Bitcoin Bears Getting Bolder as Technical Indicators Paint Grim Picture

The move has pushed BTC prices back below a number of key technical indicators suggesting that more downsides could be ahead.

On Aug. 29, the former CEO of the world’s largest corporate Bitcoin holder MicroStrategy, Michael Saylor, observed that it had dropped below the 200-week moving average, which is a rare occurrence.

The long-term indicator has served as a solid support zone during market cycle bottoms which we still appear to be in.

Rarely does $BTC trade below its 200 Week Moving Average. pic.twitter.com/f2ItcB8YLb

— Michael Saylor

(@saylor) August 28, 2023

Bitcoin Bears Getting Bolder

When BTC drops below this level, it is often seen as a golden buying opportunity for long-term investment. MicroStrategy has yet to buy at this level, as its last purchase was in late July when it acquired 467 BTC for $30,835 per coin.

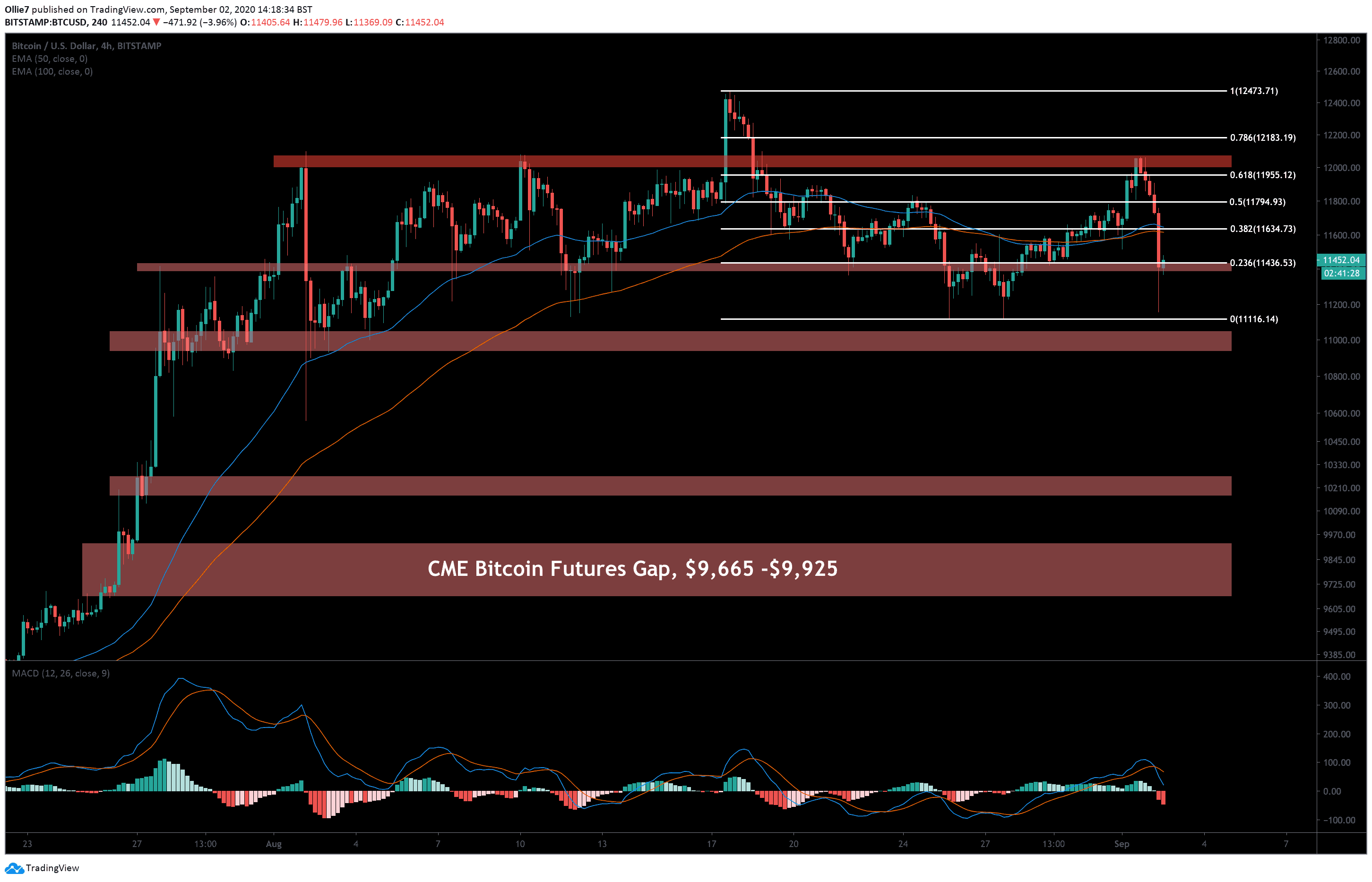

Benjamin Cowen, CEO of the ITC newsletter, looked at the monthly MACD, which is a lagging indicator. It has flipped green, and the last time it did so was in July 2019, which was the best month for that year.

The analyst predicted that it could be the same this year, suggesting more pain ahead in the short term.

“In 2023, the monthly MACD flipped green in July, and so far July is the yearly high (and good chance it stays that way).”

I see some chatter about the monthly MACD for #BTC flipping green.

In 2019, the monthly MACD flipped green in June and June was the yearly high.

In 2023, the monthly MACD flipped green in July, and so far July is the yearly high (and good chance it stays that way). pic.twitter.com/yytjLu0gdM

— Benjamin Cowen (@intocryptoverse) August 28, 2023

The sentiment was echoed by analyst Murad Mahmudov who said that delays in ETF approvals are likely to happen, which will keep markets sideways for longer.

Unpopular opinion: the longer we get no ETF the better pic.twitter.com/wfCcw149k1

— Murad (@MustStopMurad) August 28, 2023

Investor and YouTuber Lark Davis was a little more bullish, noting that buyers from small retail to whales were already outstripping the monthly supply produced by miners.

“Halving in April will reduce emissions by 50% while demand continues to rise,” he added.

General sentiment also appears to have gone bearish, with the fear and greed index reading 39, “fear” following months at neutral.

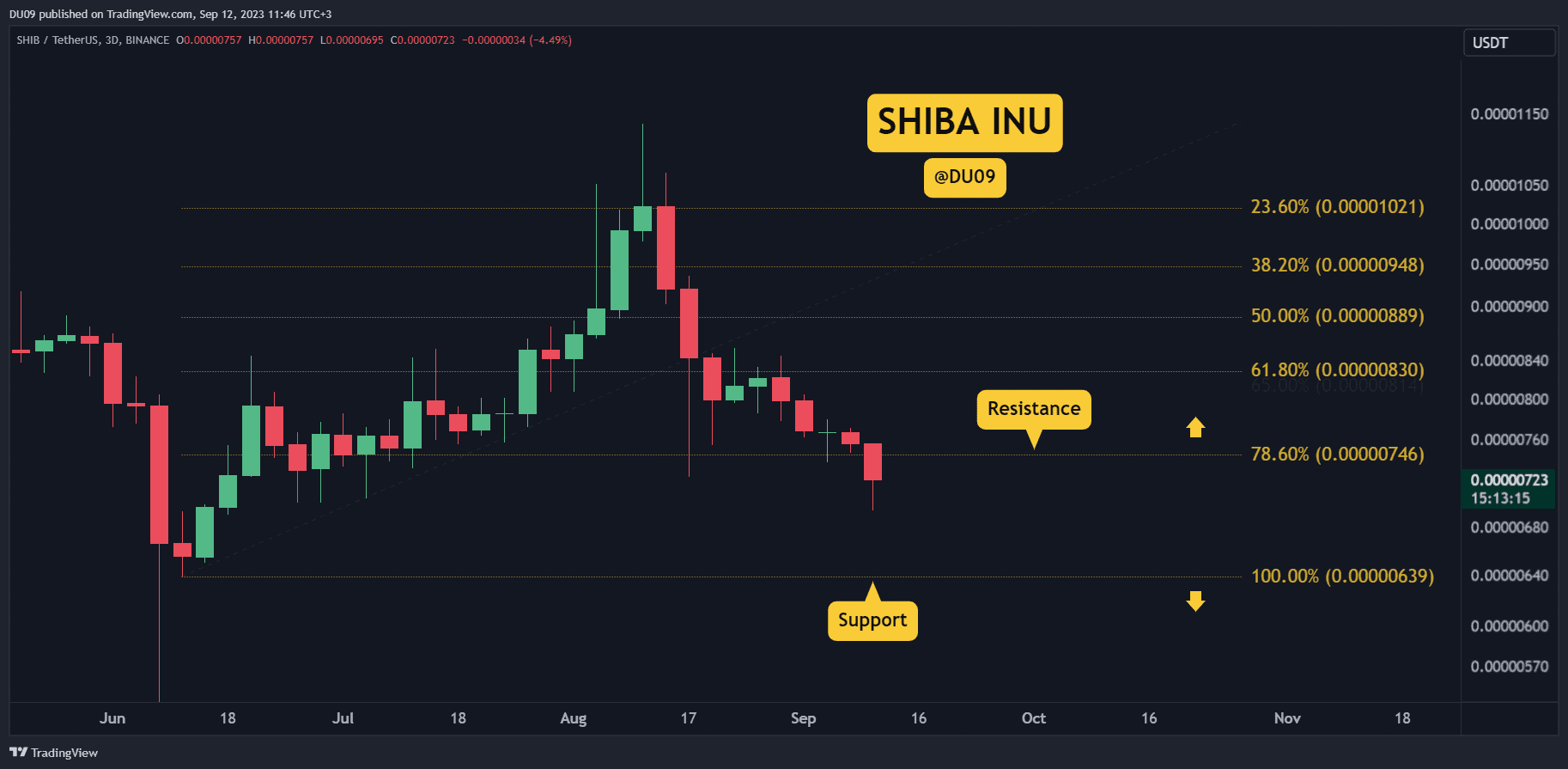

BTC Price Outlook

BTC prices dropped below $26K for the second time in 24 hours during early trading in Asia on Tuesday morning.

The asset is currently changing hands for $26,084, back at the same level it was this time yesterday.

It has started to consolidate around this level since the big slump on Aug. 18 and looks likely to head south before there is any meaningful upswing.

The post Bitcoin Bears Getting Bolder as Technical Indicators Paint Grim Picture appeared first on CryptoPotato.