Bitcoin Breaks Above $16K For The First Time Since January 2018: The Crypto Weekly Market Update

Bitcoin is up by a total of around 5% this week. However, the most interesting part is that it finally broke above the coveted $16,000 mark for the first time since January 2018.

This time, however, things are looking a lot more stable. BTC had a few attempts at $16,000 and managed to convincingly break through today. Ironically, it’s Friday the 13th so there goes the myth of bad things happening on this date.

At the time of this writing, the price is trading at above $16,200 and it’s interesting to see if the bulls can sustain the rally or if we will go through a correction anytime soon.

Another thing to consider is Bitcoin’s dominance index – the measure of its share relative to the entire crypto market. It’s currently sitting just below 65% and it’s unchanged since last week. This means that despite the increase in its price, the primary digital currency didn’t claim any new grounds.

Other important news came from PayPal. The company had previously stated that it will allow its users to buy, sell, and store cryptocurrencies. Now, this is becoming a reality as select US-based customers can buy and sell Bitcoin. PayPal is the world’s largest online payment processor with billions worth of monthly transfers and that’s undoubtedly among the most important things that have happened for the industry in 2020.

The CEO of KuCoin – the popular cryptocurrency exchange that got hacked recently, said that they’ve managed to recover 84% of the stolen funds which is also a great turn of events. More good news came from China as one of the country’s largest banks, the Construction Bank of China, announced that it will sell $3 billion worth of debt using blockchain.

In any case, the past seven days have been nothing but positive for the entire industry and it remains to be seen if this will carry on over the historically volatile November.

Market Data

Market Cap: $466B | 24H Vol: 115B | BTC Dominance: 64.8%

BTC: $16,288 (+5.36%) | ETH: $472.71 (+7.08%) | XRP: $0.264 (+2.7%)

PayPal Enables Eligible US Customers to Buy, Sell, and Store Bitcoin. Less than a month after officially announcing the integration of cryptocurrencies, the world’s largest online payment processor PayPal has allowed select US customers to buy, sell, and store crypto. The same should follow in other countries until the end of the year and in 2021.

Bitcoin Hits $16K For a New 2020 Record: 325% Up Since March Yearly Low. Bitcoin has managed to break past the coveted $16,000 for the first time since back in January 2018. The cryptocurrency is trading convincingly above it as of the time of writing this.

Bitcoin Stock-to-Flow Model Still on Track Despite Big Bets Against it. The recent move of Bitcoin to $16K has kept it right on track for the popular stock-to-flow pricing model. It remains interesting to see whether the model will play out in the future as it has considerably high price targets going forward.

KuCoin Has Recovered 84% Of All Stolen Funds, CEO Confirms. After being the victim of a massive hack attack recently, the CEO of the popular KuCoin exchange said that they’ve managed to recover 84% of all stolen funds. This happens over a month after the attack took place.

Major Chinese Bank to Sell $3 Billion of Debt Using Blockchain. The Construction Bank of China, one of the country’s biggest banking institutions, announced that it will sell up to $3 billion worth of dept using blockchain technology. Interestingly enough, investors will be able to make purchases using bitcoin.

Higher Compliance Costs for Bitcoin Holding Companies Under Biden Presidency, Ripple CEO Forecasts. The CEO of Ripple (XRP), Brad Garlinghouse, thinks that Bitcoin-holding companies will be subjected to higher compliance costs as soon as Joe Biden becomes the acting president of the United States.

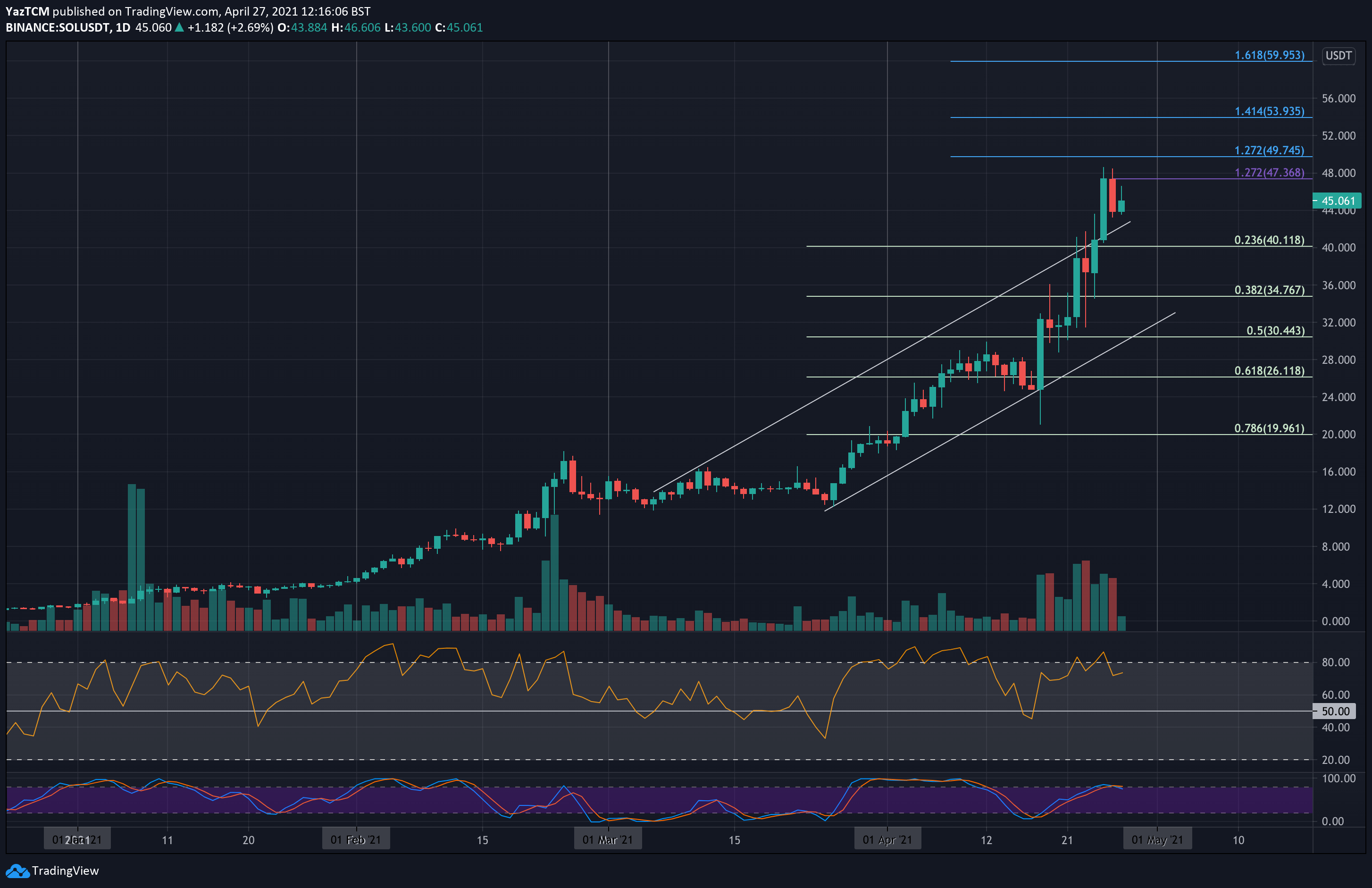

Charts

This week we have a chart analysis of Bitcoin, Ethereum, Ripple, Chainlink, and Cardano – click here for the full price analysis.