PI) Plummets by 12% (Weekend Watch) appeared first on CryptoPotato.