Bitcoin Back Above $67K as Memecoins Push up SOL and AVAX

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

-

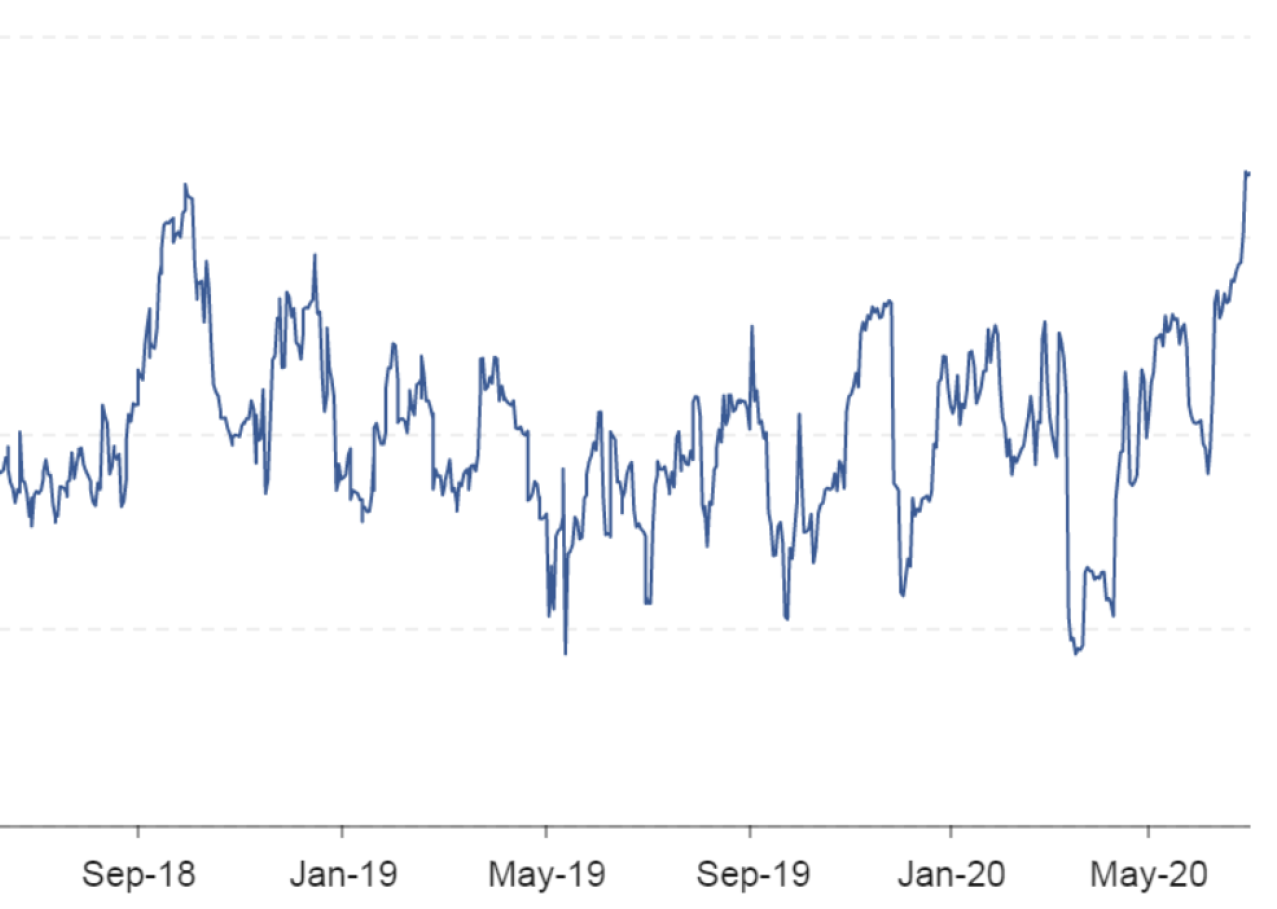

Bitcoin has rebounded above $67K amid pre-FOMC volatility and investor confidence in buying the dip, despite macroeconomic concerns.

-

Memecoins surge, driving the sector’s market cap over $55 billion

Bitcoin {{{BTC}}} changed hands at around $67,800 during Monday’s Asian trading hours, as pre-Federal Open Market Committee (FOMC) volatility worked its way through the crypto market, moving major digital assets and pushing up memecoins.

“The weekend was filled with both fear and greed as BTC was driven down to $64,500 lows,” Singapore-based QCP Capital wrote in a note on Telegram. “BTC has since bounced back above $67,000, and we’ve seen heavy BTC put selling, which suggests that ‘fear’ has dissipated in BTC, and investors are happy to buy the dip.”

FOMC risk is also spooking BTC investors, bringing back macroeconomic concern to an asset class buoyed over the last month by optimism over the approval of bitcoin exchange-traded funds (ETFs). Recent U.S. economic data indicated persistent inflation, leading to higher interest rates and a stronger dollar, which fares poorly for risk assets.

CME Fed Watch surveys give a 99% chance of interest rates remaining unchanged, while a Polymarket contract suggests the same odds.

Meanwhile, memecoins were all the rage over the weekend, pushing the sector’s market cap up over $55 billion, an 11% gain, according to CoinGecko data.

Top movers included {{{SHIB}}}, up 10.8%, DogWifHat {{{WIF}}}, up 30%, and {{{CORGIAI}}} up 8.5%.

Likewise, the tokens behind the chains these meme coins are issued on are also headed upwards. Solana’s {{{SOL}}} is up 10.8% to $205, according to CoinDesk Indicies data, while Avalanche’s {{{AVAX}}} is up 15% to $61.

“Solana has once again exploded as the trendiest crypto asset amongst traders with new meme tokens popping nearly every minute,” Nick Ruck, COO of ContentFi Labs, said in a note shared with CoinDesk.

The CoinDesk SCPXX, which covers smart contract platforms excluding ether, is up 8.2%, beating the CoinDesk 20 (CD20) index, a measure of the largest digital assets, which is up 3.5%.

Edited by Omkar Godbole.