Bitcoin and BNB Recovery as Binance Plea Seen Boosting Spot ETF Odds

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

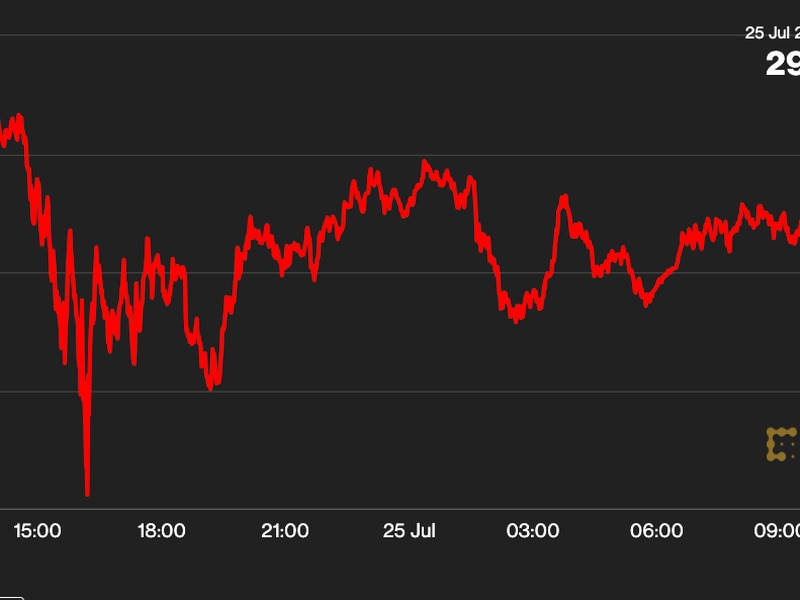

Bitcoin (BTC) and BNB trim losses suffered Tuesday as Binance’s CEO Changpeng “CZ” Zhao’s guilty plea and the exchange’s criminal settlement are seen boosting odds of an eventual approval of a spot-based bitcoin exchange-traded fund (ETF) in the U.S.

As of writing, BTC traded close to $36,400, having tanked over 4.5% to $35,700 Tuesday. BNB changed hands at $234, recovering from the overnight low of $223, CoinDesk data show. Both currencies, however, were still down 3.3% and 11.5% on a 24-hour basis, nursing hangover from Tuesday’s events, which saw Binance agree to a $4.3 billion settlement for violating sanctions and money-transmitting laws. Binance’s founder CZ pleaded guilty and stepped down as CEO in what’s called one of the largest corporate penalties ever, CoinDesk previously reported.

Binance illegally relied on U.S. customers as a significant source of revenue and trading activity, recently unsealed documents show, with the criminal complaint revealing years of compliance failures and deliberate obfuscation to protect these crucial yet off-limits users. CZ’s lawyers said that his sentencing will be delayed by 6 months and he has agreed to waive his right to appeal if the sentence does not exceed 18 months.

Some traders believe CZ’s downfall may be a blessing in disguise, boosting the probability of the U.S. SEC approving one or more spot bitcoin ETFs in the coming months.

“With this plea deal, the expectations for a spot Bitcoin ETF might have increased to 100% as the industry will be forced to follow the rules that TradFi firms must follow. More importantly, this industry’s whitewashing will strengthen the Bitcoin adoption case for institutional players and will likely become a safe-haven asset in investors’ portfolios,” crypto services provider Matrixport said in a Telegram message.

Still, the price volatility spurred by the action against Binance and CZ looks to have proved costly for leverage traders. Data from Coinglass shows that in the 12 hours since the settlement was announced, $110 million in bitcoin long positions were liquidated compared to $37.2 million in short positions. In the last hour, that number has reversed with $4.26 million in short positions being liquidated compared to $111,000 in longs.

BNB, which doesn’t trade as actively as bitcoin because most users stake it, saw $3.73 million in long positions liquidated compared to $1.61 million in short positions, according to Coinglass. Data shows that options volume for BNB has surged by 68% to $2.41 million, while options open interest has surged 29% to $3.47 million.

Elsewhere in the market, dYdX, the native token of the decentralized exchange, is up by 7%, according to CoinDesk Indicies data and Uniswap’s UNI token is up by 1.6% on-day.

Edited by Omkar Godbole.