Bitcoin ATH on Christmas Caused by Retail Investors: Adam Back

With bitcoin’s price surging to a new all-time high on Christmas Day, the community has speculated on possible reasons. Co-founder and CEO of Blockstream, Adam Back, believes that retail investors have finally arrived and driven BTC higher this time, instead of institutions.

Back: Retail Pushed BTC To A New ATH

Bitcoin has exploded in value in Q4 2020, resulting in breaking above $20,000 for the first time and charting consecutive all-time highs. The main narrative behind this impressive performance was that large corporations and institutional investors had driven the primary cryptocurrency to unseen highs.

After all, companies like MicroStrategy and institutions such as One River Asset Management, Guggenheim Partners, and MassMutual allocated in total billions of USD in bitcoin in the span of a few months.

Simultaneously, numerous reports claimed that retail investors were trailing behind, and the questions remained what could happen to BTC’s price once they arrive at the bitcoin scene.

According to Blockstream’s Adam Back, retail investors could have been behind the latest rally. BTC spiked to three consecutive ATHs on Christmas at $24,700, $24,800, and ultimately – $25,000.

Back argued that there little-to-no chance that institutions would be behind this run, particularly on Christmas Day. Instead, he asserted that “retail did it – only people near a keyboard.”

He also noted that BTC hit $25,000 on cryptocurrency exchanges that typically have most of their traffic from retail investors, while trading venues such as Bitfinex couldn’t reach that level.

What Do Google Trends Say?

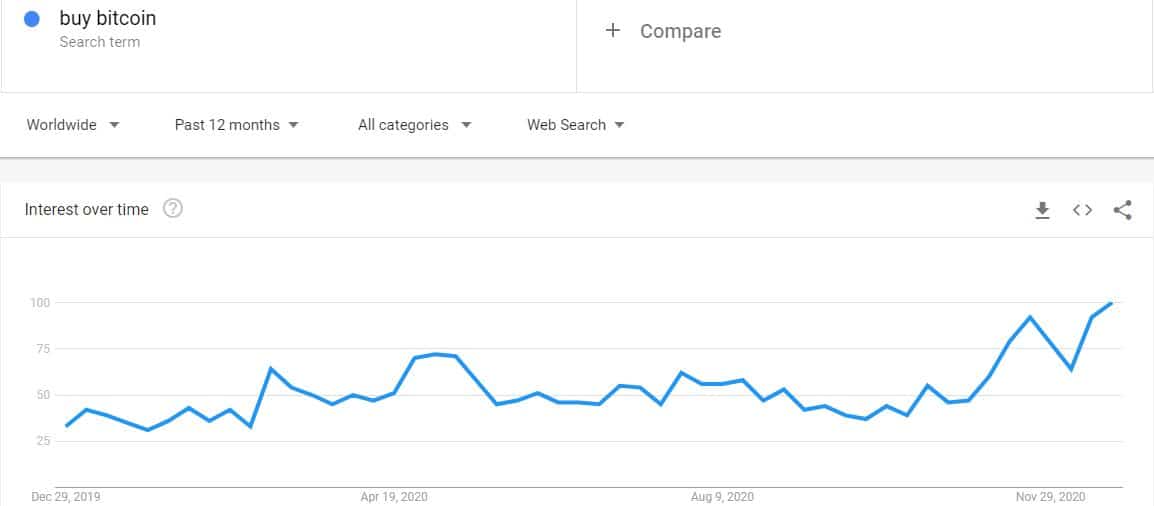

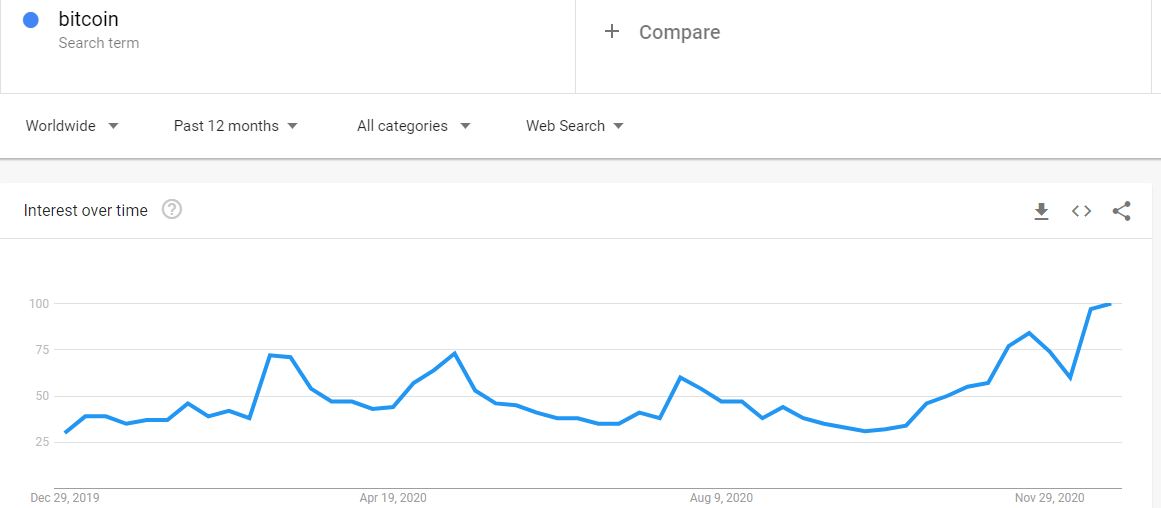

Google Trends data is generally a good indicator of the behavior of retail investors, especially when it comes down to their investment approaches towards the primary cryptocurrency. The search terms “bitcoin” and “buy bitcoin” have been trailing while BTC’s price dabbled with $10,000 a few months back, but they have picked up as the asset started appreciating.

As seen on the charts above, the worldwide Google searches for both have skyrocketed to new yearly highs just this week. This could support Back’s narrative that retail investors have indeed been more proactive towards the cryptocurrency.

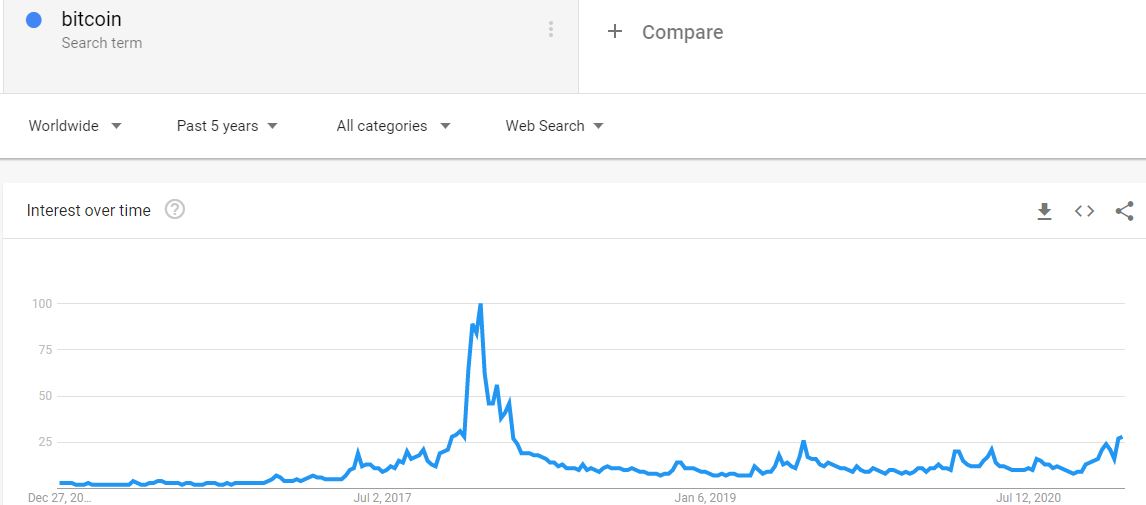

Despite reaching YTD highs, though, the macro perspective of this metric still shows that such investors are far behind the 2017/2018 boom. Nevertheless, with mass media rushing to cover BTC’s performance, a massive retail injection could be just around the corner to boost bitcoin’s price even higher.

Featured Image Courtesy of Medium