Bitcoin And The Increasing Risk Of Stagflation

Skyrocketing energy costs, risks of stagflation and a future credit crisis could have major implications on the bitcoin market.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Last week, we discussed the beginnings of a global energy crisis and the downstream effects on bitcoin mining in The Daily Dive #069. Today, we’re covering the latest developments in the skyrocketing energy costs, the risks of stagflation and how these pose increased risk for a future credit crisis.

The Risks Of Stagflation

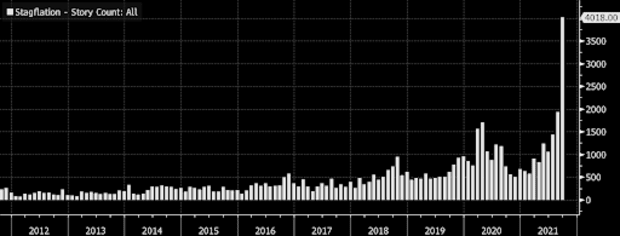

Last month, there were over 4,000 stories on the Bloomberg Terminal mentioning stagflation. It’s a growing economic concern in the market and one we’re watching closely. Stagflation refers to economic times when there’s rising inflation, a stagnation of economic output and a high rate of unemployment.

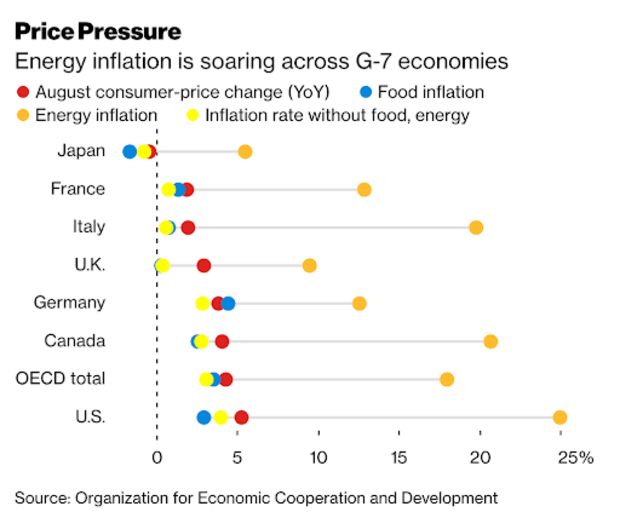

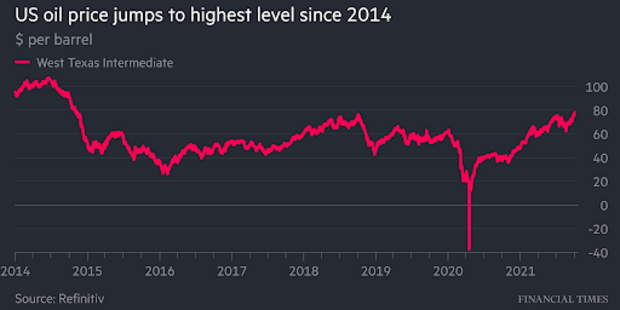

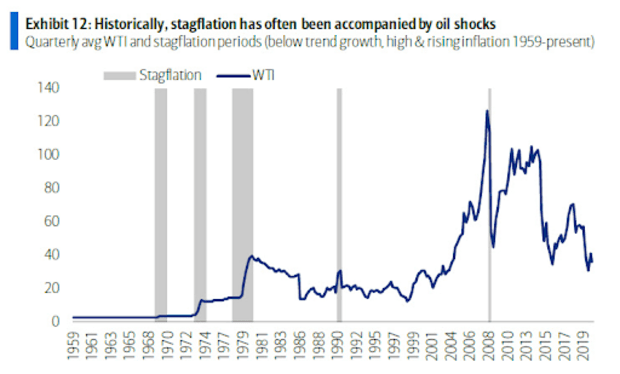

Historically, stagflation has often been accompanied by oil shocks. Now, we’re seeing the West Texas Intermediate Crude Oil price per barrel reach seven-year highs with a current global oil supply/demand imbalance. Along with the Europe and Asia natural gas and coal shortages, these factors are increasing the market chances of a stagflation scenario playing out.

Amidst the latest surge in energy prices, the Organization of the Petroleum Exporting Countries, Russia and their allies (known as OPEC+) met yesterday deciding to maintain its previously-agreed-upon production supply rather than raising supply further. The United States has called on OPEC+ to increase supply highlighting that rising gas prices are a threat to the global economic recovery.

For rising inflation, rising energy prices will affect gas prices, consumer heating bills and manufacturing production costs that can be passed onto consumers via higher prices and slow economic output.

We can already see this trend playing out through a rising surge in China’s Producer Price Index (PPI), up 9.5% in August while China Consumer Price Index (CPI) was 0.8%, showing weak purchasing demand for Chinese consumers. Chinese manufactures can look to pass on increased costs to western, foreign consumers with both demand and CPI stronger post pandemic. For the United States, this comes at the same time when monetary policy is ready to tighten.

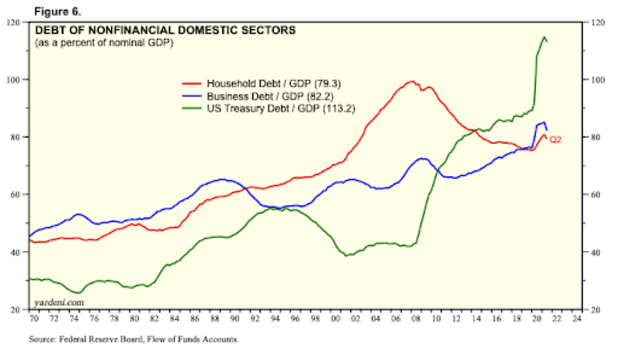

What is often misunderstood is that the Federal Reserve cannot respond to the stagflation of today like they could in the 1970s, when Paul Volcker hiked rates all the way up to 20% to curb inflation. Volker could do this because of the relatively low debt levels across the economic system, but the situation today is much different.