Bitcoin: An Unstoppable Stone

Testaments to evil have stood and been swept away, and so, too, will central banks and all they represent.

Within the Old Testament of the Bible is a brief story that serves as an effective analogy to the strength and momentum of the Bitcoin network. You can read it below:

Thou, O king, sawest, and behold a great image. This great image, whose brightness was excellent, stood before thee; and the form thereof was terrible. This image’s head was of fine gold, his breast and his arms of silver, his belly and his thighs of brass, His legs of iron, his feet part of iron and part of clay. Thou sawest till that a stone was cut out without hands, which smote the image upon his feet that were of iron and clay, and brake them to pieces. Then was the iron, the clay, the brass, the silver, and the gold, broken to pieces together, and became like the chaff of the summer threshing floors; and the wind carried them away, that no place was found for them: and the stone that smote the image became a great mountain, and filled the whole earth. (Daniel 2:31-35)

In this story, a king dreamed a dream and in it he saw a great statue. The statue was made of all manner of fine materials including gold, silver, brass, iron and clay. The statue appears to be great and terrible. Onlookers view it and see the gold, the silver and the brass. It appears to be strong, durable and of great value. But, upon close inspection, one realizes that the statue is actually built on a foundation of weak clay. The same can be said of today’s central banks. Ask any of your friends and you will find that they likely believe that the central bank currency is backed by gold. Ask them what “fiat” means and they will probably mention a European car company. Similar to the statue, most will miss the reality that central banks are built on their own version of weak clay, and that is paper money.

The story goes on to describe a “stone” that is “cut out without hands.” This stone not only topples the statue, breaking it to pieces, but also [it] “became a great mountain, and filled the whole earth.” The stone can be likened to the Bitcoin network. No one really knows the truth behind the Bitcoin network’s origin. It was created by a pseudonymous individual or team of individuals. It may as well have been “cut out without hands” as there are no hands with which to credit its creation. As the stone in the story toppled the great and terrible statue, so, too, has Bitcoin begun its path to toppling central banks.

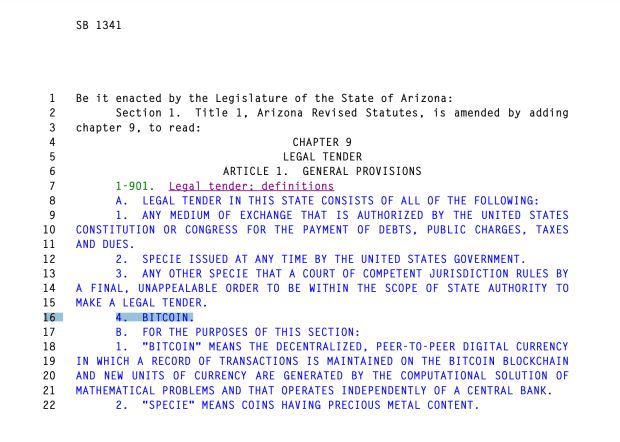

As the Bitcoin network continues to grow and gain momentum, it grows closer to toppling the world’s central banks. There comes a point when attempts to regulate or ban it become as pathetic as attempting to stop a large stone as it rolls mercilessly down a mountain side. We have recently seen Nigeria “ban” the network only to see its peer-to-peer usage surge. The ban did not last long and was officially lifted earlier last week. Bitcoiners joke that India has banned the Bitcoin network at least three times already, whereas nearby Pakistan has taken a different approach. I would argue that the network has already crossed the inflection point and has sufficient momentum that it cannot be stopped.

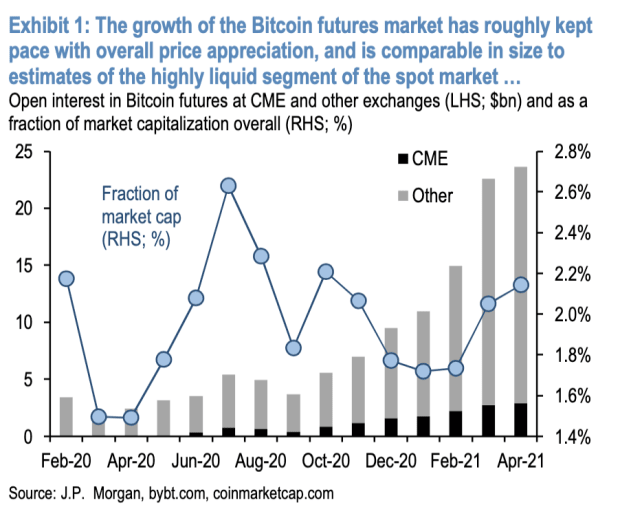

As an example, this past week, Jay Powell (chairman of the Federal Reserve) compared the network to digital gold, saying, “It is essentially a substitute for gold rather than the dollar.” This pivot from previous statements suggests he has read the writing on the wall and is just trying to get out of the way. We see companies like MicroStrategy (MSTR) dollar-cost averaging into bitcoin; according to bitcoin treasuries they currently hold 91,326 bitcoin. We see the Canada-based Purpose ETF surpass $1 billion dollars worth of value a month after its initial launch. There appears to be 8 more bitcoin ETFs awaiting SEC approval at this time. The Bitcoin network stores over $1 trillion worth of value. There are close to 9,700 nodes, spread out across every continent, enforcing its rules. The network’s computing power is so massive that its detractors complain it will boil oceans. It is clearly beyond the point of regulation. Just as the great and terrible statue was destroyed, so, too, will the central banks of this world be. The Bitcoin network will fill the whole earth, and there is nothing anyone can do to stop it.