Bitcoin Breaks 2017 ATH But Gets Rejected: The Crypto Weekly Market Update

To say that this week was interesting would be an understatement. It had a little bit of everything.

Starting off, towards the beginning of the week, Bitcoin officially surged past its 2017 high and recorded a new all-time high, clocking at almost $20,000 but couldn’t really manage to surge past that point.

Naturally, as it always happens with the primary cryptocurrency, things took a turn for the exact opposite of what many were expecting. The price took a beating ad dropped to the low $18,000s in a matter of hours. This resulted in around $800 million worth of liquidations in less than 24 hours.

The bulls weren’t finished, however. They intercepted the move, and the price started recovering. At the time of this writing, Bitcoin is trading around $19,000, and it’s interesting to see where it would take from here.

Elsewhere, there was quite a bit of positive news throughout the entire week. Just yesterday, the audio streaming giant Spotify posted a job opening that revealed that it’s contemplating cryptocurrencies for payments. The acting Comptroller of the Currency in the US, Brian Brooks, said that banning crypto is not part of the country’s plans, reassuring that positive news will follow by the end of Trump’s term.

Unfortunately, the week also presented us with some bad news. As CryptoPotato reported, a large Australian exchange accidentally exposed over 270,000 customer emails in a serious privacy breach. This is not the first time an incident of this kind happens as in late 2019, BitMEX went through something similar.

In any case, the overall sentiment within the community remains overly positive. In fact, a cryptocurrency sentiment survey conducted by Kraken revealed that investors hold that Bitcoin will hit $36,000 in 2021. Will it happen? Only time will tell.

Market Data

Market Cap: $562B | 24H Vol: 139B | BTC Dominance: 62.7%

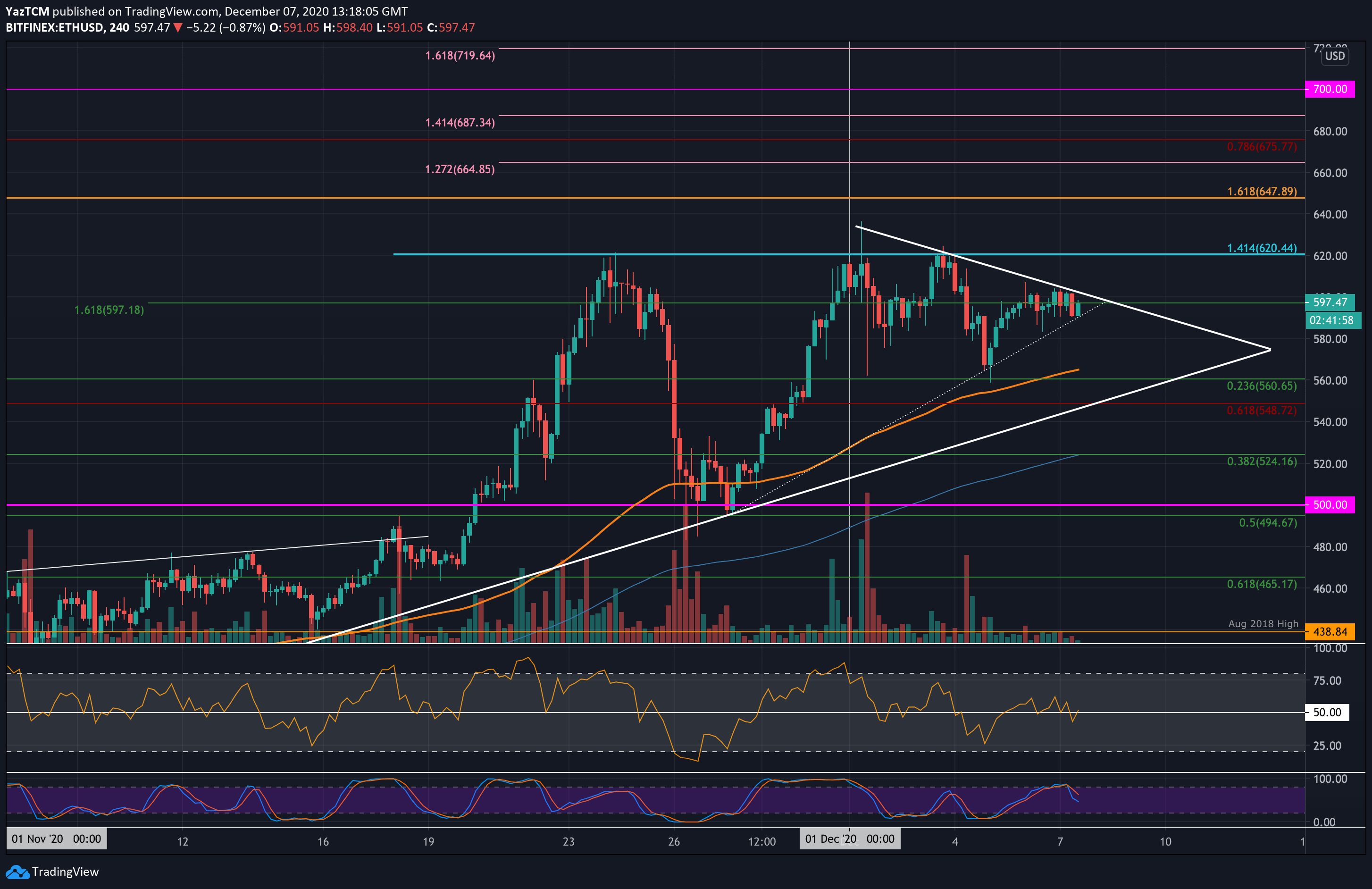

BTC: $18,915 (+13.03%) | ETH: $587.46 (+16.13%) | XRP: $0.56 (+5.61%)

Audio Streaming Mogul Spotify Considering Cryptocurrency Payments. The popular audio streaming mogul Spotify has posted a job opening that reveals its intention to potentially incorporate bitcoin and other cryptocurrencies as a means of payment. With this, Spotify follows a group of major corporations that are putting effort towards implementing digital assets in their ecosystems.

Bullish Indicator to Buy Bitcoin Has Flashed Yet Again After 5 Months. The majorly bullish indicator has flashed green once again after five months. The Hash Ribbons, as it’s referred to, preceded BTC’s rallies to $10,500 in April and the run-up to $12,500 in August. It’s interesting to see if it will be correct again and if BTC will produce yet another leg up, taking it above $20,000.

Bitcoin Arrives At Wall Street: Crypto Indexes To Be Launched in 2021 By S&P Dow Jones Indices. In another news of serious cryptocurrency adoption, the leading index provider S&P Dow Jones Indices has revealed a partnership with the crypto-based Lukka to launch cryptocurrency indexes that follow 550 of the leading coins.

Bitcoin Price to Hit $36,000 in 2021: Kraken Crypto Sentiment Survey. According to a recent sentiment survey conducted by the popular cryptocurrency exchange Kraken, a majority of the respondents believe that Bitcoin will hit $36,000 in 2021. The same also think that Ether will clock in at a price of around $1450.

Visa Partners With Circle to Integrate USDC for Payments. The payment processing giant Visa has partnered up with Circle with the intention to integrate the USDC stablecoin within its network of merchants. The report also shared that 25 other companies involved in Visa’s Fast Track program would be included in the collaboration.

Australian Crypto Exchange Accidentally Exposes Over 270,000 Customer Emails. In what seems like another serious privacy breach, an Australian cryptocurrency exchange has accidentally exposed over 270,000 customer emails. This follows another mistake of the kind that happened with BitMEX in late 2019.

Charts

This week we have a chart analysis of Bitcoin, Ethereum, Ripple, Bitcoin Cash, and Litecoin – click here for the full price analysis.