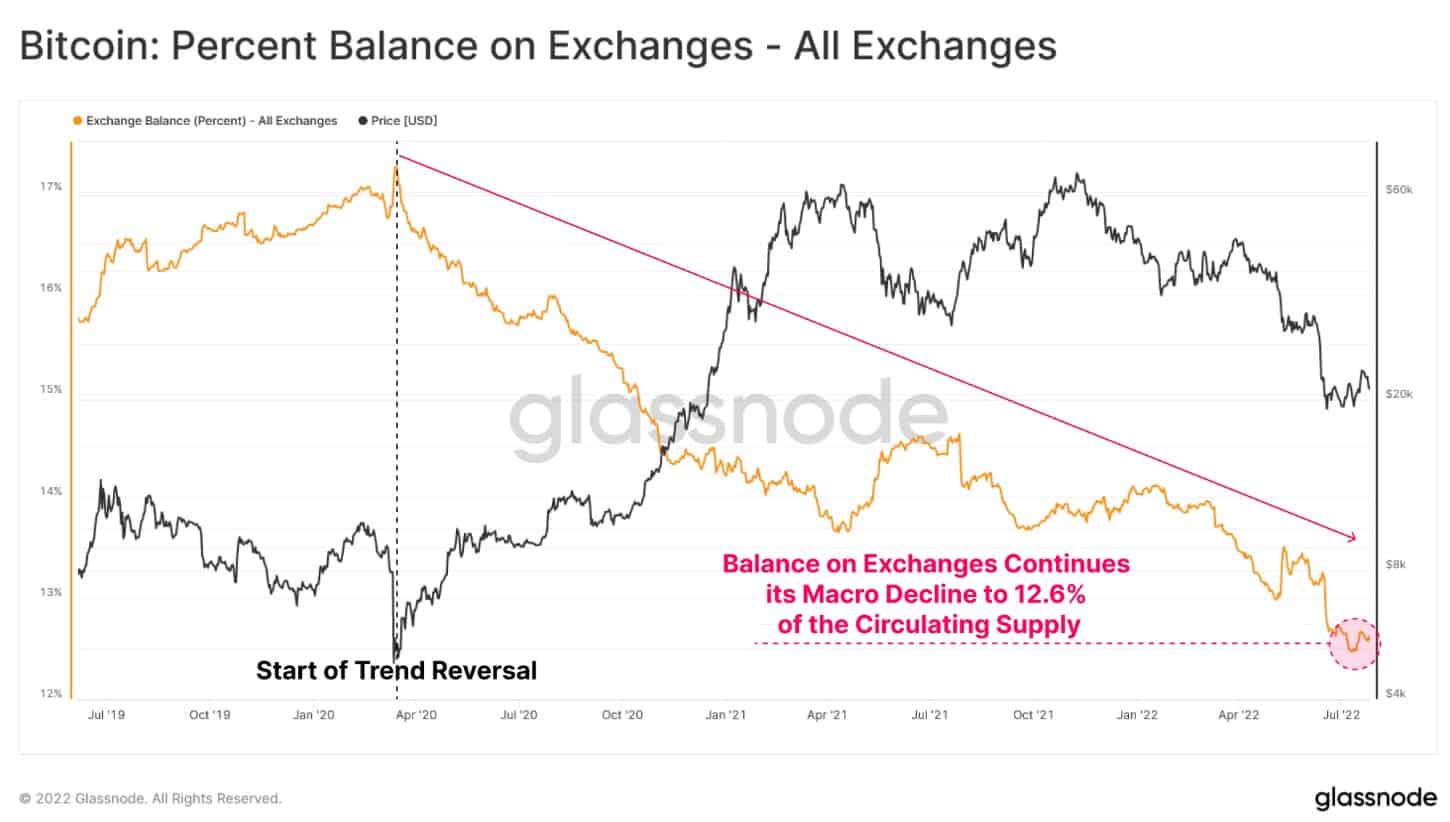

Bitcoin Balance on Exchange Sees Macro Decline

On-chain metrics reveal that Bitcoin balance on cryptocurrency exchanges continued its macro decline. The figures have reached 2.4 million BTC, which is around 12.6% of the circulating supply.

- According to Glassnode, Bitcoin exchange balances witnessed a macro outflow of more than 4.6% of the circulating supply after reaching an all-time high on March 2020.

- The balance on exchanges shrunk considerably in the last few months.

- This is a healthy sign of Bitcoin’s long-term performance and underscores a strong demand at lower price levels.

- The reversal in the trend first started in April.

- As the crypto winter deepens, some investors offloaded their wallets.

- However, on a macro level, players are still holding onto their tokens, but not on the exchanges.

- Instead, they are storing their coins offline in crypto wallets.

- The crypto analytic firm had earlier stated:

“Bitcoin has seen a near complete expulsion of market tourists, leaving the resolve of HODLers as the last line standing”

- The further decline comes in the wake of Bitcoin performing an impressive rally, increasing by over 15% over the past few days. At the time of this writing, the cryptocurrency trades at around $23,600.

- Previous reports suggested that the holders of the world’s largest cryptocurrency were in an accumulation mode that subsequently did result in a short-term relief rally.

- It will be interesting to see if Bitcoin manages to retain the present momentum.

- Craig Johnson, chief market technician at Piper Sandler Companies had recently weighed in on the price action and said that only a close above $26,000 or $28,000 could finally put a stop to the downward slide that the crypto-asset has been on since April.