Bitcoin And The Cardinal Virtues: How The Rabbit Hole Instills Virtuous Behavior

Bitcoin’s mission and incentives point its community toward classically virtuous behavior.

This is an opinion editorial by Mitchell Askew, a Christian, conservative Bitcoiner who produces Bitcoin-related research and social media content for Blockware Solutions.

“You don’t change Bitcoin, Bitcoin changes you.”

This is one of many mantras circulating around the Bitcoin community. I am two years removed from the start of my Bitcoin journey and can personally attest to the legitimacy of this statement. While my experience in Bitcoin is relatively short-lived, people can grow a great deal in two years, especially those in their early 20s. Bitcoin is a never-ending quest for knowledge and anyone who joins the expedition will in due time find themselves embracing the cardinal virtues.

The cardinal virtues, deeply rooted in Christianity and among philosophers such as Plato and Aristotle, represent a universal foundation of moral guidance. The virtues are prudence, temperance, justice and fortitude. They were dubbed “cardinal” from the Latin root “cardo,” which means “hinge,” as in: all other virtues hinge (rely) upon the four cardinal virtues.

I have outlined how anyone in honest pursuit of the Bitcoin mission to separate money and state is strongly incentivized to behave according to the cardinal virtues.

Bitcoin Instills Prudence

Acting with or showing care and thought for the future.

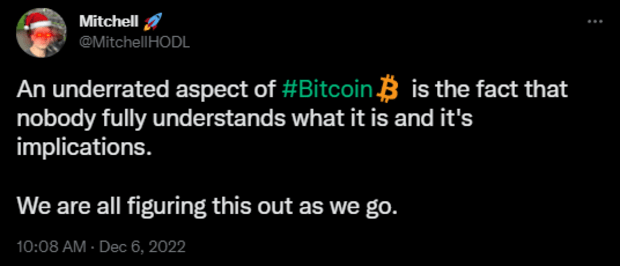

You will not understand what Bitcoin is the first time you hear about it. Nor will you have a firm grasp the second, third or fourth time. In today’s fast-paced world, few have put in the hours necessary to have a solid understanding of how Bitcoin functions, technically. Of those that have, even fewer have taken the time to study all of the encompassing domains of Bitcoin, including but not limited to economics, personal finance, computer science, energy markets, the history of money and geopolitical game theory.

To say that Bitcoin will have a profound impact on the world is an understatement. To begin having the slightest understanding of what the impact will be requires prudence. In the words of Michael Saylor “there are no informed critiques.” Those who immediately dismiss Bitcoin as a Ponzi scheme no different than those of Bernie Madoff or Sam Bankman-Fried, are simply exposing their intellectual sloth.

A common theme among Bitcoiners, popularized by Austrian economists such as Saifedean Ammous, is the concept of time preference. To have a low time preference means that you are willing to place more emphasis on your future wellbeing relative to your present wellbeing; this quite literally is the definition of prudence. Those who engage in the speculative markets of altcoins, or attempt to trade bitcoin’s unpredictable short-term volatility, rather than HODL the least uncertain asset of all time, are inherently imprudent.

By putting in the hours necessary to have a basic understanding of Bitcoin’s technical fundamentals and its broad implications on society, you have exhibited prudence.

Bitcoin Instills Temperance

Habitual moderation in the indulgence of the appetites or passions.

Similar to prudence, Bitcoiners achieve temperance through low time preference behavior.

Contrary to common FUD propagated among no-coiners, Bitcoin is not full of whales seeking to dump their positions in pursuit of fiat-denominated profit. Moreover, the exponentially-increasing adoption of Bitcoin coupled with its immutably scarce supply means that each wave of newcomers are met with the realization that it is wise to acquire as much bitcoin as possible before the rest of the world catches on.

When bitcoin becomes your individual unit of account, you begin weighing every potential purchase or experience against the opportunity cost of acquiring more bitcoin. This has led to many Bitcoiners, including myself, embracing minimalist lifestyles. The key point here is that this declination of materialistic goods in pursuit of more bitcoin, though perhaps initially sparked by a desire to satisfy future greed, brings forth the realization that an abundance of materialistic goods is unnecessary.

By eliminating many of the “wants” from your personal budget, i.e., moderating the indulgence of appetites or passions, and limiting yourself to “needs” in order to save wealth in bitcoin, you are embracing the cardinal virtue of temperance.

Bitcoin Instills Justice

Just dealing or right action; giving each person his or her due.

The biggest financial fraud of all time is the fiat monetary system. For far too long, the existence of central banks has provided governments with the ability to fund the ideals of the ruling class at the expense of cash savings and future economic productivity. Prior to the rapid acceleration of inflation during the past couple of years, most Westerners were completely unaware of the backdoor thievery that occurs with the expansion of the money supply.

Bitcoin grants inalienable property rights to all of its users. No government agency or corporation has the power to dilute the value of each unit in the network and, when stored properly, BTC is virtually impossible to confiscate. Bitcoin is an open, neutral network that does not discriminate based on religion, ethnicity, sex, race or vaccination status. Nobody is restricted from running a node to audit the authenticity of each transaction on the ledger.

By guaranteeing irrefutable access to an unconfiscatable and undilutable form of property, Bitcoin represents the most just asset and monetary network in the history of mankind.

Bitcoin Instills Fortitude

Courage in pain or adversity.

Bitcoiners develop fortitude in two ways.

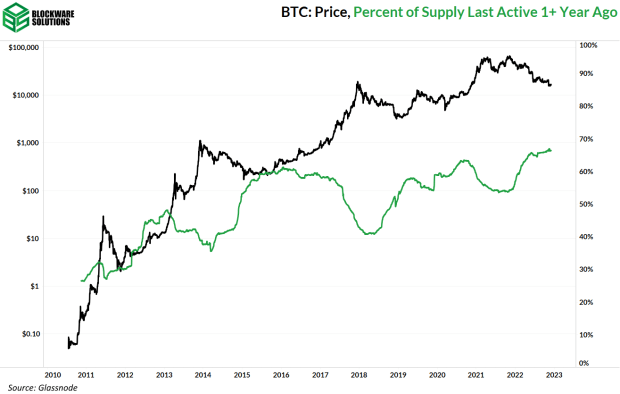

The first way is by encouraging HODLing through volatility. At the time of this writing, bitcoin is down by over 70% from its all-time high. This is the fourth time in Bitcoin’s thirteen-year history that we have experienced a drawdown of this magnitude. Bitcoiners are clearly exhibiting courage in the face of this adversity as evidenced by on-chain data. An all-time high of over 66% of Bitcoin’s supply has not moved in one year or longer. This fortitude is not unprecedented either, as this metric has hit all-time highs during previous bear markets as well.

I sense that a positive feedback loop is occurring here. When you can see for yourself that other bitcoin holders are undisturbed by the extreme drawdowns in price, it enables one to become more confident in the future of the network, and thus continue HODLing themselves.

The second way in which Bitcoiners develop fortitude is by encouraging Bitcoiners to take an action akin to the founding fathers signing of the Declaration Of Independence. While holding bitcoin is not outright illegal in most countries, it certainly does not put you in a favorable standing with the most powerful entities in the world.

History has shown that regimes in control of the global reserve currency do not take kindly to that position being usurped. As such, there is a non-zero chance that Bitcoiners could be declared treasonous in a dramatic, last-chance attempt by the United States government to maintain control over the monetary system.

However, this extremity can be avoided by winning the race of adoption as Cory Klippsten, CEO of Swan Bitcoin, eloquently describes in this article.

This is a guest post by Mitchell Askew. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.