Bitcoin Brings Clarity Through Sound Money

Bitcoin represents the ultimate step forward in bringing clarity to the world through money grounded in physics and math.

This is an opinion editorial by James Collins, a financial professional with experience in various asset classes.

As I sit here writing this piece, I search for the words to best describe my thoughts on the present state of the world. I couldn’t seem to find words to express my vantage point until I landed on Clockwork Orange. Stanley Kubrick’s 1971 dystopian crime thriller, “A Clockwork Orange,” presents ranging views of individualism and freewill to authoritarianism and force. The parallels between some people’s idea that we are headed toward a global totalitarian state known as the “Great Reset” and the intense level of response to the blatant use of force by The State and power in numbers expressed in the counterforce of the “Great Awakening” fit firmly in the scripting of “A Clockwork Orange.” We have a heightened global awareness of these buzz words like Great Reset and Great Awakening, but what I believe is the best descriptor of these connected, yet conflicting, ideas of global magnitude is the “Great Confusion.”

The Great Confusion stems from an underlying absence of the inverse, which is clarity. I believe if we as humans desire to grow as a species, we must sync to a global baseline level of objective truth or 100% clarity.

“Bitcoin, Clockwork Orange” is my musing on how clarity through money removes us from the “Great Confusion.”

To find clarity, we must sync to a global baseline of objective truth. What can we use as the baseline? It must be something that everyone can agree on, regardless of spoken language and geographical location, like mathematics and physics. Whether in the United States or El Salvador, two plus two will always equal four, and there is no place on earth where humans can jump off a building and fly; gravity will win. These objective truths are the perfect baseline for humans to build upon as a strong base layer.

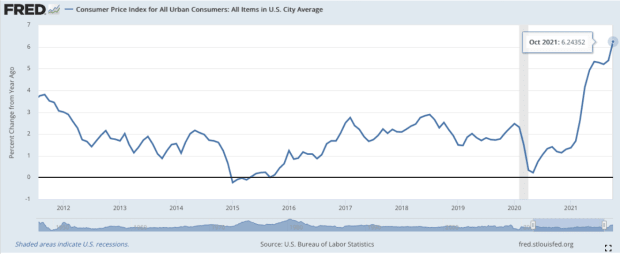

“Mathematics is the base layer of language” — @FossGregFoss

On January 3, 2009, Satoshi Nakamoto released a decentralized system of peer-to-peer electronic cash in the form of Bitcoin, and that has changed our world forever, giving humanity clarity in the form of money. The Bitcoin network and its unit of account, bitcoin, flips upside down everything we once knew about finance. The time-value of money is the core principle of finance — that money today is worth more than money tomorrow. The current time-value of money only exists because a central authority can alter the volume of currency within an economic system at any time. Due to the central control of money creation, the saying is that governments can always print more money to handle their debts, so they have a risk-free rate. This risk-free rate is the base rate added when layering other risk factors when analyzing an investment in other bonds or equities. A central authority’s ability to alter the underlying money supply and affect these rates means they can affect everything in an economy and completely distort price signals. If looked at through its most sinister lens, controlled issuance of money supply in traditional finance is how central authorities keep their population on the road to serfdom; people work exponentially more onerous for a currency growing exponentially weaker, thereby being robbed of their time expressed through destroyed purchasing power.

“Finance is the time value of money. Bitcoin is the monetary value of time.” — @Lisa_Hough_

Satoshi Nakamoto solved the ills associated with time theft through currency debasement by discovering absolute scarcity using technologies that leverage the objective truth of mathematics and physics to back a natively digital supply by time itself, the only absolutely scarce asset we possess. Paraphrasing the work outlined in Chapter 2, Bitcoin is Time in Gigi’s “21 Lessons,” the Bitcoin Network is a decentralized timestamping server that uses asymmetric cryptography to create causality in cyberspace. Those causal events (known data needed to create a hash of that known data which is linked to the next block) link together by giving them meaning through entropy or the randomness, in the form of no one in a decentralized system knowing who is going to win the next block reward and which transaction will be hashed into a block to create the particular Merkel root defining a point in time that resembles an absolute now in the digital realm. Discovering a method of determining the “now” or “time” in a decentralized adversarial system is what allowed Satoshi Nakamoto to solve the centralization of time-keeping of the ledger to prevent double spending, as well as definable “time” in cyberspace, which is necessary for the determination of “when” transactions occurred.

(Bitcoin is simply a transaction-based ledger where the transactions are the spreading of ownership of the units of time encapsulated in bits called satoshis by signing continuous digital signatures to this append-only distributed timestamp server). The entropy of asymmetric cryptography creates an irreversible arrow of this “now” time, creating a legitimate past, present and unknown future. As mentioned, the objective truth of physics also comes into play through the unpredictability expressed through the same asymmetric cryptography in mathematics applied to the physical exertion of energy within proof-of-work consensus to solve the cryptographic puzzle, therefore emitting more bitcoin into circulation. Proof-of-work is essential to the underlying value of bitcoin because it runs physical computation, the only native form of energy transfer in the digital realm with no way to cheat it. Through an asymmetric cryptographic function, proof-of-work creates a scenario where the time taken to brute force the answer over the almost nonexistent time to verify the findings is expressed via computationally time-derived bits.

Finally, Nakamoto utilized the difficulty adjustment in block height or Bitcoin’s native clock to connect this computational work of time-exertion back to our physical world by using a cryptanalytically stable problem, allowing for a speed limit on the time expressed between our physical world (an average 10-minute block time) and the digital realm (a difficulty adjustment every 2016 blocks). The finality of this time-derived speed limit connecting our physical world to the digital world allows the absolutely scarce hard-cap of 21 million bitcoin expressed in the Bitcoin Core source code to be upheld.

No matter how much energy or computation you throw at the network, you can not speed up the emission schedule, and more energy does not mean more bitcoin; bitcoins underlying value is not computation through energy intensity but computation through energy exertion measuring the time asymmetry made possible through one-way cryptography.

“When you have scarcity in money, you have abundance in everything else.” — @JeffBooth

In conclusion, humanity is in the midst of the Great Confusion — some people think we are headed towards a Great Reset while others believe we are in a Great Awakening — and some don’t care. This lack of focus and attention is due to overwhelming noise and misdirection.

The signal we are looking for can be found at the depths of our oldest social structure, money, which has now been transformed through objective truth in mathematics and physics into the perfect signal. Bitcoin leverages that perfection to invert everything we know about finance and money. Satoshi Nakamoto used objective truth in mathematics and physics to bridge a synthetic digital time and space to our physical time and space in a decentralized manner allowing for coordination of when an absolute volume of costly unforgeable bits of digital time interlock with our physical efforts of computation.

The discovery of absolute mathematical scarcity with an intrinsic value of inescapable costliness in the real physical world linked to the heartbeat of a synthetic time in block height controlled by the cryptanalytic stability of the difficulty adjustment, a physical world time-based adjustment, is the most crucial discovery in monetary application of all time. Bitcoin is the unstoppable march of time-derived money wrapped in mathematics and physics, defining a pure price signal. Tick tock next block.

This is a guest post by James Collins. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.